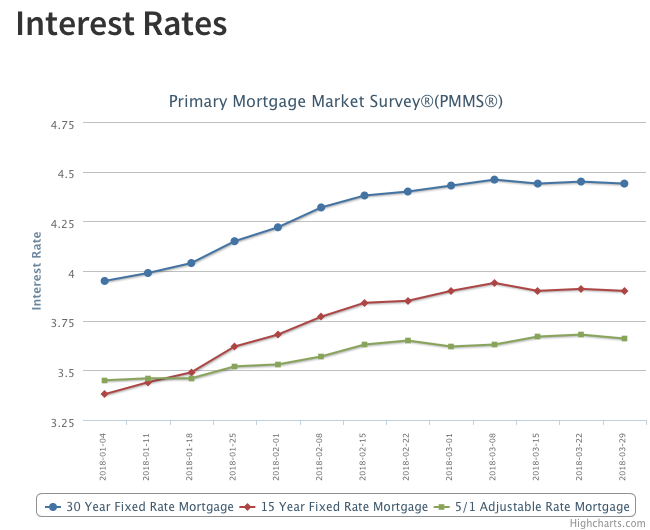

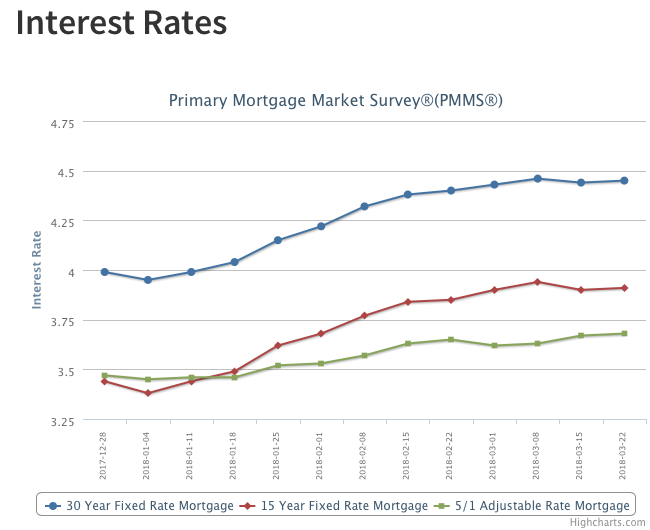

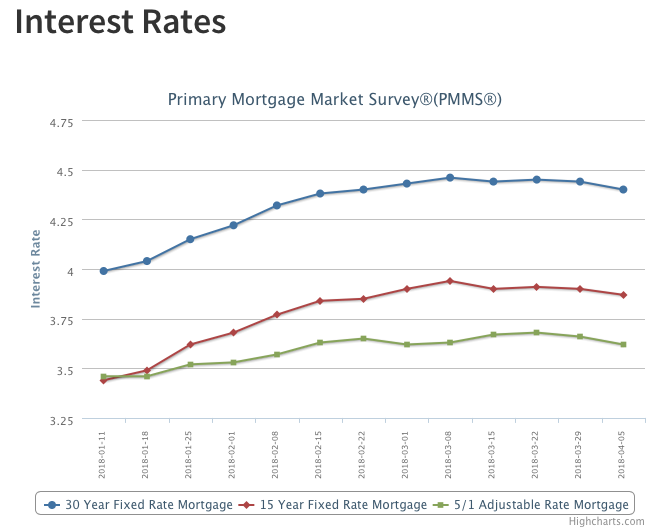

After dropping earlier this week on trade-related anxiety in financial markets, the benchmark 10-year Treasury stabilized on Wednesday, but at a level slightly lower than from the start of last week. Mortgage rates followed and fell for the second consecutive week; the U.S. weekly average 30-year fixed mortgage was 4.4 percent in the Primary Mortgage Market Survey® (PMMS®) this week. Though rates on the 30-year fixed mortgage are up 0.3 percentage points from the same week a year ago, a robust labor marking is helping home purchase demand weather modestly higher rates.