- « Previous Page

- 1

- …

- 123

- 124

- 125

- 126

- 127

- …

- 234

- Next Page »

Weekly Market Report

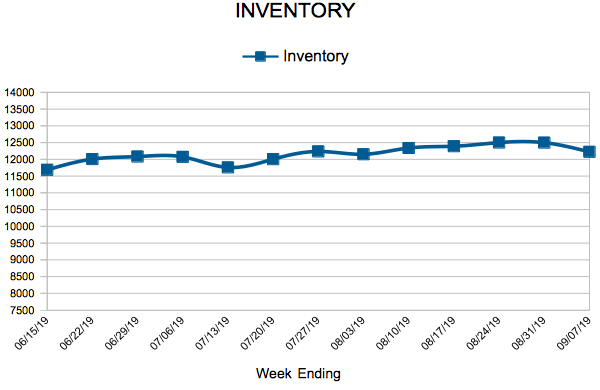

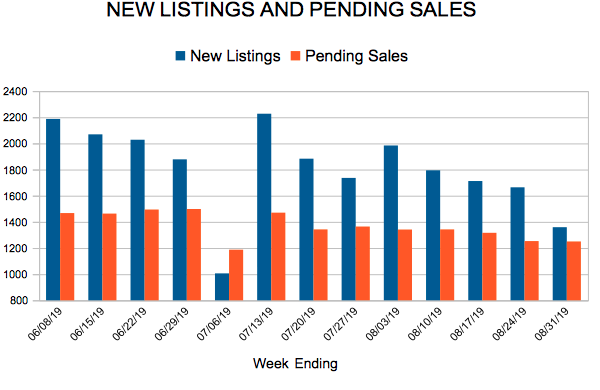

For Week Ending September 7, 2019

For Week Ending September 7, 2019

The White House has released a plan to broadly overhaul the housing finance system, including the re-privatization of Fannie Mae and Freddie Mac and reforms to federal agencies involved with financing substantial portions of the mortgages made every year. These changes will affect the cost and availability of loans in the future. Many recommendations will require legislative approval, so it is unclear at this time how much of the plan may eventually be implemented and its ultimate impact on the housing market.

In the Twin Cities region, for the week ending September 7:

- New Listings decreased 3.8% to 1,691

- Pending Sales increased 5.3% to 1,113

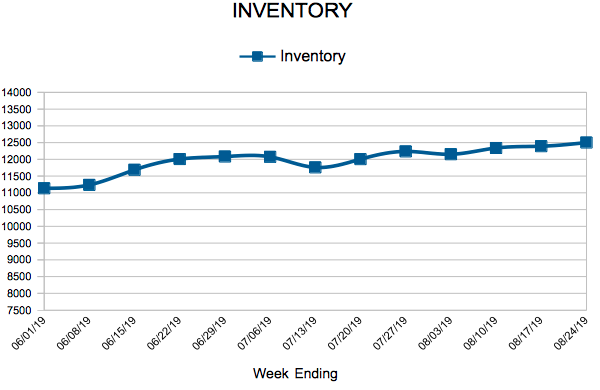

- Inventory decreased 4.5% to 12,224

For the month of August:

- Median Sales Price increased 6.7% to $286,000

- Days on Market increased 2.5% to 41

- Percent of Original List Price Received decreased 0.2% to 99.0%

- Months Supply of Homes For Sale decreased 3.8% to 2.5

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

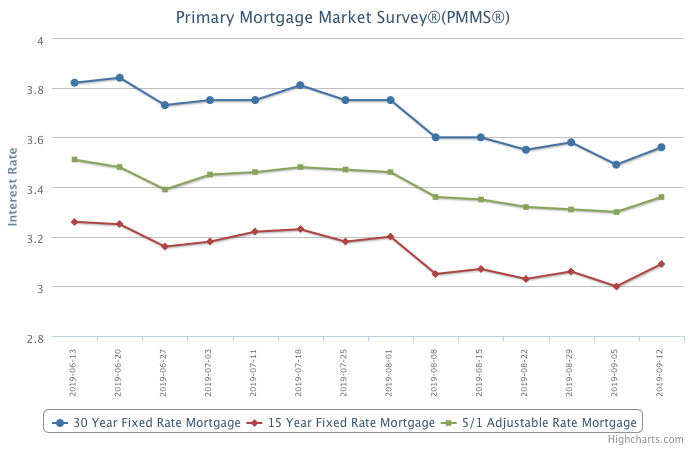

Mortgage Rates Increase

September 12, 2019

Pipeline purchase demand continues to improve heading into the late fall with purchase mortgage applications up nine percent from a year ago. The improved demand reflects the still healthy underlying consumer economic fundamentals such as a low unemployment rate, solid wage growth and low mortgage rates. While there has been a material weakness in manufacturing and consistent trade uncertainty, so far, the American consumer has proved to be resilient with solid home purchase demand.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

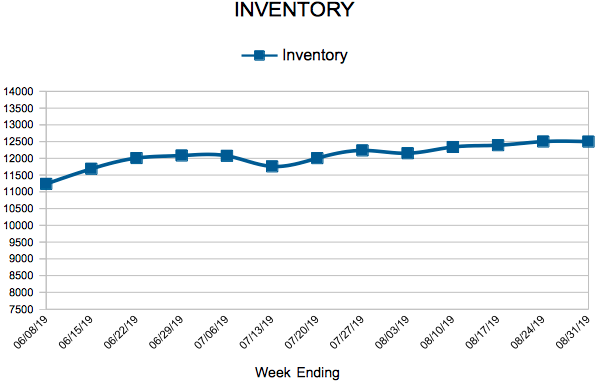

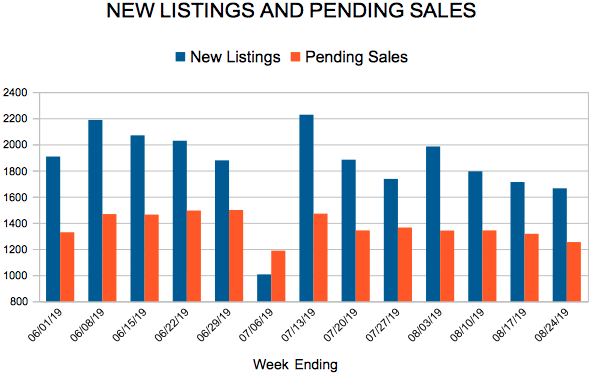

For Week Ending August 31, 2019

For Week Ending August 31, 2019

Recent mortgage rate declines may provide a small tailwind as we enter the fall housing market, giving buyers a bit more buying power and a little more incentive to lock in a home purchase. However, stock market volatility and concern of a wider economic slowdown in the coming year may temper some buyer enthusiasm. But as rents continue to rise, the value proposition of owning a home remains a compelling option and a goal of most Americans.

In the Twin Cities region, for the week ending August 31:

- New Listings increased 4.9% to 1,359

- Pending Sales decreased 3.1% to 1,250

- Inventory decreased 4.4% to 12,498

For the month of July:

- Median Sales Price increased 5.9% to $283,900

- Days on Market remained flat at 38

- Percent of Original List Price Received decreased 0.1% to 99.7%

- Months Supply of Homes For Sale remained flat at 2.5

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

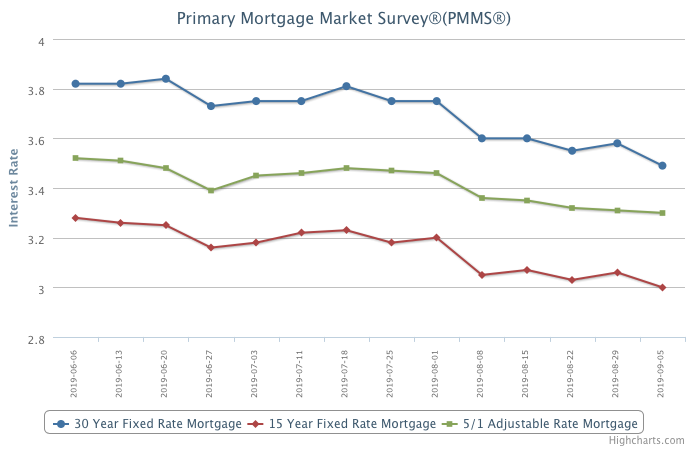

Mortgage Rates Drop

September 5, 2019

Mortgage rates continued the summer swoon due to weaker economic data. While economic growth is clearly slowing due to rising manufacturing and trade headwinds, economic fundamentals are still solid for U.S. consumers. The unemployment rate is low, housing affordability is improving, homebuyer demand is rising, and home price growth is stable.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 24, 2019

For Week Ending August 24, 2019

Lack of affordable inventory has been a key story in real estate in the last few years. There is a growing consensus suggesting the U.S. economy could be entering a recession, and some wonder whether this could lead to an adjustment in housing prices. However, this scenario is unlikely to make housing more affordable, as economic uncertainty is likely to discourage first-time home buyers and could make construction companies leary of building new homes.

In the Twin Cities region, for the week ending August 24:

- New Listings decreased 1.5% to 1,664

- Pending Sales increased 1.9% to 1,253

- Inventory decreased 3.9% to 12,501

For the month of July:

- Median Sales Price increased 5.8% to $283,420

- Days on Market remained flat at 38

- Percent of Original List Price Received decreased 0.1% to 99.7%

- Months Supply of Homes For Sale remained flat at 2.5

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 123

- 124

- 125

- 126

- 127

- …

- 234

- Next Page »