- « Previous Page

- 1

- …

- 161

- 162

- 163

- 164

- 165

- …

- 234

- Next Page »

Inventory

Weekly Market Report

For Week Ending February 24, 2018

We are in a bit of a residential real estate holding pattern thus far in 2018. While some regions have witnessed a welcome increase in pending sales, declines in metrics such as closed sales, new listings and inventory in national year-over-year comparisons are more common, and it may take until late summer or early fall to see evidence of a predicted increase in inventory. In the mean time, buyer interest has remained strong despite the usual supply challenge.

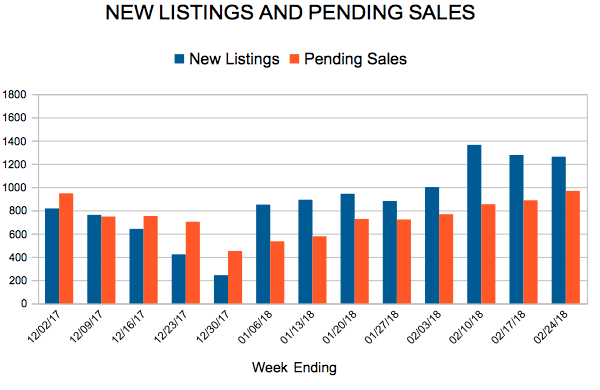

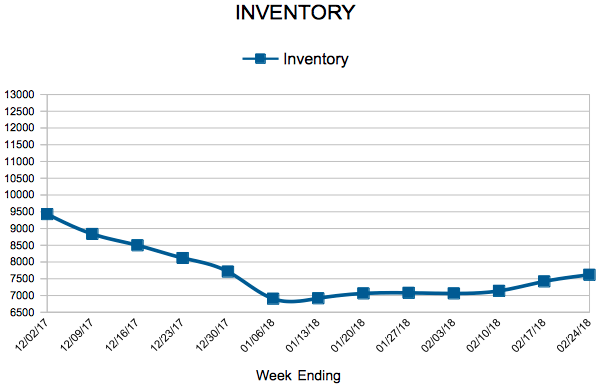

In the Twin Cities region, for the week ending February 24:

- New Listings decreased 8.0% to 1,262

- Pending Sales decreased 8.6% to 968

- Inventory decreased 22.8% to 7,618

For the month of January:

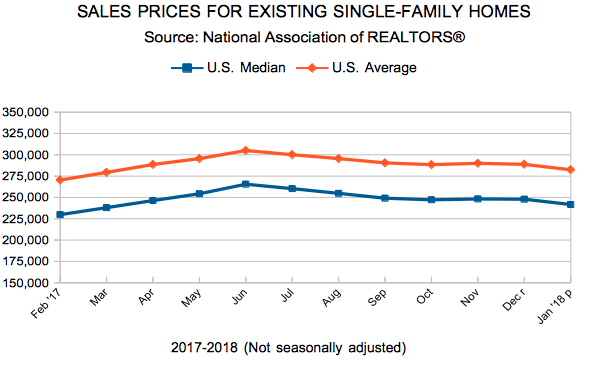

- Median Sales Price increased 9.7% to $244,000

- Days on Market decreased 13.8% to 69

- Percent of Original List Price Received increased 1.0% to 96.9%

- Months Supply of Inventory decreased 22.2% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

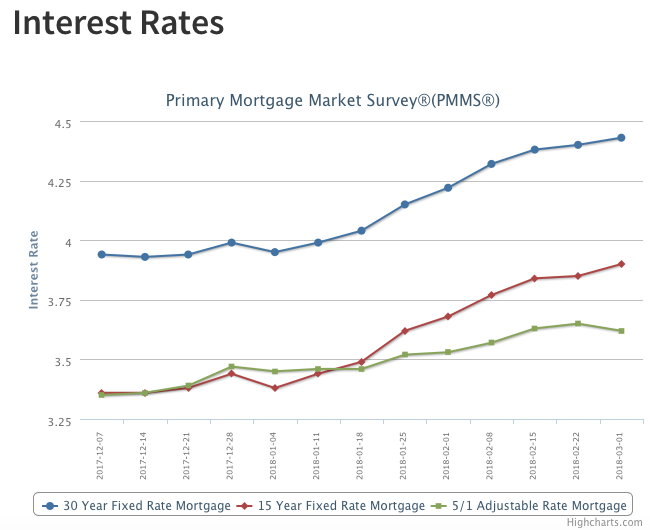

Fixed-Rate Mortgage Rates Rise for Eighth Consecutive Week

Optimistic testimony on Capitol Hill from Federal Reserve Chairman Jerome Powell sent Treasury yields higher as Powell stated his outlook for the economy has strengthened since December. Following Treasurys, the 30-year fixed mortgage rate jumped 3 basis points to reach 4.43 percent in this week’s survey. The 30-year rate has been on a tear in 2018, climbing 48 basis points since the start of the year and increasing for 8 consecutive weeks.

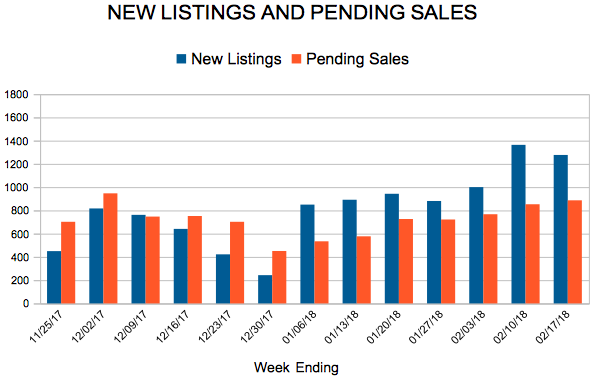

New Listings and Pending Sales

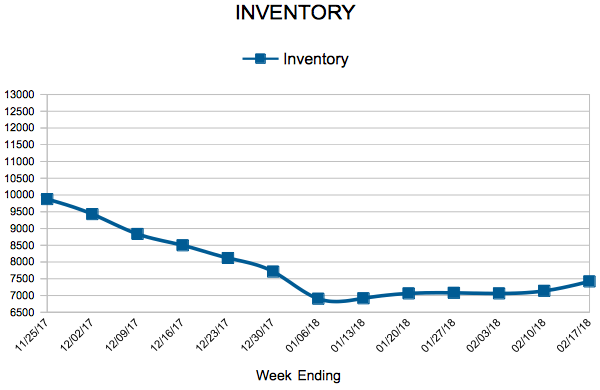

Inventory

Weekly Market Report

For Week Ending February 17, 2018

The trends from the last several weeks and, honestly, the last several months remain in place in much of the country as well as locally. The market is trying to sustain a healthy number of listings to keep pace with a consumer base that is clearly in a buying mood. There is real evidence of increased showing activity and anecdotal evidence from busy real estate professionals that we are setting up for another busy year in residential real estate.

In the Twin Cities region, for the week ending February 17:

- New Listings decreased 6.1% to 1,277

- Pending Sales decreased 14.9% to 887

- Inventory decreased 23.8% to 7,420

For the month of January:

- Median Sales Price increased 9.4% to $243,500

- Days on Market decreased 13.8% to 69

- Percent of Original List Price Received increased 1.0% to 96.9%

- Months Supply of Inventory decreased 22.2% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

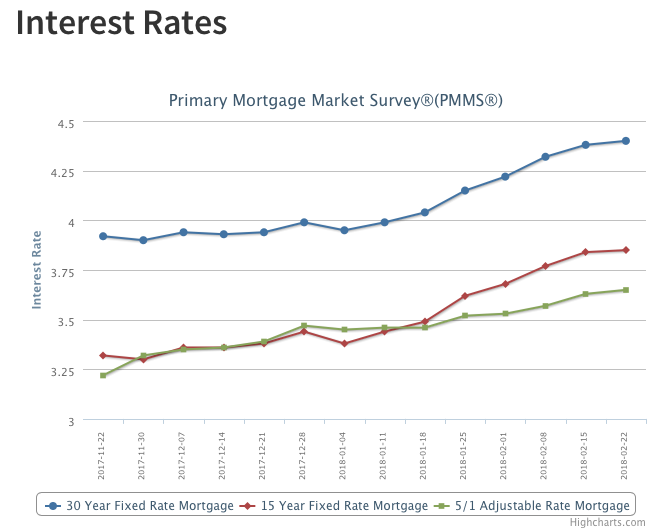

Mortgage Rates Continue Upward Climb

Fixed mortgage rates increased for the seventh consecutive week, with the 30-year fixed mortgage rate reaching 4.40 percent in this week’s survey; the highest since April of 2014. Mortgage rates have followed U.S. Treasurys higher in anticipation of higher rates of inflation and further monetary tightening by the Federal Reserve. Following the close of our survey, the release of the FOMC minutes for February 21, 2018 sent the 10-year Treasury above 2.9 percent. If those increases stick, we will likely see mortgage rates continue to trend higher.

Existing Home Sales

January Monthly Skinny Video

“We are now several years deep into a period of rising prices and low inventory”

- « Previous Page

- 1

- …

- 161

- 162

- 163

- 164

- 165

- …

- 234

- Next Page »