- « Previous Page

- 1

- …

- 148

- 149

- 150

- 151

- 152

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending September 8, 2018

Changing demographics, income levels, corporate growth and natural disasters all affect residential real estate markets. Home prices in Seattle and San Francisco have increased amidst e-commerce and technology success stories, while listings and sales decline precipitously when a hurricane strikes. This week, we are reminded of the destruction delivered by Hurricane Harvey to Houston at this time last year. From Katrina to Sandy to Maria to Florence, housing markets have bent but remain unbroken.

In the Twin Cities region, for the week ending September 8:

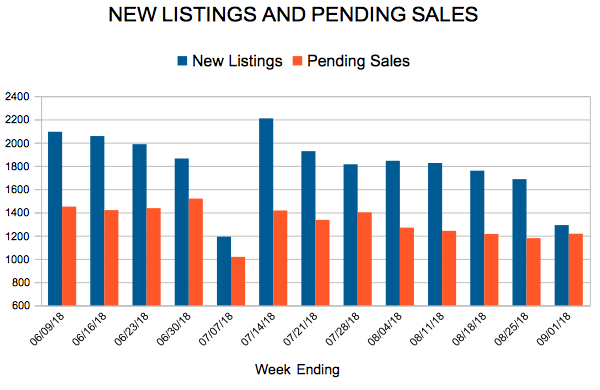

- New Listings increased 3.8% to 1,755

- Pending Sales decreased 2.3% to 1,048

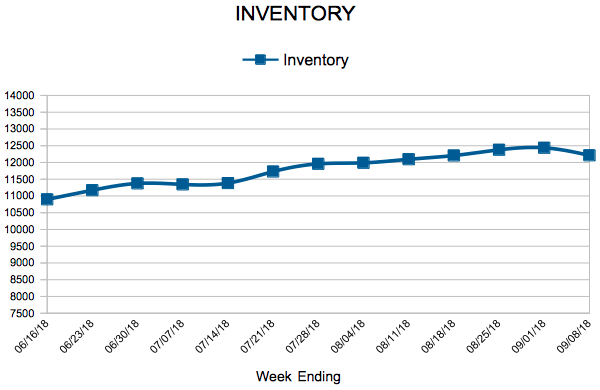

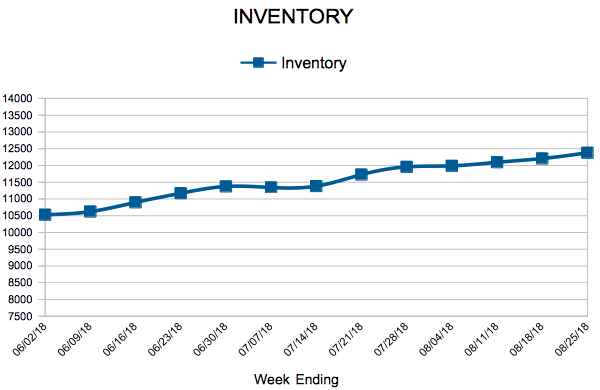

- Inventory decreased 7.2% to 12,213

For the month of August:

- Median Sales Price increased 6.3% to $268,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.7% to 99.2%

- Months Supply of Inventory decreased 3.8% to 2.5

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

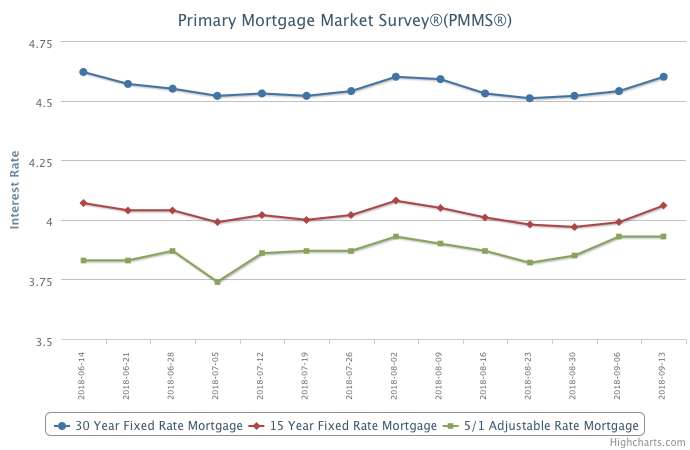

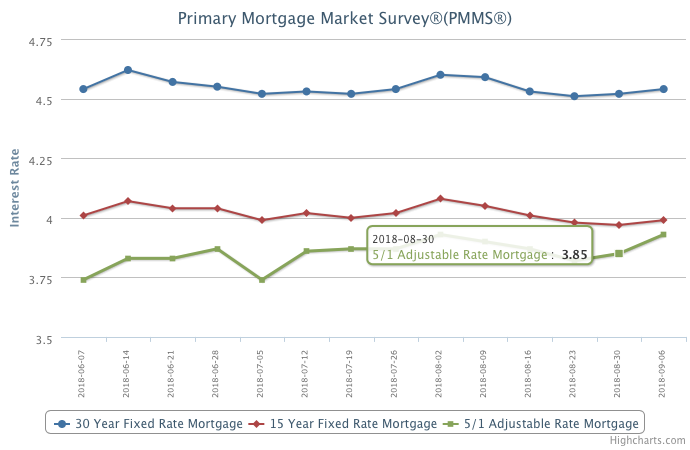

Mortgage Rates Rise for Third Straight Week

The one-two punch of strong job and consumer credit growth drove mortgage rates up to their highest mark since August 2.

Mortgage rates are currently 0.82 percent higher than a year ago, which is the biggest year-over-year increase since May 2014. Looking ahead, annualized comparisons for mortgage applications may look weaker than they appear, but that’s primarily because of the large spread between mortgage rates now and last September, which was when they reached their low for the year.

Overall, this spectacular stretch of solid job gains and low unemployment should help keep homebuyer interest elevated. However, mortgage rates will likely also move up, as the Federal Reserve considers short-term rate hikes this month and at future meetings.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 1, 2018

At this time of year, there tends to be a final push to get a housing deal done before a natural switch in focus toward the likes of back-to-school needs, home preparation for colder weather and even pre-planning for winter holiday and leisure travel. Although there doesn’t appear to be a huge national increase in sales compared to last year, there also isn’t any overt let-down. Residential real estate is healthy now and should continue to be healthy into the fall and winter seasons.

In the Twin Cities region, for the week ending September 1:

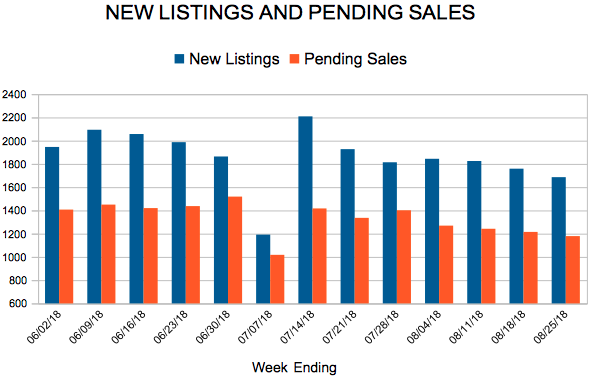

- New Listings decreased 1.4% to 1,291

- Pending Sales increased 0.4% to 1,217

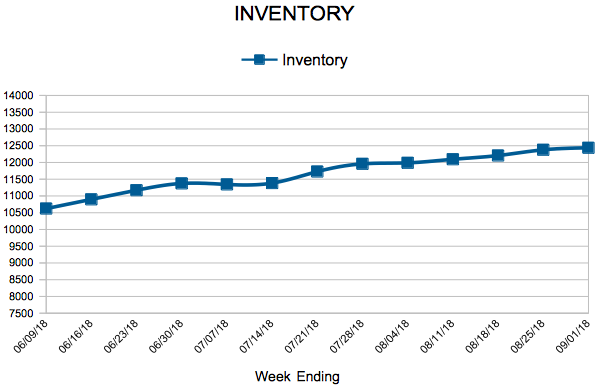

- Inventory decreased 7.6% to 12,438

For the month of July:

- Median Sales Price increased 6.6% to $268,000

- Days on Market decreased 17.4% to 38

- Percent of Original List Price Received increased 0.7% to 99.8%

- Months Supply of Inventory decreased 7.4% to 2.5

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Move Up Again

The 30-year fixed-rate mortgage inched higher for the second straight week.

Borrowing costs may be slowly on the rise again in coming weeks, as investors remain optimistic about the underlying strength of the economy. It’s important to note that mortgage rates are now up three-quarters of a percentage point from last year and home prices – albeit at a slower pace – are still outrunning rising inflation and incomes.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 25, 2018

In both academic and conversational circles, more people are beginning to discuss 2018 as the end of the freewheeling days of residential real estate – with its high prices and fast sales, site unseen. Such a portrayal of the last several years of the housing market are sensationalistic at best, patently false at worst. It is true that median sales prices have risen and total days on market have lessened. This prevailing market trend has occurred gradually, and so shall the next trend.

In the Twin Cities region, for the week ending August 25:

- New Listings increased 12.5% to 1,686

- Pending Sales decreased 7.6% to 1,179

- Inventory decreased 9.0% to 12,378

For the month of July:

- Median Sales Price increased 6.6% to $268,000

- Days on Market decreased 17.4% to 38

- Percent of Original List Price Received increased 0.7% to 99.8%

- Months Supply of Inventory decreased 7.4% to 2.5

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 148

- 149

- 150

- 151

- 152

- …

- 234

- Next Page »