- « Previous Page

- 1

- …

- 143

- 144

- 145

- 146

- 147

- …

- 234

- Next Page »

October Monthly Skinny Video

“A trend of market balance is emerging as we approach the end of 2018.”

Weekly Market Report

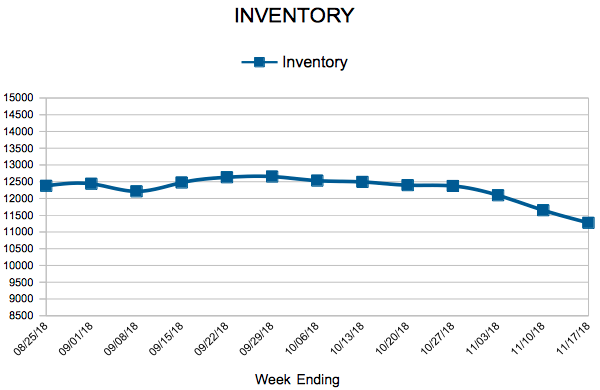

For Week Ending November 17, 2018

Sales and new listings continue to perform well in much of the nation thanks to a booming economy. Housing affordability remains a concern and is beginning to affect new single-family home construction. Builders are showing caution in the face of rising home prices and mortgage rates. Historically, housing can still be considered relatively affordable, but affordability measures have shown decline for several years. If this continues, it could negate recent gains in inventory.

In the Twin Cities region, for the week ending November 17:

- New Listings increased 6.7% to 955

- Pending Sales decreased 7.0% to 891

- Inventory increased 0.9% to 11,273

For the month of October:

- Median Sales Price increased 8.6% to $265,000

- Days on Market decreased 7.7% to 48

- Percent of Original List Price Received increased 0.2% to 97.9%

- Months Supply of Inventory remained flat at 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

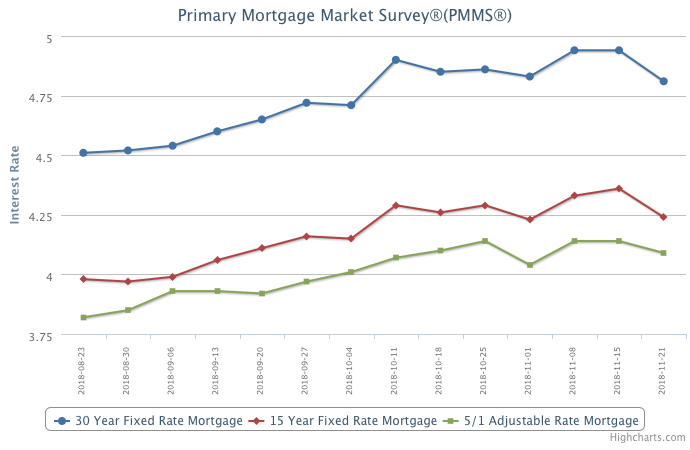

Mortgage Rates Pull Back

November 21, 2018

The downward spiral in oil prices and a volatile equities market caused mortgage rates to decline 13 basis points to 4.81 percent, the largest weekly drop since January 2015. Mortgage rates are the lowest since early October and the dip offers a window of opportunity for would be buyers that have been on the fence waiting for a drop in mortgage rates.

Information provided by Freddie Mac.

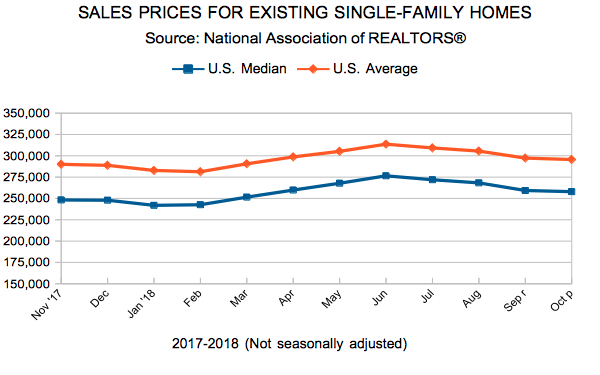

Existing Home Sales

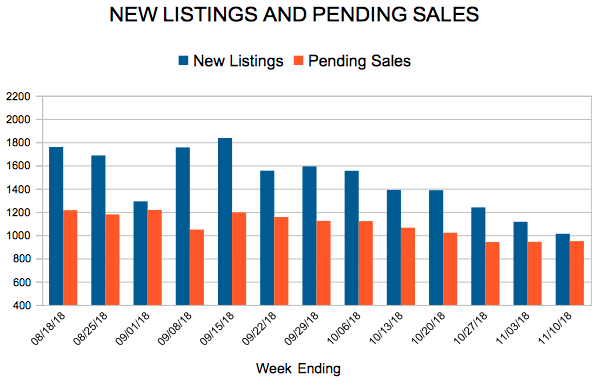

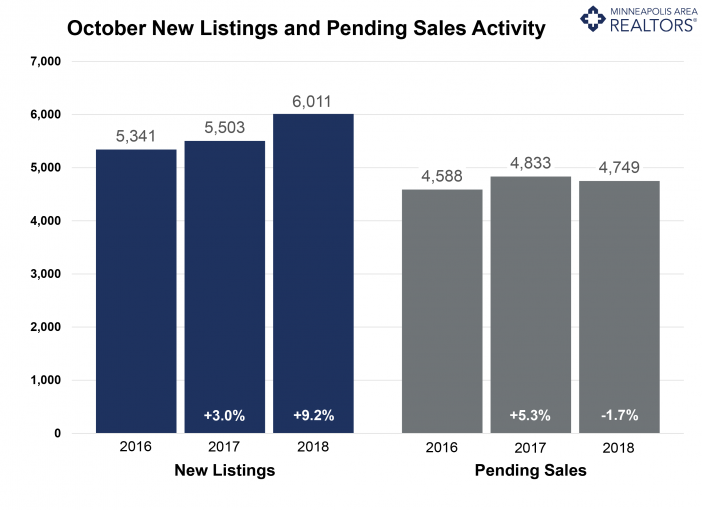

New Listings and Pending Sales

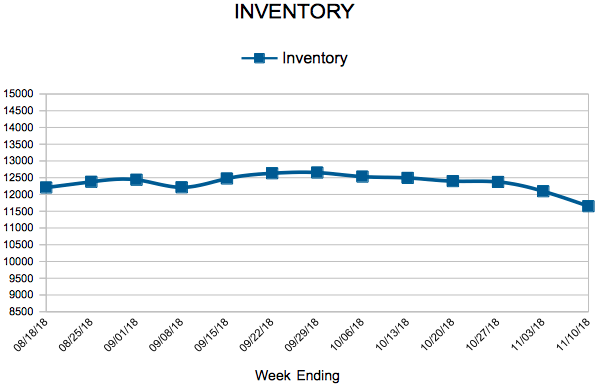

Inventory

Weekly Market Report

For Week Ending November 10, 2018

The Bureau of Labor Statistics recently reported that the unemployment rate for October 2018 remained unchanged from the prior month at 3.7 percent. Low unemployment has been one of many positive outcomes during a strong U.S. economy. Real estate has also been a benefactor of recent economic strength, as cranes dot U.S. skylines and median sales prices have increased in most residential real estate markets for several years. Gainful employment is important in order for these conditions to continue.

In the Twin Cities region, for the week ending November 10:

- New Listings increased 9.4% to 1,012

- Pending Sales decreased 6.1% to 949

- Inventory increased 0.8% to 11,649

For the month of October:

- Median Sales Price increased 8.6% to $265,000

- Days on Market decreased 7.7% to 48

- Percent of Original List Price Received increased 0.2% to 97.9%

- Months Supply of Inventory remained flat at 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Supply tight but flattening, prices still rising, sales fluctuating

By David Arbit on Friday, November 16th, 2018

As sentiments regarding the direction of housing markets have changed, it’s worth remembering two key facts. First, all housing is local—what’s happening in San Francisco, Seattle and Denver is not reflective of the Minneapolis-St. Paul market. Second, the housing market faces fewer risks than in the mid-2000s. After years of strong buyer activity and weak seller activity, the tides seem to finally be shifting. Five of the last six months showed increases in new listings; while five of the last six months also had decreases in pending sales. It’s worth noting there’s a significant difference between deceleration and contraction. The market is decelerating, but not yet contracting. Prices continue to rise, homes are selling in less time and sellers are yielding a higher share of their list price.

Excluding September 2018, October had the smallest decline in active listings since May 2015, and those long-awaited inventory gains could arrive as early as next year. Months supply was stable at 2.4 months, suggesting a tight market but also a flattening out pattern. Rising rates could impact some budget-conscious buyers. The lack of supply is especially noticeable at the entry-level prices, where multiple offers and homes selling for over list price are commonplace. The move-up and upper-bracket segments are less competitive and—for the most part—much better supplied. Inventory could double while sales remain stable and we’d still have less than 5 months of supply.

OCTOBER 2018 BY THE NUMBERS (COMPARED TO A YEAR AGO)

– Sellers listed 6,011 properties on the market, a 9.2 percent increase

– Buyers closed on 5,235 homes, a 3.4 percent increase from last October

– Inventory levels for October fell 2.2 percent compared to 2017 to 11,719 units

– Months Supply of Inventory was flat at 2.4 months

– The Median Sales Price rose 8.6 percent to $265,000, a record high for September

– Cumulative Days on Market declined 7.7 percent to 48 days, on average (median of 28)

– Changes in Sales activity varied by market segment:

Single family sales rose 4.4 percent; condo sales jumped 10.6 percent; townhome sales were flat

Traditional sales rose 5.2 percent; foreclosure sales sank 41.2 percent; short sales rose 4.5 percent

Previously-owned sales were up 3.7 percent; new construction sales increased 12.3 percent

From The Skinny Blog.

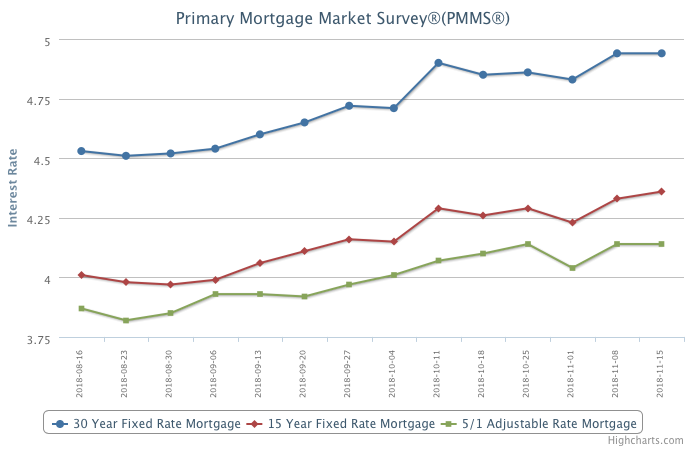

Mortgage Rates Stabilize

November 15, 2018

Despite recent market volatility, mortgage rates remained steady this week. The stability in mortgage rates reflects the moderation in inflationary pressures in the economy due to lower oil prices and subdued wage growth. On the margin, lower energy costs are a positive for the home sales market, particularly for lower-middle income suburban buyers who spend proportionately more income on transportation costs.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 143

- 144

- 145

- 146

- 147

- …

- 234

- Next Page »