- « Previous Page

- 1

- …

- 146

- 147

- 148

- 149

- 150

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending October 6, 2018

Residential real estate continues to churn out impressive numbers as we reach deeper into autumn. In many markets, new listings and/or pending sales are still outperforming the results from this same time last year. When the economy is strong, buyers and sellers will remain active beyond the more traditional selling season. Predictions for a slowdown are rolling in, but we’re not there yet. Let’s take a look at what’s happening locally.

In the Twin Cities region, for the week ending October 6:

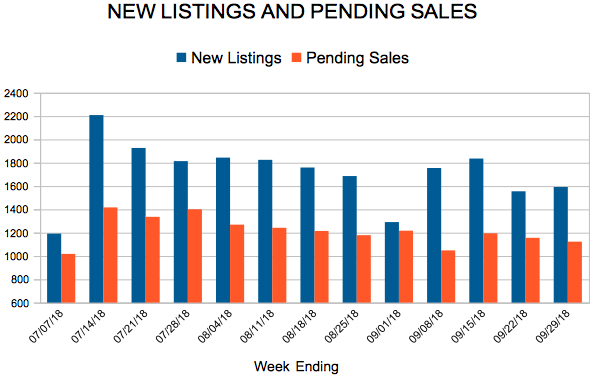

- New Listings increased 11.0% to 1,554

- Pending Sales decreased 1.3% to 1,121

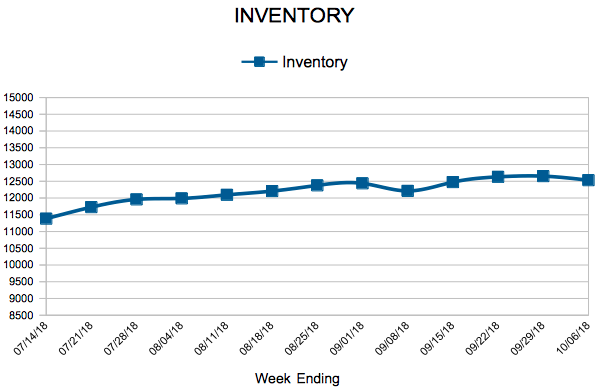

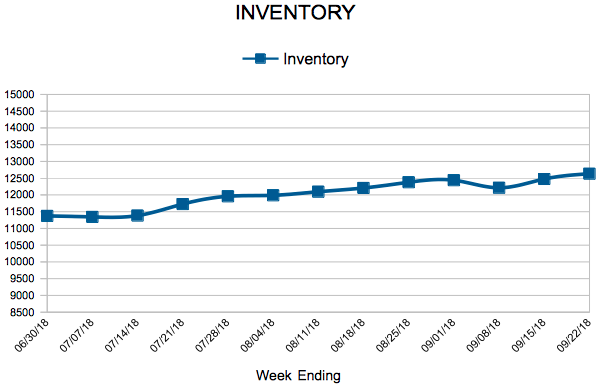

- Inventory decreased 3.3% to 12,532

For the month of September:

- Median Sales Price increased 6.1% to $262,000

- Days on Market decreased 16.0% to 42

- Percent of Original List Price Received increased 0.3% to 98.4%

- Months Supply of Inventory remained flat at 2.6

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

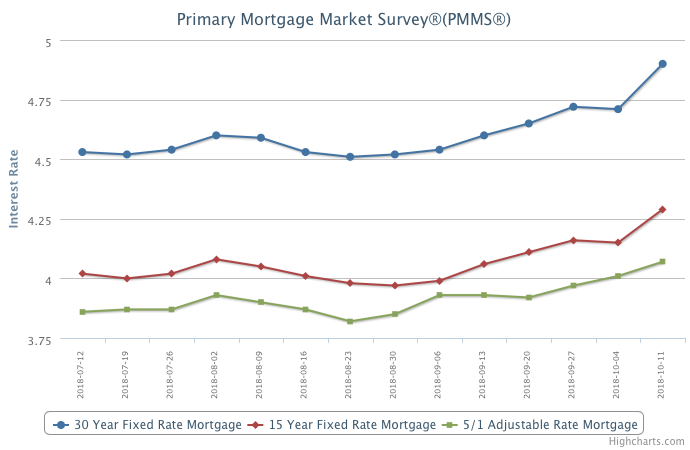

Mortgage Rates Jump

October 11, 2018

In this week’s survey, the 30-year fixed-rate mortgage jumped 19 basis points to 4.90 percent. Rates are now at their highest level since the week of April 14, 2011.

Rising rates paired with high and escalating home prices is putting downward pressure on purchase demand. While the monthly payment remains affordable due to the still low mortgage rate environment, the primary hurdle for many borrowers today is the down payment and that is the reason home sales have decreased in many high-priced markets.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 29, 2018

The U.S. unemployment rate recently dropped to 3.7 percent, which is its lowest mark since December 1969. The economy continues to bear impressive fruit within and outside of residential real estate, and the Federal Reserve has reacted by raising the benchmark federal funds rate by a quarter of a percentage point, the third rate hike of 2018. While this may be undesirable news for those carrying high credit debt, it is also a reflection of a bright economic outlook.

In the Twin Cities region, for the week ending September 29:

- New Listings increased 15.0% to 1,592

- Pending Sales decreased 6.3% to 1,123

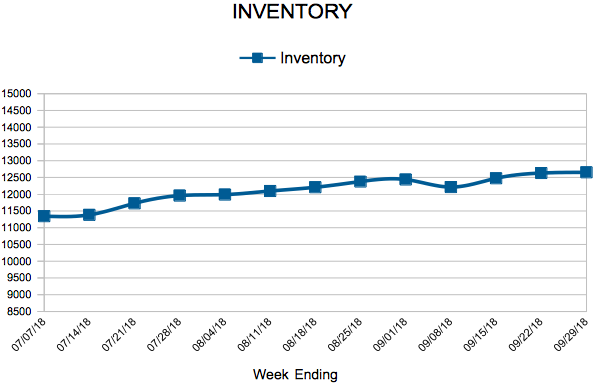

- Inventory decreased 4.7% to 12,653

For the month of August:

- Median Sales Price increased 6.3% to $268,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.7% to 99.2%

- Months Supply of Inventory remained flat at 2.6

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

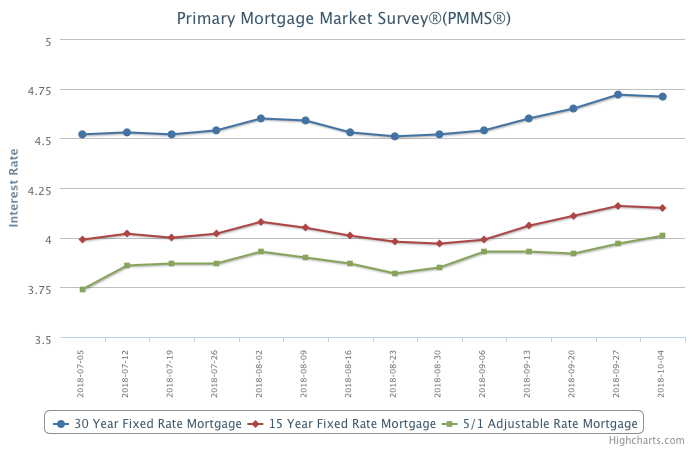

Mortgage Rates Largely Hold Steady

October 4, 2018

Mortgage rates inched back a little in this week’s survey, easing 1 basis point to 4.71 percent after hitting a seven year high last week. There is upside risk to mortgage rates as the economy remains very robust and this is reflected in the very recent strength in the fixed income and equities markets.

However, the strength in the economy has failed to translate to gains in the housing market as higher mortgage rates have contributed to the decrease in home purchase applications, which are down from a year ago. With mortgage rates expected to track higher, it’s going to be a challenge for the housing market to regain momentum.

Information provided by Freddie Mac.

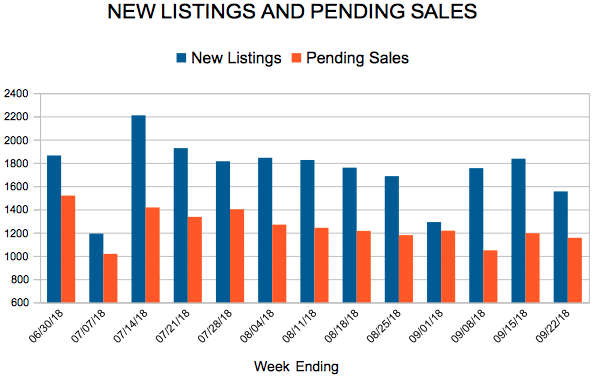

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 22, 2018

Seven years ago, FICO conducted a survey of bankers that concluded that home prices would not recover until 2020. While roughly one million people are still considered underwater in terms of home value, many people would consider the housing industry to not only be fully recovered but flying forward toward unprecedented price points. While high prices may soon begin to turn buyers off, it will be interesting to see if there is a measurable slowdown in real estate activity versus a natural shift to balanced prices.

In the Twin Cities region, for the week ending September 22:

- New Listings increased 6.1% to 1,555

- Pending Sales increased 3.0% to 1,156

- Inventory decreased 5.3% to 12,632

For the month of August:

- Median Sales Price increased 6.3% to $268,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.7% to 99.2%

- Months Supply of Inventory decreased 3.8% to 2.5

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 146

- 147

- 148

- 149

- 150

- …

- 234

- Next Page »