- « Previous Page

- 1

- …

- 133

- 134

- 135

- 136

- 137

- …

- 234

- Next Page »

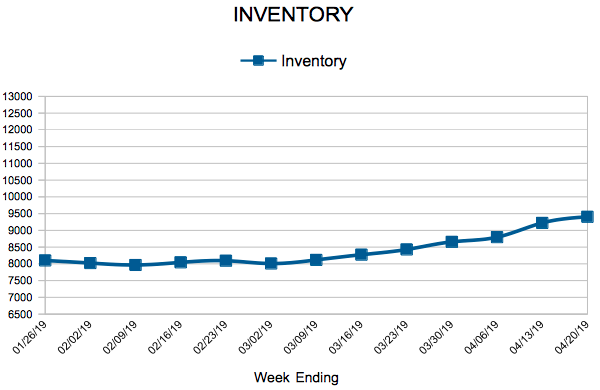

Inventory

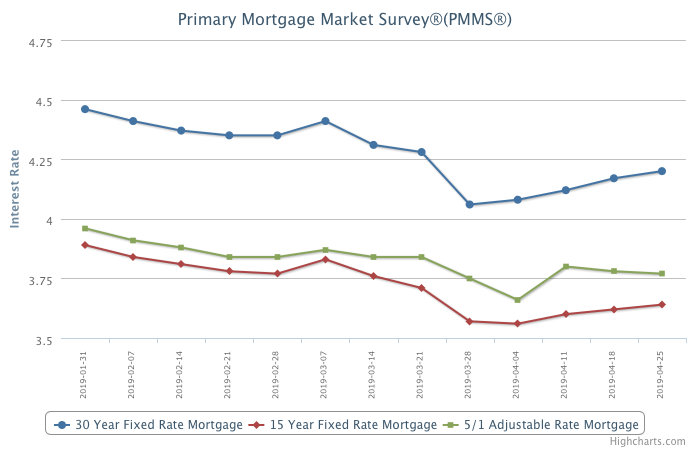

Mortgage Rates Continue to Climb

April 25, 2019

Despite the recent rise in mortgage rates, both existing and new home sales continue to show strength – indicating the lagged effect of lower rates on housing demand. This, along with improved affordability, should push housing activity higher in the coming months.

Information provided by Freddie Mac.

March Monthly Skinny Video

“In addition to the quandary of ongoing housing price increases and affordability concerns in many U.S. markets, the first quarter of 2019 saw a fair share of adverse weather as well.”

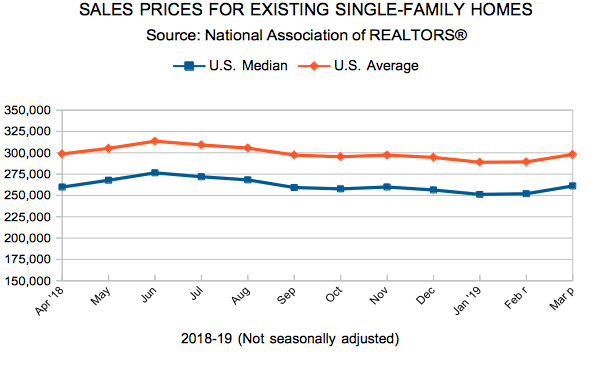

Existing Home Sales

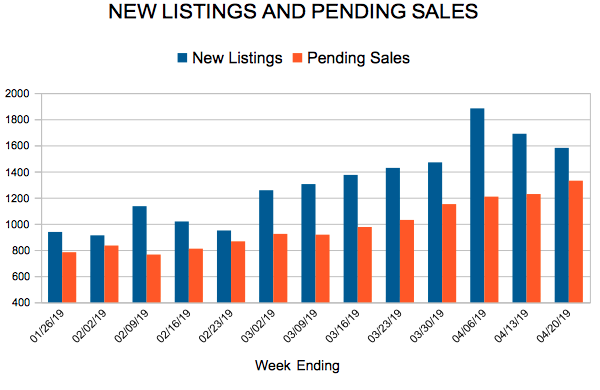

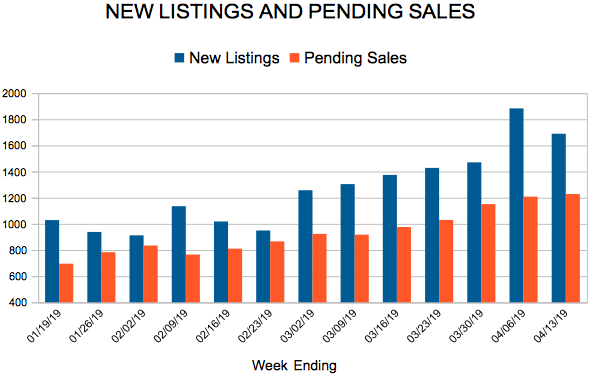

New Listings and Pending Sales

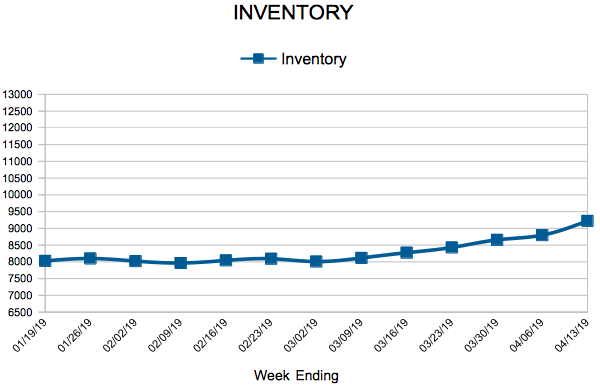

Inventory

Weekly Market Report

For Week Ending April 13, 2019

For Week Ending April 13, 2019

Housing activity is on the upswing after a slow start to the year. Showings, new listings and pending sales are increasing across much of the country, and inventory is straining to keep pace with demand. These pivotal weeks of the spring market are worth watching with extra care, as they may portend the entirety of the 2019 residential real estate market. Buyers are certainly active. Sales and prices will be strong if there are enough options to choose from.

In the Twin Cities region, for the week ending April 13:

- New Listings increased 1.8% to 1,689

- Pending Sales decreased 6.0% to 1,228

- Inventory decreased 2.0% to 9,223

For the month of March:

- Median Sales Price increased 6.5% to $275,000

- Days on Market increased 15.8% to 66

- Percent of Original List Price Received decreased 0.5% to 98.6%

- Months Supply of Homes For Sale increased 5.6% to 1.9

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Buyer and seller activity down; weather partly to blame

If February was the month of record snowfall, March was the month of record wet basements. The effects of extreme weather continue to impact the market. Despite that, the latest numbers for Twin Cities residential real estate show some strength amidst ongoing signs of change. Prices continued to climb, reaching a new record. New listings fell 8.8 percent as fewer sellers listed their properties. Closed sales were down 9.3 percent as some buyers waited on soggy properties as well as additional inventory options. Market times rose year-over-year for the first time since March 2015. Another sign of a changing market is the ratio of sold to list price has fallen for four of the last five months. This—along with other indicators—suggest the market is improving for buyers, even though sellers still have strong pricing power, favorable negotiating leverage and quick market times.

The number of active listings for sale decreased compared to the prior year. Even so, buyers have seen inventory gains for five of the last six months. Months supply, however, was flat at 1.8 months, suggesting the market is still tight but realigning. Buyers should still expect competition on the most coveted listings. After touching 5.0 percent in November, mortgage rates have settled back down around 4.1 percent, which is great news for buyers. The supply squeeze is most evident at the entry-level prices, where multiple offers and homes selling for over list price are commonplace. The move-up and upper-bracket segments are less competitive and better supplied.

March 2019 by the Numbers (compared to a year ago)

- Sellers listed 6,160 properties on the market, an 8.8 percent decrease from last March

- Buyers closed on 3,673 homes, a 9.3 percent decrease

- Inventory levels for March declined 4.2 percent compared to 2018 to 8,685 units

- Months Supply of Inventory was flat at 1.8 months

- “There’s plenty of buyers and sellers out there looking to get deals done,” said Linda Rogers, President-Elect of Minneapolis Area REALTORS®. “If rates and inventory cooperate, we’re still anticipating a solid year.”

- The Median Sales Price rose 6.5 percent to $275,000, a record high for any month

- Cumulative Days on Market rose 15.8 percent to 66 days, on average (median of 30)

- Changes in Sales activity varied by market segment

- Single family sales declined 7.2 percent; condo sales sank 16.5 percent; townhome sales fell 12.2 percent

- Traditional sales decreased 7.9 percent; foreclosure sales declined 26.8 percent; short sales fell 32.3 percent

- Previously-owned sales were down 10.1 percent; new construction sales rose 2.3 percent

Quotables

“The extremes of February and March are still noticeable,” said Todd Urbanski, President of Minneapolis Area REALTORS®. “It’s difficult to disentangle weather-induced market shifts with organic market shifts.”

All information is according to the Minneapolis Area REALTORS® based on data from NorthstarMLS. Minneapolis Area REALTORS® is the leading regional advocate and provider of information services and research on the real estate industry for brokers, real estate professionals and the public. We serve the Twin Cities 16-county metro area and western Wisconsin.

From The Skinny Blog.

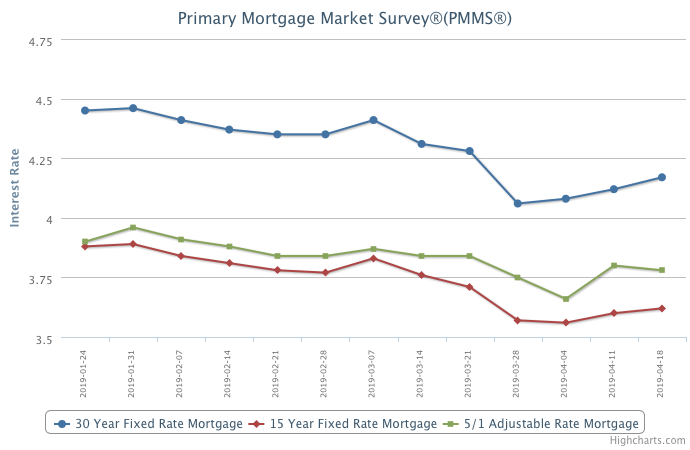

Mortgage Rates Continue to Rise

April 18, 2019

After dropping dramatically in late March, mortgage rates have modestly increased since then. While this week marks the third consecutive week of rises, purchase activity reached a nine-year high – indicative of a strong spring homebuying season.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 133

- 134

- 135

- 136

- 137

- …

- 234

- Next Page »