- « Previous Page

- 1

- …

- 136

- 137

- 138

- 139

- 140

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending March 9, 2019

New listings and overall housing inventory are still proceeding slower than last year in many markets across the U.S., and they are mostly trailing activity for last year, which was already rather low. Sales have also been slower than last year at this time in areas with lingering winter weather, but the thaw is on. That may present a new set of difficulties for communities that have experienced an abundance of rain and snow over the last few months.

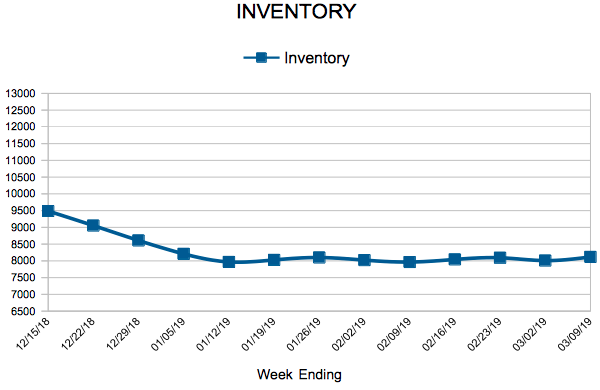

In the Twin Cities region, for the week ending March 9:

- New Listings decreased 8.6% to 1,304

- Pending Sales decreased 16.2% to 917

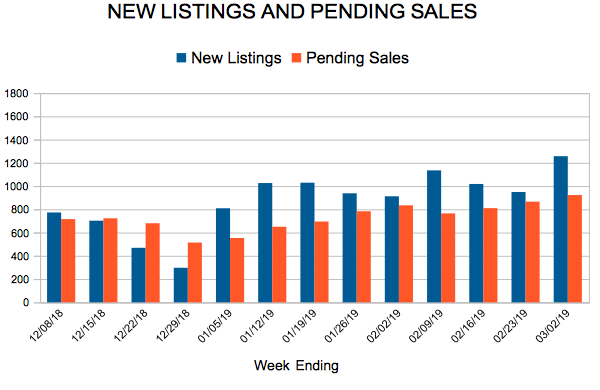

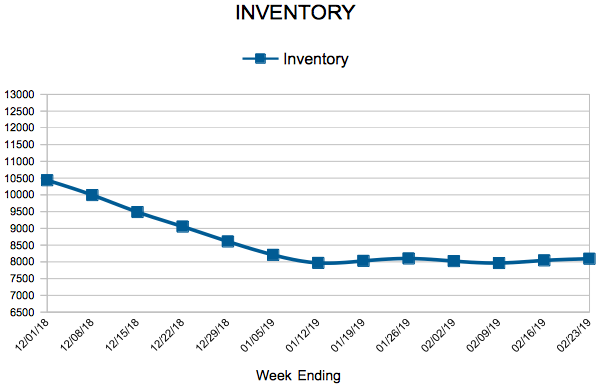

- Inventory decreased 6.2% to 8,117

For the month of February:

- Median Sales Price increased 6.2% to $265,500

- Days on Market remained flat at 69

- Percent of Original List Price Received decreased 0.3% to 97.7%

- Months Supply of Homes For Sale remained flat at 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

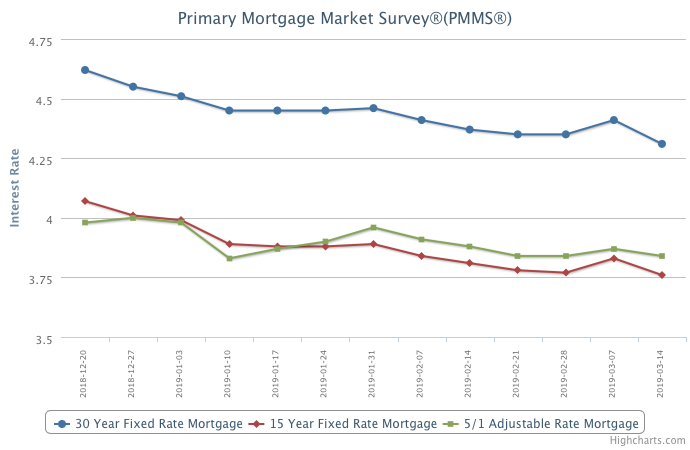

Mortgage Rates Drop, Making Homebuying Less Costly

March 14, 2019

Mortgage rates declined decisively this week amid various market reports, a strong bond auction and further uncertainty around the Brexit deal, which all contributed to driving bond yields lower. At 4.31 percent, the average 30-year fixed mortgage rate is at its lowest since February of last year. While these low rates will certainly get the attention of prospective homebuyers, the supply of homes for sale remains stubbornly low.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 2, 2019

Sales totals have been mixed across the nation and dependent on what has been a considerably persistent wintry mix in the Great Plains, Midwest and Northeast. While this time of year brings unpleasant weather to all parts of the country, it has less impact on southern and western states. While there is no true national real estate market, overarching trends continue to be higher prices and more inventory, especially west of the Rocky Mountains. Let’s look more closely at what is happening locally.

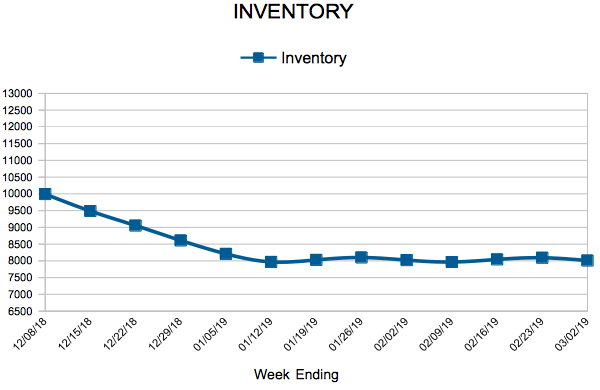

In the Twin Cities region, for the week ending March 2:

- New Listings decreased 20.0% to 1,257

- Pending Sales decreased 13.3% to 923

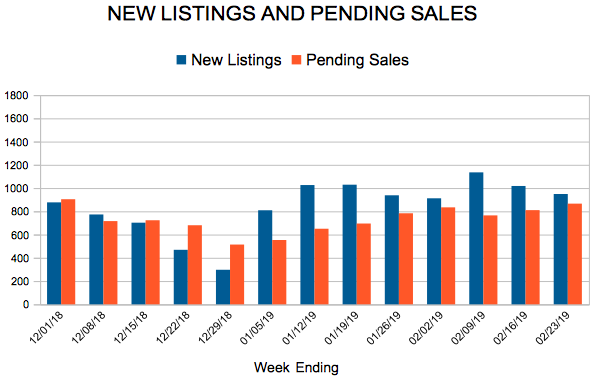

- Inventory decreased 5.5% to 8,009

For the month of January:

- Median Sales Price increased 6.1% to $259,000

- Days on Market decreased 5.8% to 65

- Percent of Original List Price Received increased 0.1% to 97.0%

- Months Supply of Homes For Sale increased 13.3% to 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

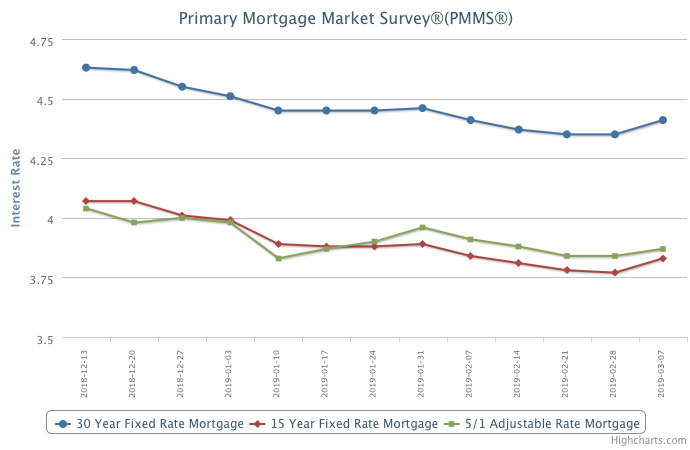

Downward Mortgage Rate Trend Ends

March 7, 2019

While mortgage rates very modestly rose to 4.41 percent this week, they remain below year-ago levels for the fourth week in a row. In late 2018, mortgage rates rose over a full percentage point from the prior year, which was one of the main reasons that weakness in home sales continued into early 2019. However, the impact of recent lower rates and a strong labor market has led to a rise in purchase mortgage demand as we start the spring homebuying season.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending February 23, 2019

Two years ago, Millennials (born between 1981 and 1996) passed older generational groups to account for the most new mortgages. Today, Millennials also account for the most total dollar amount of those mortgages. Given the state of ongoing median sales price increases in the majority of the country, this should not come as a surprise. And given the positive state of the U.S. economy, finding the correct balance between positive sales figures and sales prices will be a dominant theme of 2019.

In the Twin Cities region, for the week ending February 23:

- New Listings decreased 25.0% to 949

- Pending Sales decreased 12.6% to 866

- Inventory decreased 3.0% to 8,093

For the month of January:

- Median Sales Price increased 6.1% to $259,000

- Days on Market decreased 5.8% to 65

- Percent of Original List Price Received increased 0.1% to 97.0%

- Months Supply of Homes For Sale increased 13.3% to 1.7

All comparisons are to 2018

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 136

- 137

- 138

- 139

- 140

- …

- 234

- Next Page »