- « Previous Page

- 1

- …

- 155

- 156

- 157

- 158

- 159

- …

- 234

- Next Page »

Inventory

Weekly Market Report

For Week Ending May 26, 2018

Residential real estate activity is in full swing across America. Some trends are persisting as they have week after week, month after month and now year after year. But some metrics are teasing a deviation from the norm. There may not be as many homes for sale as there were last year at this time, and home price increases are still more likely than not, but there is a chance that we could see more positive changes in either sales or new listings as the summer months progress.

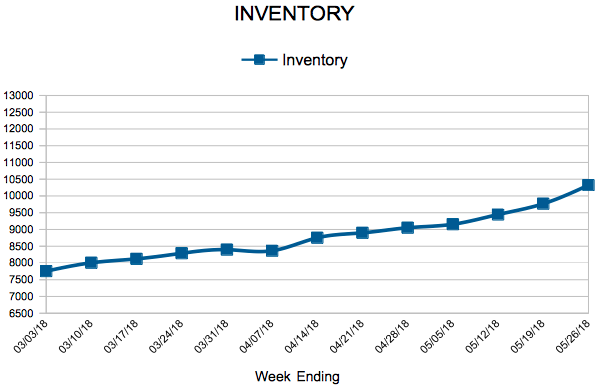

In the Twin Cities region, for the week ending May 26:

- New Listings increased 5.5% to 1,817

- Pending Sales decreased 9.9% to 1,405

- Inventory decreased 19.4% to 10,322

For the month of April:

- Median Sales Price increased 8.8% to $266,500

- Days on Market decreased 10.2% to 53

- Percent of Original List Price Received increased 0.8% to 99.9%

- Months Supply of Inventory decreased 20.8% to 1.9

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

April Monthly Skinny Video

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending May 19, 2018

According to the National Association of REALTORS®, existing home sales were down 2.5 percent for the nation as a whole in April. While local trends do not necessarily coincide with national trends, a holistic outlook can often explain the general state of feelings regarding residential real estate. Sales have been lower in year-over-year comparisons in the hottest submarkets due to low inventory and a speed to sale that is faster than the market can replenish itself.

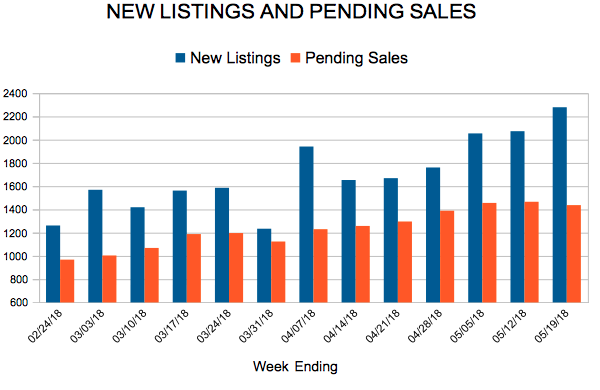

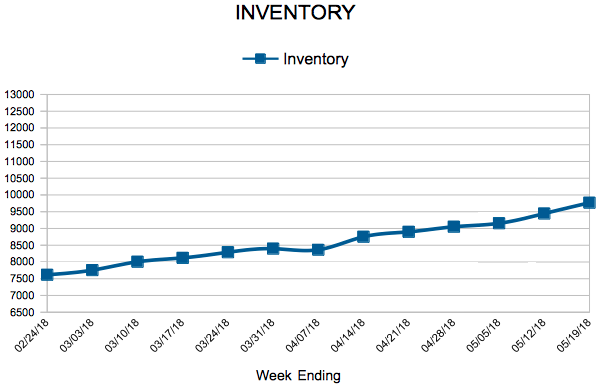

In the Twin Cities region, for the week ending May 19:

- New Listings increased 8.9% to 2,279

- Pending Sales decreased 10.2% to 1,437

- Inventory decreased 22.6% to 9,768

For the month of April:

- Median Sales Price increased 9.0% to $267,000

- Days on Market decreased 10.2% to 53

- Percent of Original List Price Received increased 0.8% to 99.9%

- Months Supply of Inventory decreased 20.8% to 1.9

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Existing Home Sales

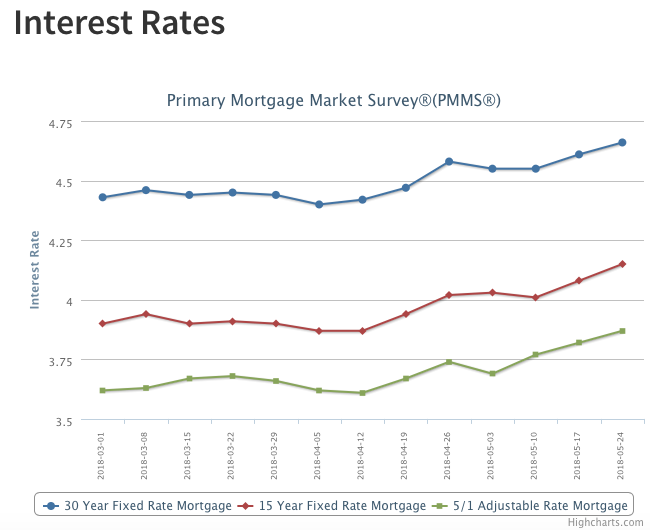

Mortgage Rates Maintain Steady Climb

Mortgage rates moved up over the past week to 4.66 percent, their highest level since May 5, 2011 (4.71 percent). Mortgage rates so far in 2018 have had the most sustained increase to start the year in over 40 years. Through May, rates have risen in 15 out of the first 21 weeks (71 percent), which is the highest share since Freddie Mac began tracking this data for a full year in 1972.

Slightly less activity yet higher prices in less time

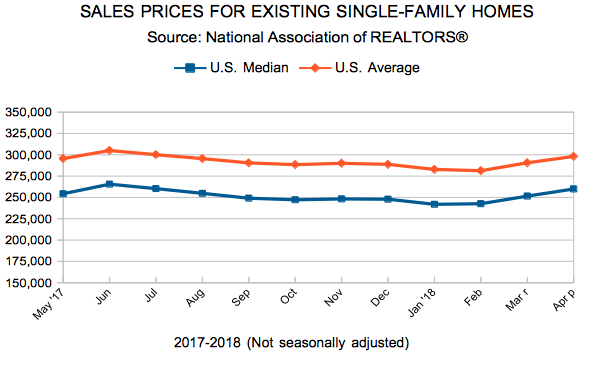

Housing demand is strong and supply is low. That’s been the story for a few years. But there is some early evidence that things could be starting to loosen up. That said, buyers shopping this spring will still face stiff competition. The lack of inventory combined with rising prices is encouraging some sellers to stay put; however, the move up market offers a bit more inventory. This combined with historically low interest rates creates a perfect opportunity for homeowners looking to move up.

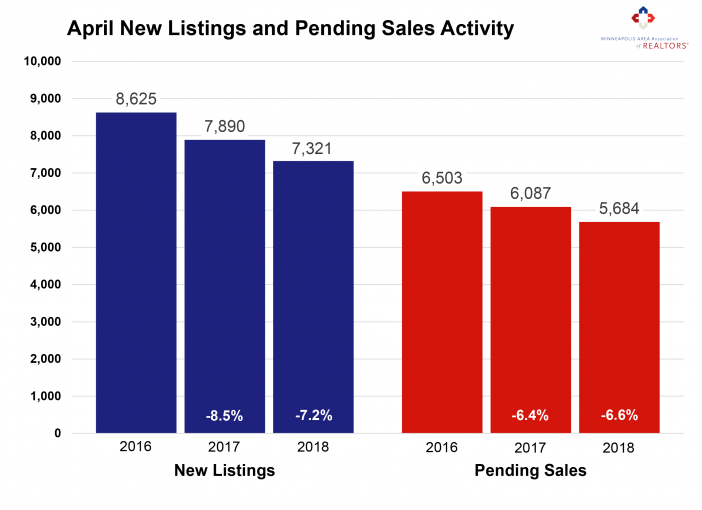

In April, sellers listed 7.2 percent fewer homes on the market—the sixth consecutive month of declines compared to a year ago. Largely due to the shortage, closed sales declined 5.2 percent compared to the prior year. For-sale housing inventory was 25.1 percent lower than April 2017. This shortage, which is particularly acute at the entry-level prices, has created a competitive environment where multiple offers and homes selling for over list price have become more common. Sellers are often receiving strong offers close to their original list price quickly, which can sometimes frustrate home buyers.

New construction closed sales rose 13.2 percent compared to last April. Although single family homes made up about 73.0 percent of all sales, townhomes and condos have seen stronger demand lately. Similarly, previously-owned homes made up about 90.0 percent of sales, but new construction showed a much stronger increase in pending and closed purchase activity. The average time on market is still 53 days, reminding sellers that they still need to stage and price their homes well.

April 2018 by the Numbers (compared to a year ago)

• Sellers listed 7,321 properties on the market, a 7.2 percent decrease

• Buyers closed on 4,635 homes, a 5.2 percent decrease

• Inventory levels for April fell 25.1 percent compared to 2017 to 8,958 units

• Months Supply of Inventory was down 25.0 percent to 1.8 months

• The Median Sales Price rose 8.6 percent to $266,000, a record high for April

• Cumulative Days on Market declined 10.2 percent to 53 days, on average (median of 18)

• Changes in Sales activity varied by market segment

Single family sales declined 6.4 percent; condo sales rose 3.0 percent; townhome sales rose 1.0 percent

Traditional sales fell 2.8 percent; foreclosure sales decreased 43.3 percent; short sales fell 20.0 percent

Previously-owned sales fell 5.6 percent; new construction sales rose 13.2 percent

- « Previous Page

- 1

- …

- 155

- 156

- 157

- 158

- 159

- …

- 234

- Next Page »