- « Previous Page

- 1

- …

- 160

- 161

- 162

- 163

- 164

- …

- 234

- Next Page »

New Listings and Pending Sales

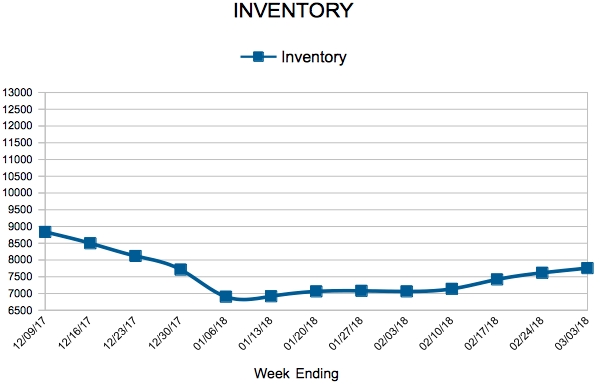

Inventory

Weekly Market Report

For Week Ending March 10, 2018

There is not much new to report this week compared to last week or the week before, but that is more good news than bad news at this juncture of the year. It’s true that more homes listed for sale would be welcome for a housing market ready for an influx of options. At the same time, there is ample evidence of buyers making the most of what is present on the market now. Contracts are being signed, and the prices being paid continue to prove demand.

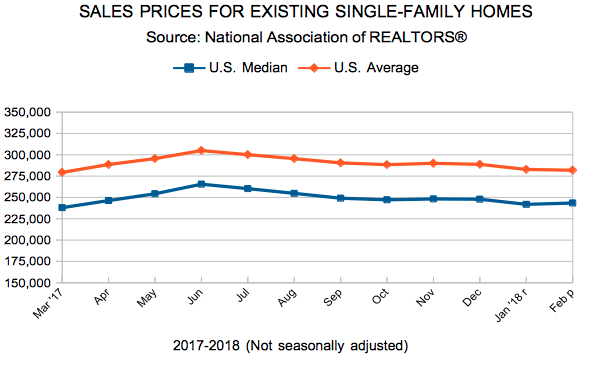

In the Twin Cities region, for the week ending March 10:

- New Listings decreased 20.3% to 1,419

- Pending Sales decreased 9.5% to 1,069

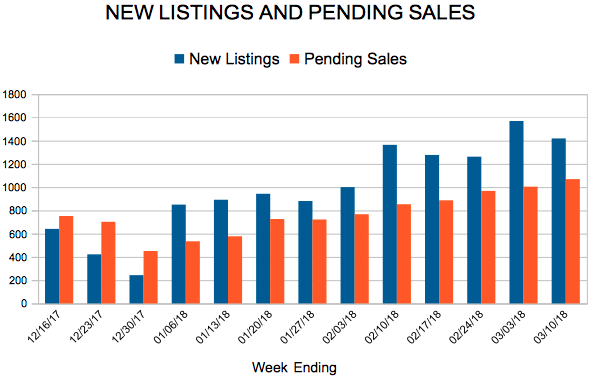

- Inventory decreased 21.7% to 8,006

For the month of February:

- Median Sales Price increased 12.7% to $250,000

- Days on Market decreased 15.9% to 69

- Percent of Original List Price Received increased 1.6% to 98.0%

- Months Supply of Inventory decreased 21.1% to 1.5

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

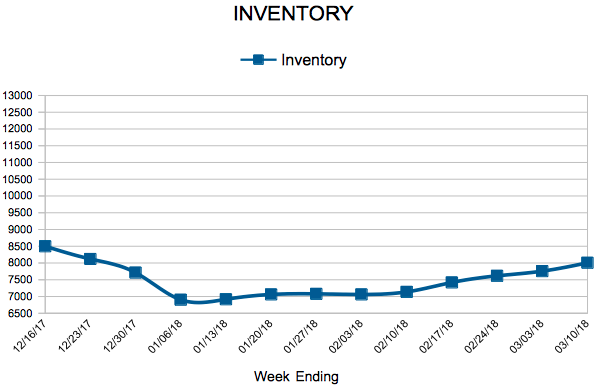

Sales down in early spring market while prices rally

By David Arbit on Friday, March 16th, 2018

The big story of 2017 was threefold: the median sales price reached an all-time high; closed sales reached a 12-year high; and inventory levels reached a 15-year low. Sales nearly broke their all-time record, but fell just short of their all-time 2004 high. In February 2018, new listings posted a year-over-year decline for a fourth consecutive month. Mostly due to the supply shortage, closed sales were lower compared to the year prior for a third consecutive month. For-sale housing supply (inventory) was 23.0 percent lower than February 2017. This shortage has created a competitive environment where multiple offers have become commonplace. Sellers are receiving strong offers close to their original list price in record time, which can sometimes frustrate home buyers. New construction closed sales rose 15.7 percent compared to last February. Although single-family homes made up about 73.0 percent of all sales, condos and townhomes showed the strongest increase in closed sales. Similarly, previously-owned homes made up about 88.7 percent of sales but new construction showed a much stronger increase in pending and closed purchase activity.

February 2018 by the Numbers

- Sellers listed 5,072 properties on the market, an 8.0 percent decrease from February 2017

- Buyers closed on 2,635 homes, a 6.0 percent decrease from 2017

- Inventory levels for February fell 23.0 percent compared to 2017 to 7,537 units, near a 15-year low

- Months Supply of Inventory was down 21.1 percent to 1.5 months, also near a 15-year low

- The Median Sales Price rose 12.7 percent to $250,000, a record high for February

- Cumulative Days on Market declined 15.9 percent to 69 days, on average (median of 38)—a 12-year low

- Changes in sales activity varied by market segment

- Single-family sales fell 8.3 percent; condo sales rose 1.9 percent; townhome sales rose 6.3 percent

- Traditional sales fell 1.3 percent; foreclosure sales fell 43.3 percent; short sales fell 39.6 percent

- Previously-owned sales fell 6.3 percent; new construction sales rose 15.7 percent

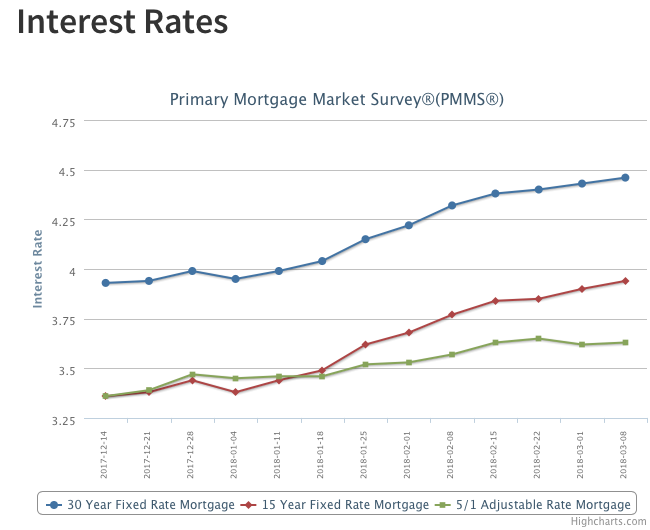

Mortgage Rates Drop for First Time in 2018

Tuesday’s Consumer Price Index report indicated inflation may be cooling down; headline consumer price inflation was 2.2 percent year-over-year in February. Following this news, the 10-year Treasury fell slightly. Mortgage rates followed Treasurys and ended a nine-week surge. The U.S. weekly average 30-year fixed mortgage rate fell 2 basis points to 4.44 percent in this week’s survey, its first decline this year.

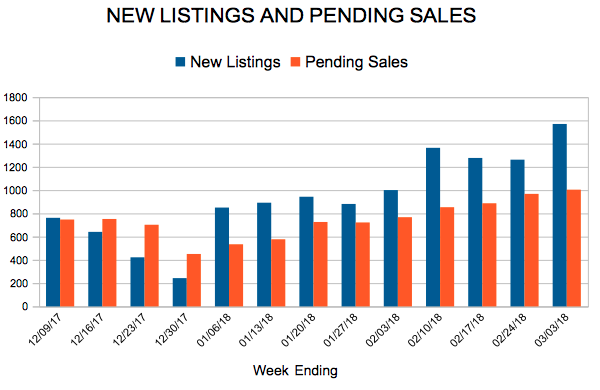

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 3, 2018

We are still not seeing a big surge in new listings or sales as we make our way into the springtime months. Housing activity around the country is generally lagging compared to last year at this time. Lower affordability due to higher mortgage rates and increasing prices could be the culprit for a slower start in 2018. It could also be that some locales have had unseasonably cold weather, holding some people back from listing or buying. Let’s look at how the local market is doing.

In the Twin Cities region, for the week ending March 3:

- New Listings decreased 11.1% to 1,569

- Pending Sales decreased 19.5% to 1,004

- Inventory decreased 21.9% to 7,757

For the month of January:

- Median Sales Price increased 9.7% to $244,000

- Days on Market decreased 13.8% to 69

- Percent of Original List Price Received increased 1.0% to 96.9%

- Months Supply of Inventory decreased 22.2% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Push Higher

The 10-year Treasury yield has been bouncing around in a narrow 15 basis point range for the last month. While the yield on the 10-year Treasury is currently below the high of 2.95 percent reached two weeks ago, mortgage rates are up for the ninth consecutive week. The U.S. weekly average 30-year fixed mortgage rate rose 3 basis points to 4.46 percent in this week’s survey, its highest level since January 2014.

- « Previous Page

- 1

- …

- 160

- 161

- 162

- 163

- 164

- …

- 234

- Next Page »