- « Previous Page

- 1

- …

- 154

- 155

- 156

- 157

- 158

- …

- 234

- Next Page »

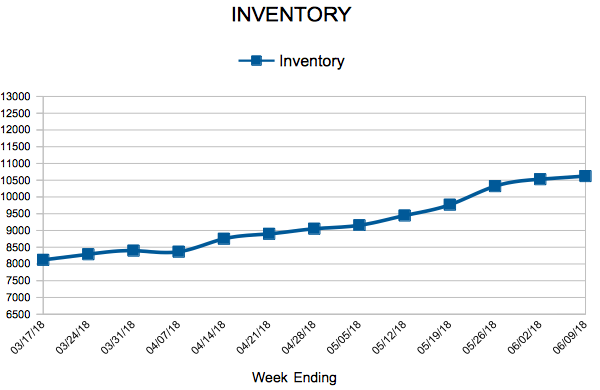

Inventory

Weekly Market Report

For Week Ending June 9, 2018

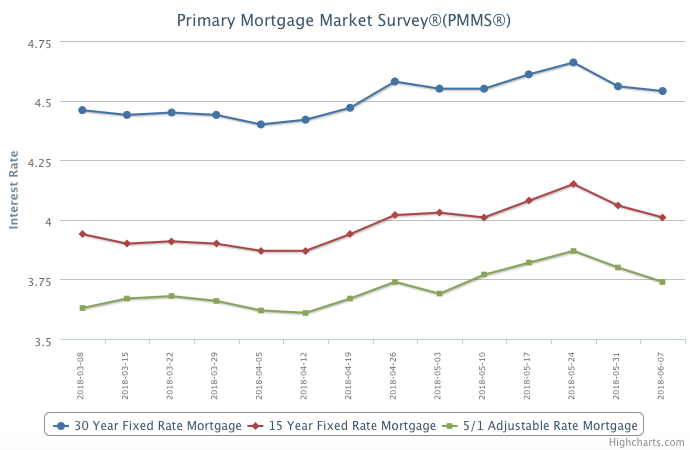

The Federal Reserve recently increased the federal funds rate by 0.25 percent, marking the second rate hike this year and seventh since late 2015. Two more 0.25 percent increases are expected by the end of the year. The 30-year mortgage rate did not increase, yet Fed action can have an indirect effect on the housing market. Buyers often react by trying to lock in at the current rate ahead of assumed future higher rates. Educating consumers that the Fed rate and mortgage rates are not the same can help curb panic buying.

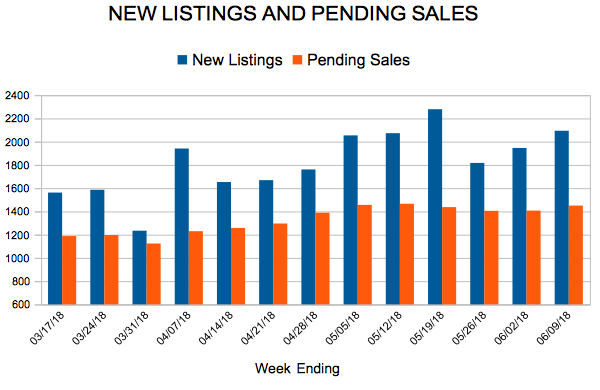

In the Twin Cities region, for the week ending June 9:

- New Listings decreased 2.7% to 2,094

- Pending Sales decreased 4.1% to 1,450

- Inventory decreased 18.5% to 10,623

For the month of May:

- Median Sales Price increased 8.4% to $271,000

- Days on Market decreased 9.6% to 47

- Percent of Original List Price Received increased 0.7% to 100.2%

- Months Supply of Inventory decreased 12.0% to 2.2

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

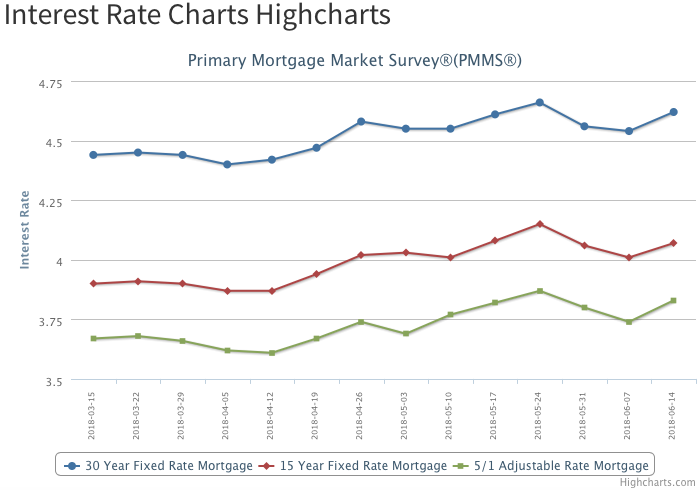

Mortgage Rates Back on the Rise

June 14, 2018

After declining for two straight weeks, mortgage rates reversed direction this week and rose to their second highest level this year. The 30-year fixed-rate mortgage climbed eight basis points to 4.62 percent, and the Federal Reserve Board on Wednesday raised the federal funds rate by 25 basis points.

The good news is that the impact of rising rates on consumer budgets will be smaller than past rate hike cycles. That is because a much smaller segment of mortgage loans in today’s market are pegged to short-term rate movements. The adjustable rate mortgage (ARM) share of outstanding loans is a lot smaller now – 8 percent versus 31 percent – than during the Fed’s last round of tightening between 2004 and 2006.

Long-Term Price Trend

Have you ever wondered to yourself what the home price trendline would look like compared to a hypothetical trendline that starts at the same price in 1990 but increased at a steady and predictable 4% annual growth? Well you’re in luck, because that’s exactly the sort of in-depth market insights that we serve up on a regular basis.

As you can see, recorded average sales prices were well above their trend from 1997 through 2008. The gravity or weight behind the long-term average has an inescapable pull. Some call this return to the average a “reversion to the mean.” There will always be short-term market fluctuations, but the overall long-term direction and growth of the market is upward at around 4-5% per year (before inflation). When we use the 4% figure, prices are only slightly above trend. If we were to use the 5% figure, prices would appear drastically undervalued relative to their long-term average.

The truth, as always, is somewhere in the middle.

*(Note that 2018 data is year-to-date up through April)

From The Skinny Blog.

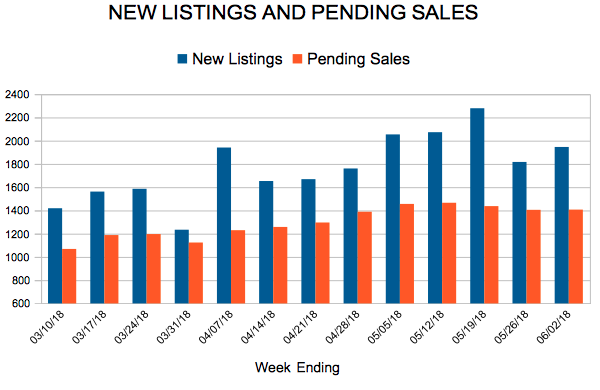

New Listings and Pending Sales

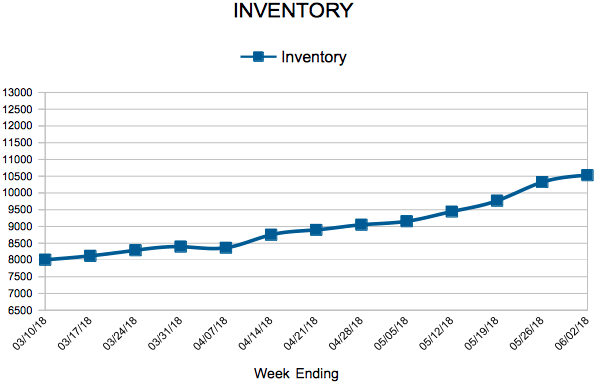

Inventory

Weekly Market Report

For Week Ending June 2, 2018

At this time last year, there were two universal truths in residential real estate across the country. Whether or not sales were up in year-over-year comparisons, the market was assuredly active, and, thus, overall inventory was trending downward compared to the year before. That remained the case for the entirety of 2017, and that refrain sounds entirely familiar for the duration of 2018.

In the Twin Cities region, for the week ending June 2:

- New Listings decreased 3.0% to 1,946

- Pending Sales decreased 1.5% to 1,407

- Inventory decreased 17.6% to 10,530

For the month of April:

- Median Sales Price increased 8.9% to $266,750

- Days on Market decreased 10.2% to 53

- Percent of Original List Price Received increased 0.8% to 99.9%

- Months Supply of Inventory decreased 20.8% to 1.9

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

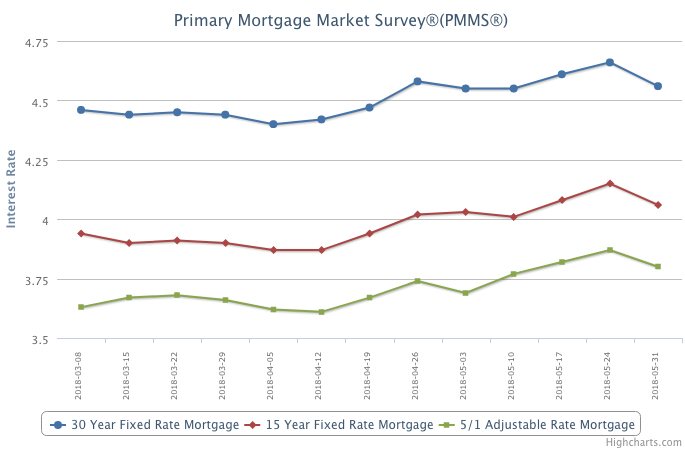

Mortgage Rates Inch Backward

Mortgage rates dipped for the second consecutive week. Homebuyers have taken advantage of the recent moderation in rates, which led to a 4 percent increase in purchase applications last week. Although demand has remained steadfast against the backdrop of this year’s higher borrowing costs, it’s important to note that the growth rate of purchase loan balances has moderated so far this year – and particularly since March. This slowdown indicates that buyers are having difficulty stretching to keep up with the pace of home-price growth.

Mortgage Rates Ease Up

- « Previous Page

- 1

- …

- 154

- 155

- 156

- 157

- 158

- …

- 234

- Next Page »