- « Previous Page

- 1

- …

- 151

- 152

- 153

- 154

- 155

- …

- 234

- Next Page »

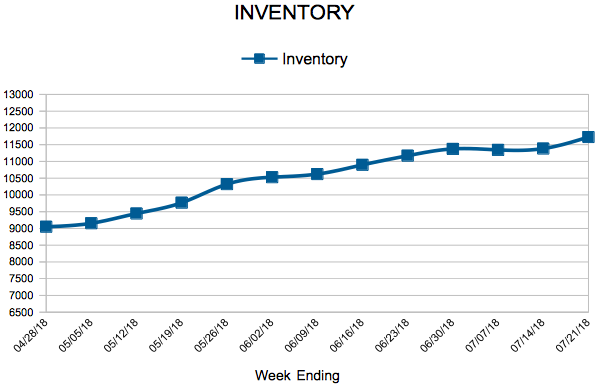

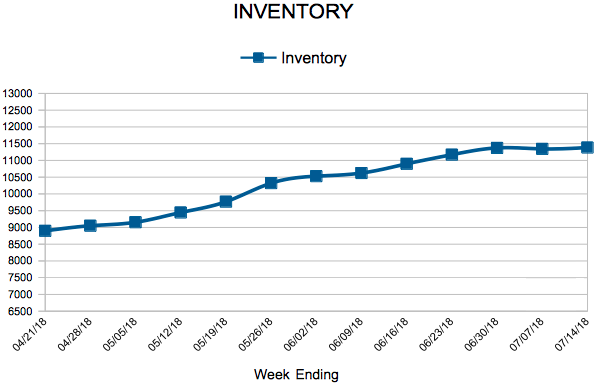

Inventory

Weekly Market Report

For Week Ending July 21, 2018

Although talk of another real estate pricing bubble poised to burst is premature, pundits are nevertheless beginning to point toward the common markers that caused the last housing market downturn. As prices continue to rise while wages don’t rise as quickly, a new situation could be an eventuality. Yet today’s market is quite different than the last recession. The economy is growing, lending practices are more in line with economic fundamentals and inventory appears to be improving in many markets, which would help alleviate price pressure.

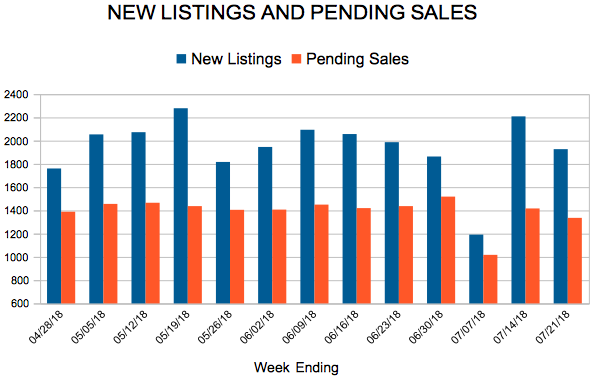

In the Twin Cities region, for the week ending July 21:

- New Listings increased 2.2% to 1,927

- Pending Sales decreased 3.1% to 1,336

- Inventory decreased 13.6% to 11,728

For the month of June:

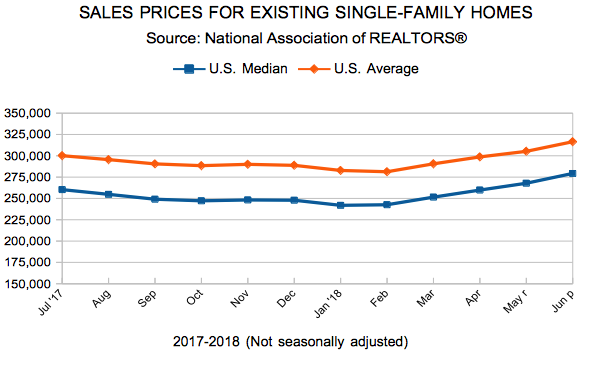

- Median Sales Price increased 5.3% to $271,000

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.8% to 100.3%

- Months Supply of Inventory decreased 11.1% to 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

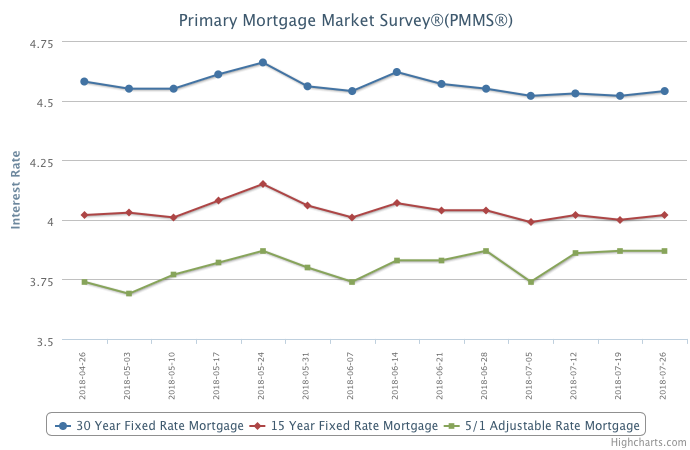

Mortgage Rates Shift Slightly Higher

Mortgage rates moved up slightly over the past week to their highest level since late June.

The next few months will be key for gauging the health of the housing market. Existing sales appear to have peaked, sales of newly built homes are slowing and unsold inventory is rising for the first time in three years.

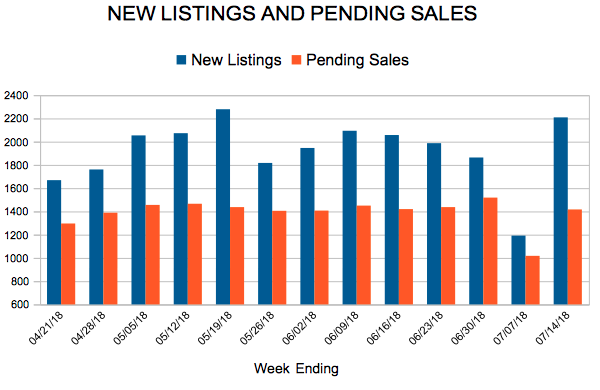

New Listings and Pending Sales

Inventory

Existing Home Sales

Weekly Market Report

For Week Ending July 14, 2018

National indicators do not necessarily predict the local economy, but the national trends can be a reliable gauge for what is happening with local residential real estate. Case in point, the U.S. Bureau of Labor Statistics recently reported that unemployment is relatively unchanged since last month. Meanwhile, a national statistics release about housing starts indicates that housing starts are lower nationwide, even as consumer spending on home goods purchases and renovations are up.

In the Twin Cities region, for the week ending July 14:

- New Listings increased 11.4% to 2,209

- Pending Sales decreased 2.7% to 1,417

- Inventory decreased 14.4% to 11,384

For the month of June:

- Median Sales Price increased 5.2% to $270,750

- Days on Market decreased 16.7% to 40

- Percent of Original List Price Received increased 0.8% to 100.3%

- Months Supply of Inventory decreased 11.1% to 2.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

June Monthly Skinny Video

“Buyer competition is frequently manifesting quick sales above asking price.”

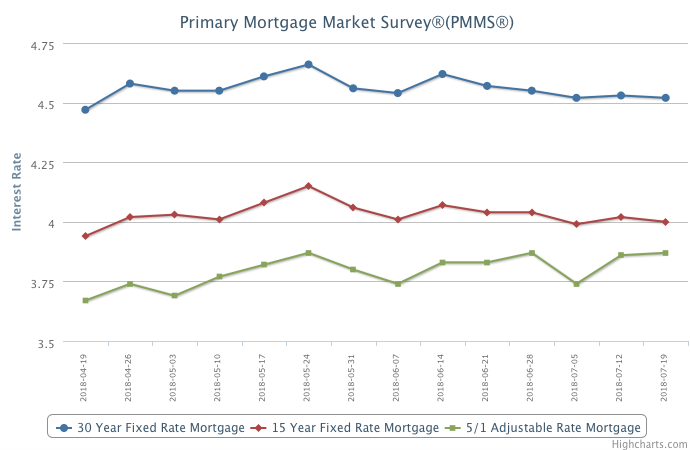

Mortgage Rates Barely Move

Mortgage rates were once again mostly flat over the past week, inching backward slightly.

Manufacturing output and consumer spending showed improvements, but construction activity was a disappointment. This meant there was no driving force to move mortgage rates in any meaningful way, which has been the theme in the last two months. That’s good news for price sensitive home shoppers, given that this stability in borrowing costs allows them a little extra time to find the right home.

- « Previous Page

- 1

- …

- 151

- 152

- 153

- 154

- 155

- …

- 234

- Next Page »