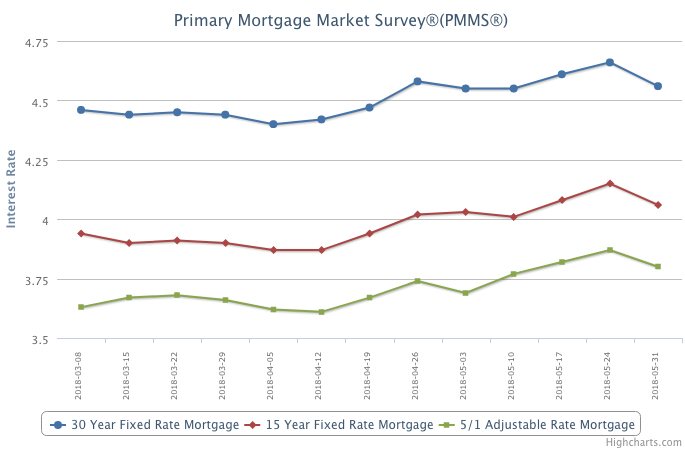

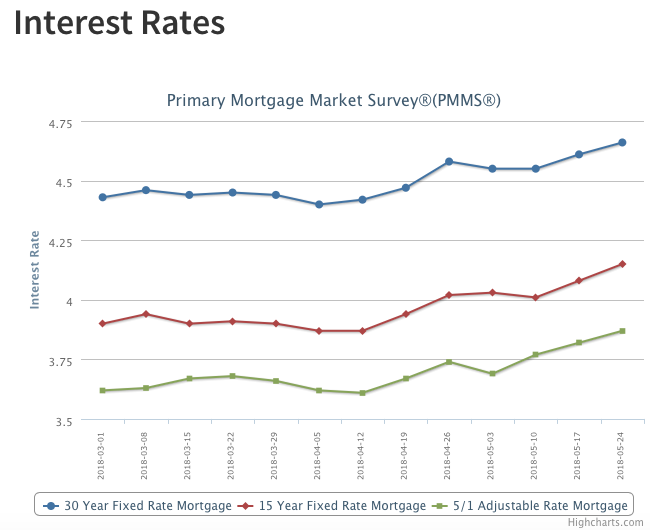

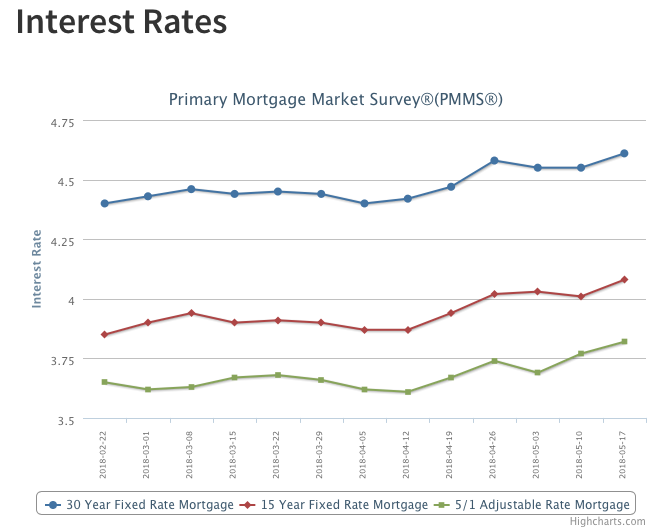

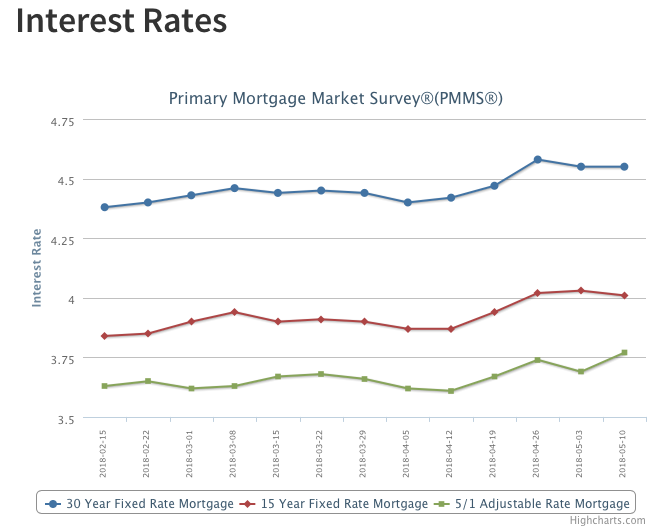

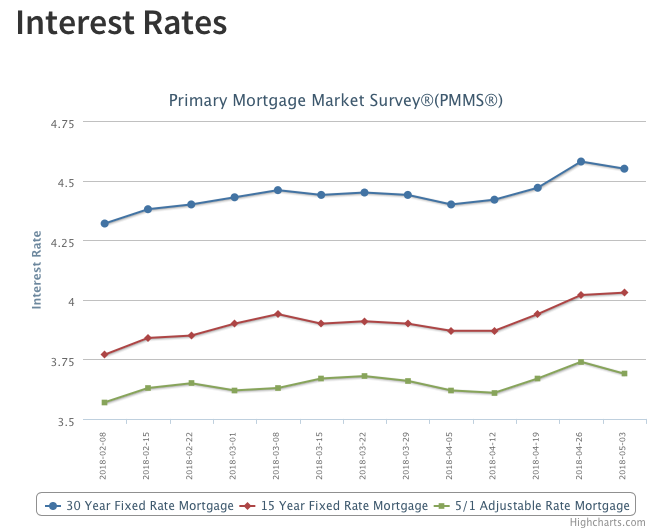

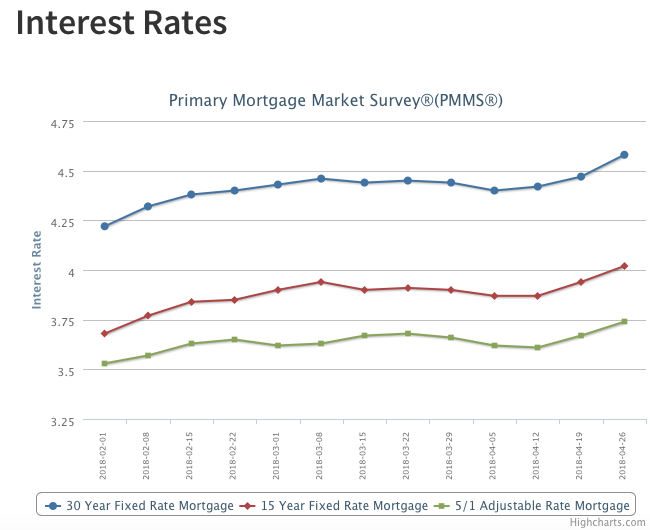

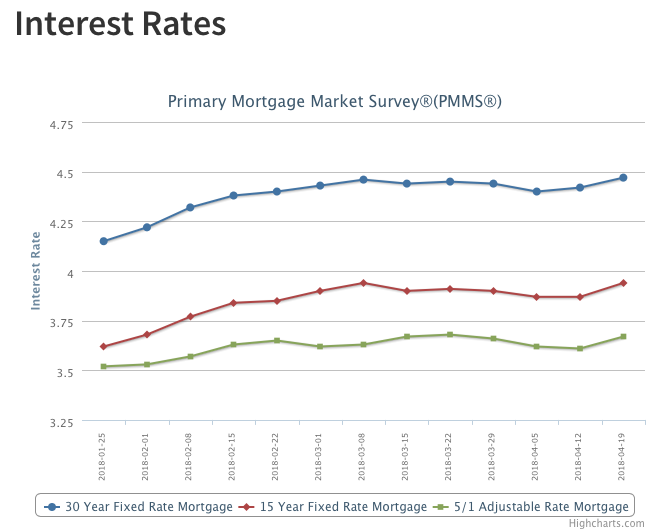

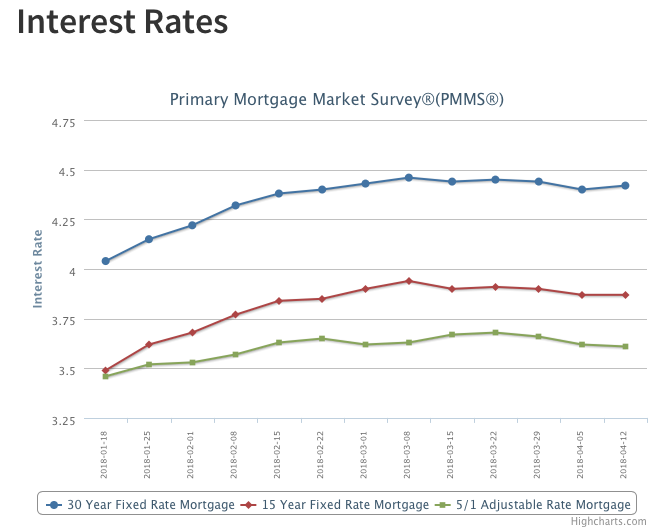

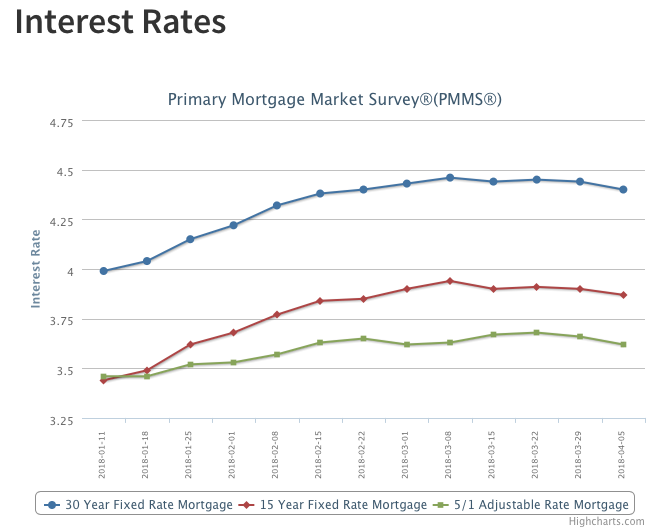

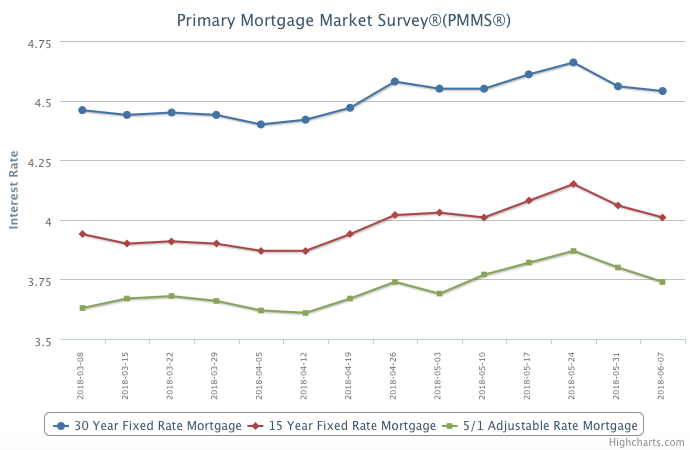

Mortgage rates dipped for the second consecutive week. Homebuyers have taken advantage of the recent moderation in rates, which led to a 4 percent increase in purchase applications last week. Although demand has remained steadfast against the backdrop of this year’s higher borrowing costs, it’s important to note that the growth rate of purchase loan balances has moderated so far this year – and particularly since March. This slowdown indicates that buyers are having difficulty stretching to keep up with the pace of home-price growth.