- « Previous Page

- 1

- …

- 121

- 122

- 123

- 124

- 125

- …

- 234

- Next Page »

Inventory

Weekly Market Report

For Week Ending October 5, 2019

For Week Ending October 5, 2019

With the 30-year fixed-rate mortgage approximately one percentage point lower than a year ago according to Freddie Mac, buyers are actively taking advantage. Home refinancing is also going strong and overall mortgage demand, which includes purchase mortgages as well as refinancings, is up 50% from a year ago. Lower mortgage rates help maintain housing affordability in the face of price appreciation across much of the country.

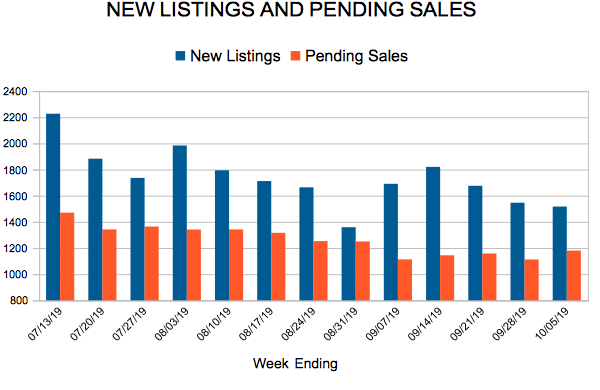

In the Twin Cities region, for the week ending October 5:

- New Listings decreased 2.7% to 1,517

- Pending Sales increased 1.5% to 1,180

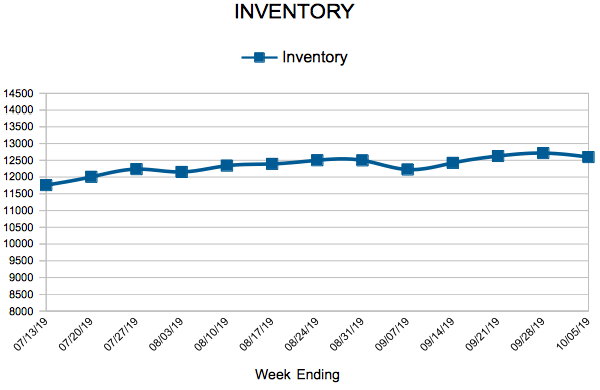

- Inventory decreased 3.4% to 12,597

For the month of August:

- Median Sales Price increased 7.1% to $286,900

- Days on Market increased 2.5% to 41

- Percent of Original List Price Received decreased 0.2% to 99.0%

- Months Supply of Homes For Sale remained flat at 2.6

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

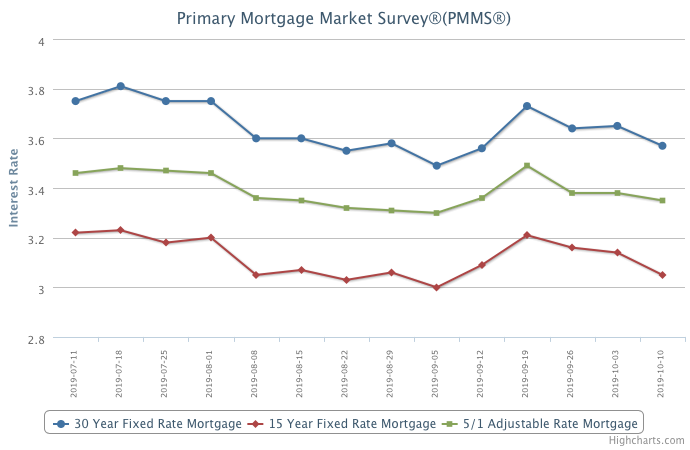

Mortgage Rates Decrease

October 10, 2019

Despite the economic slowdown due to weakening manufacturing and corporate investment, the consumer side of the economy remains on solid ground. The fifty-year low in the unemployment rate combined with low mortgage rates has led to increased homebuyer demand this year. Much of this strength is coming from entry-level buyers – the first-time homebuyer share of the loans Freddie Mac purchased in 2019 is forty-six percent, a two-decade high.

Information provided by Freddie Mac.

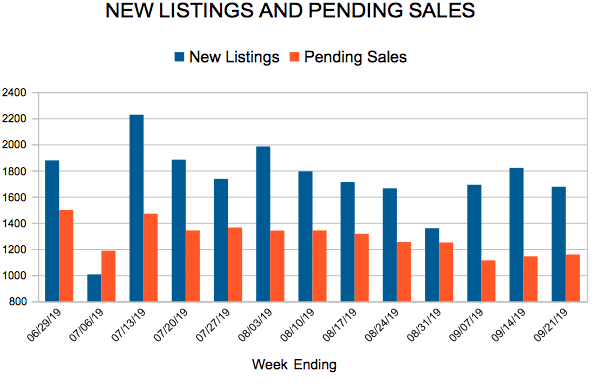

New Listings and Pending Sales

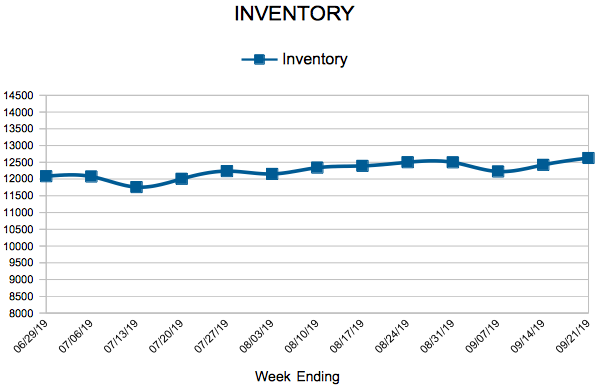

Inventory

Weekly Market Report

For Week Ending September 28, 2019

For Week Ending September 28, 2019

The Commerce Department reported sales of newly built homes nationwide have surged 18% compared to a year ago and housing starts and building permits reached a 12-year high in August. This surge in both sales and new construction shows strong market confidence by both buyers and builders. However, further increases in new construction starts are still required to meet demand and bring more balance.

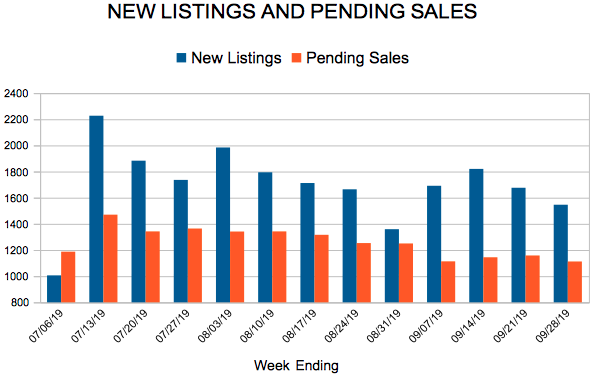

In the Twin Cities region, for the week ending September 28:

- New Listings decreased 3.3% to 1,546

- Pending Sales decreased 3.0% to 1,112

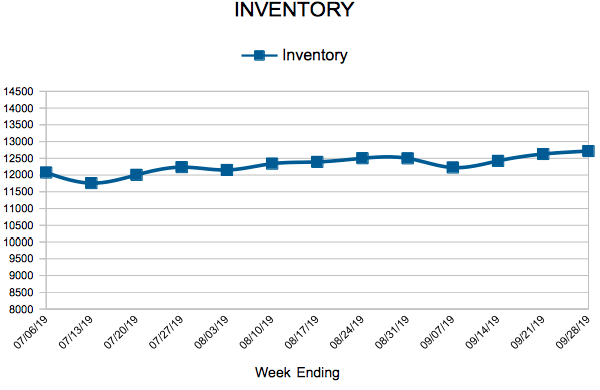

- Inventory decreased 3.6% to 12,716

For the month of August:

- Median Sales Price increased 7.0% to $286,875

- Days on Market increased 2.5% to 41

- Percent of Original List Price Received decreased 0.2% to 99.0%

- Months Supply of Homes For Sale remained flat at 2.6

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

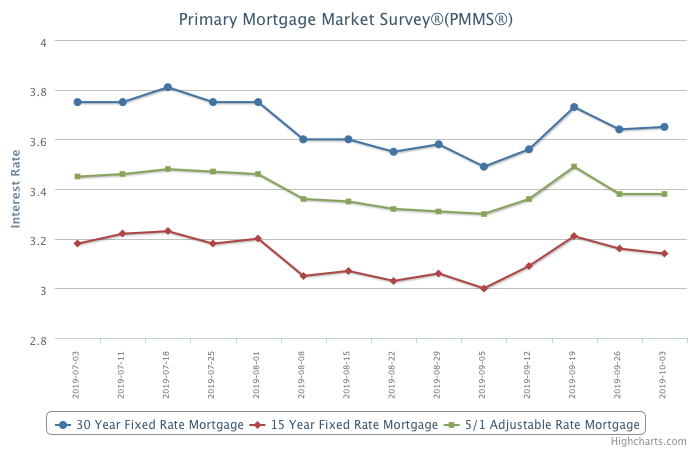

Mortgage Rates Hold Steady

October 3, 2019

While mortgage rates generally held steady this week, overall mortgage demand remained very strong, rising over fifty percent from a year ago thanks to increases in both refinance and purchase mortgage applications. As economic growth decelerates, it is clear that low mortgage rates will continue to support the mortgage market and we expect that to persist for the remainder of the year.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 121

- 122

- 123

- 124

- 125

- …

- 234

- Next Page »