- « Previous Page

- 1

- …

- 33

- 34

- 35

- 36

- 37

- …

- 44

- Next Page »

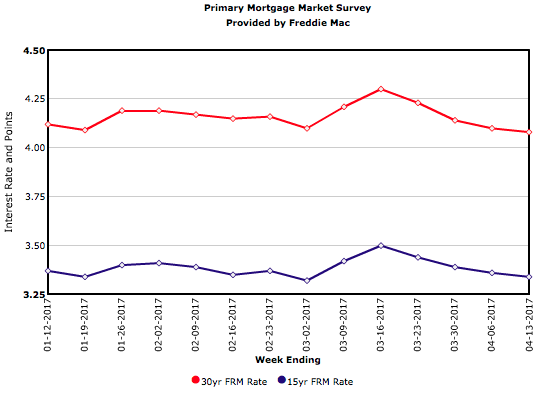

Mortgage Rates Move Lower

Mortgage Rates See Another Significant Decline

Mortgage Rate Drop Signals Continued Uncertainty

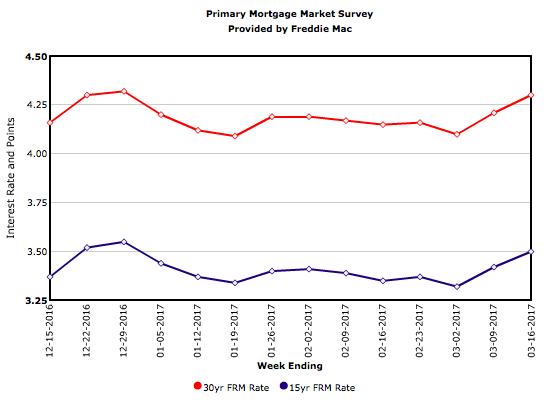

Mortgage Rates Move Higher

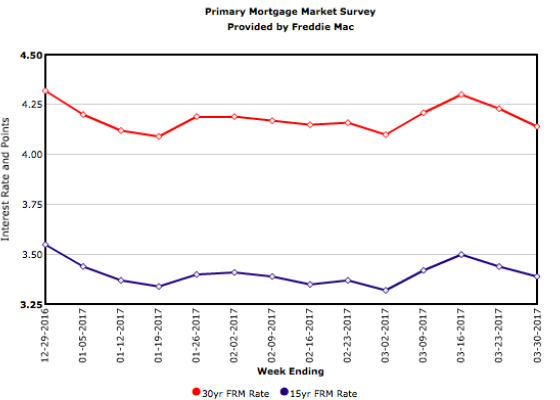

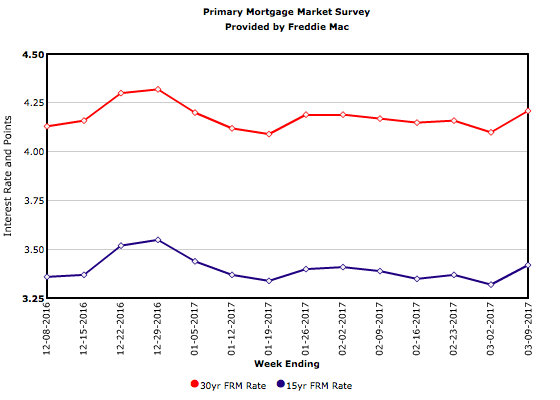

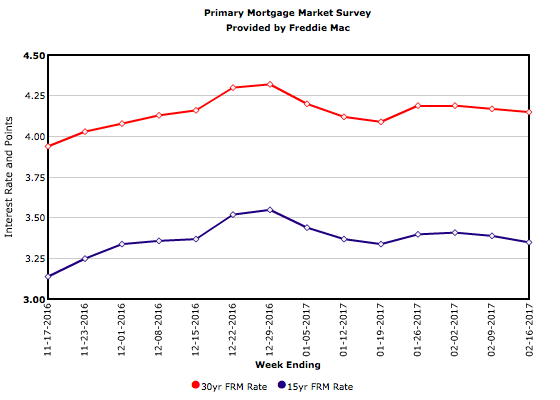

The FOMC announced its first rate hike of 2017 and hinted at additional increases throughout the remainder of the year. Although Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) was conducted prior to the Fed’s decision, the release of the February jobs report all but guaranteed a rate hike and boosted the 30-year mortgage rate 9 basis points to 4.30 percent this week.

Mortgage Rates Hit 2017 High

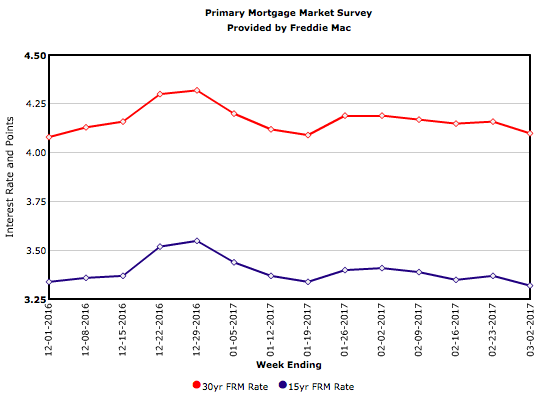

Mortgage Rates Move Lower

Uncertainty Causes Mortgage Rates to Hold

Mortgage Rates Continue Holding Pattern

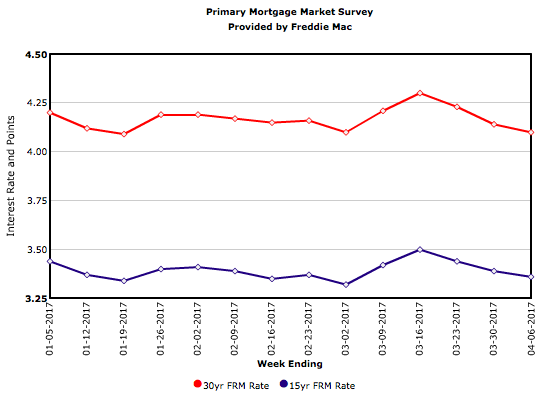

For the last 46 years, the 30-year mortgage rate has been almost perfectly correlated with the yield on the 10-year Treasury, but not this year. From Dec. 29, 2016, through today, the 30-year mortgage rate fell 17 basis points to this week’s reading of 4.15 percent. In contrast, the 10-year Treasury yield began and ended the same period at 2.49 percent. A year ago at this time, the 30-year FRM averaged 3.65 percent.

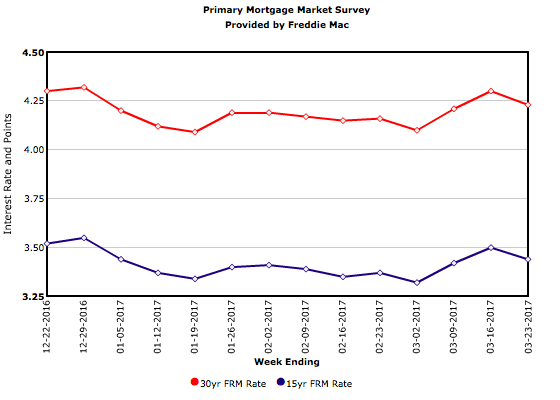

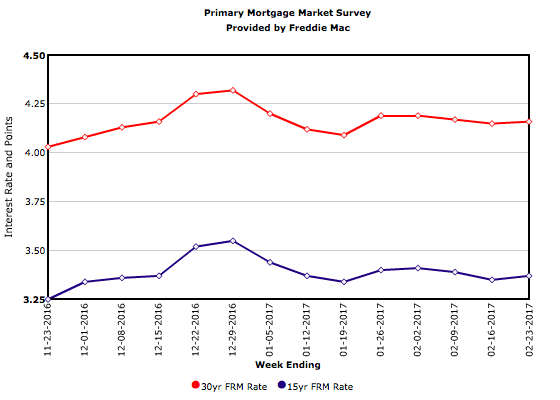

Mortgage Rates in Holding Pattern

The 30-year fixed mortgage fell two basis points to 4.17 percent this week. Rates are at about the same level at which they started the year and have stayed within a two basis point range over the past three weeks. Mixed economic releases such as Friday’s jobs report and uncertainty about the Administration’s fiscal policies have contributed to the holding pattern in rates.

- « Previous Page

- 1

- …

- 33

- 34

- 35

- 36

- 37

- …

- 44

- Next Page »