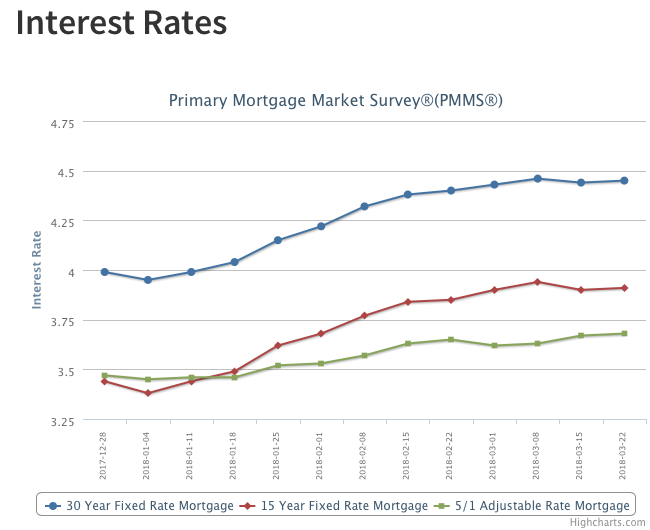

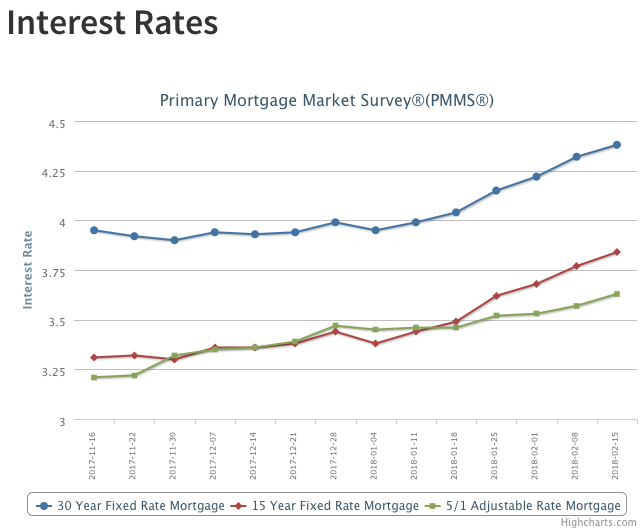

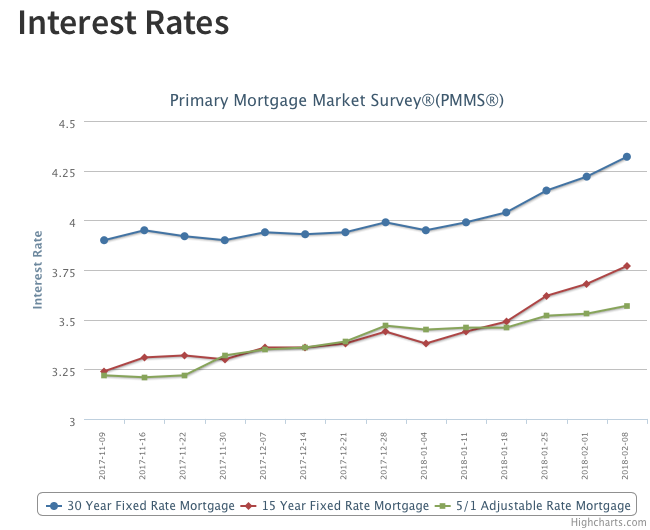

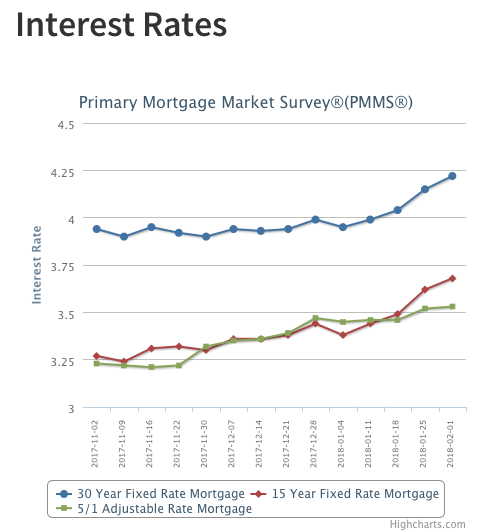

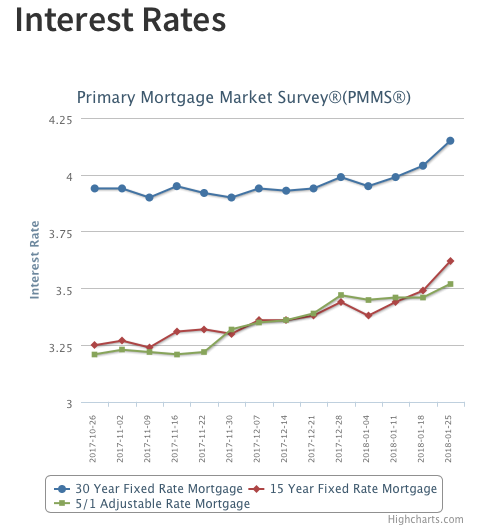

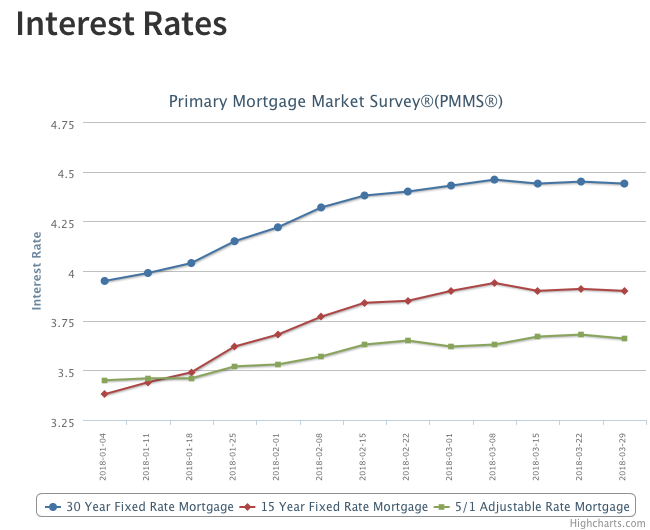

Treasury yields fell from a week ago helping to drive mortgage rates modestly lower. The yield on the 10-year Treasury dipped below 2.8 percent for the first time since early February of this year. The decline in Treasury yields comes as investors move into safer assets amid increased trade tensions. Following Treasurys, mortgage rates fell slightly. The U.S. weekly average 30-year fixed mortgage rate fell 1 basis point to 4.44 percent in this week’s survey.