- « Previous Page

- 1

- …

- 164

- 165

- 166

- 167

- 168

- …

- 234

- Next Page »

Inventory

Weekly Market Report

For Week Ending January 13, 2018

At the beginning of a calendar year, it is often common for home buyers and sellers to become immediately more active. Call it the result of a resolution or the promise of something new, but it is a noted phenomenon across the country. It’s really too early to say if the trend will continue in 2018, but the first weeks of the year have not necessarily shown a huge jolt in activity so much as the last weeks of 2017 were quieter than usual.

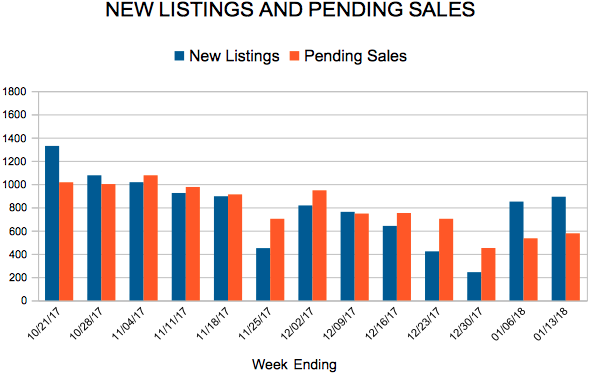

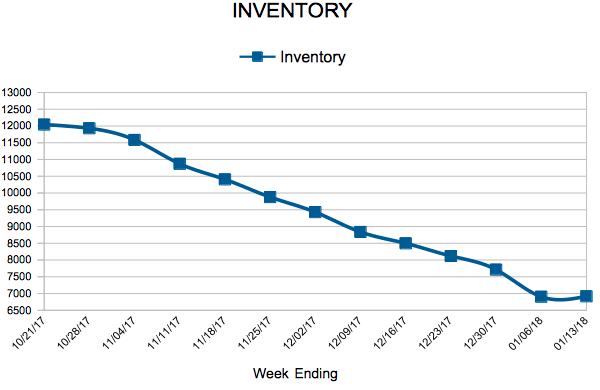

In the Twin Cities region, for the week ending January 13:

- New Listings decreased 5.4% to 892

- Pending Sales decreased 13.0% to 577

- Inventory decreased 26.9% to 6,918

For the month of December:

- Median Sales Price increased 9.7% to $248,000

- Days on Market decreased 15.3% to 61

- Percent of Original List Price Received increased 1.3% to 97.1%

- Months Supply of Inventory decreased 26.3% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

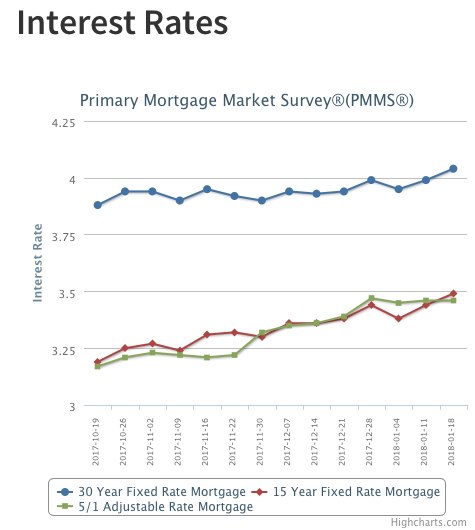

Mortgage Rates Move Higher For Second Consecutive Week

The U.S. weekly average for the 30-year fixed mortgage rate rose above 4 percent for the first time since last summer to 4.04 percent in this week’s survey. This is the highest weekly average for the 30-year fixed rate mortgage since May of 2017. Inflation is firming, the Federal Reserve’s Beige Book indicates broad-based economic growth and labor markets are tightening. This means upward pressure on long-term rates, like the 30-year fixed-rate mortgage, is building.

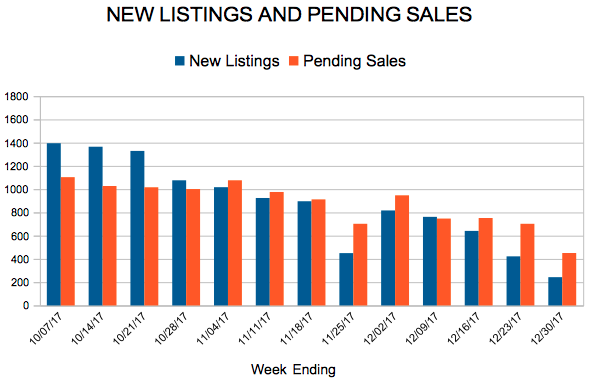

New Listings and Pending Sales

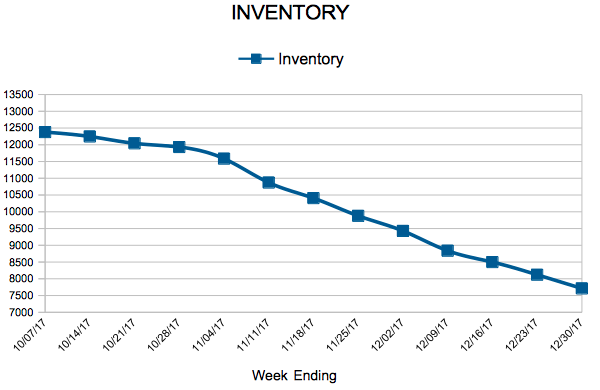

Inventory

Weekly Market Report

For Week Ending January 6, 2018

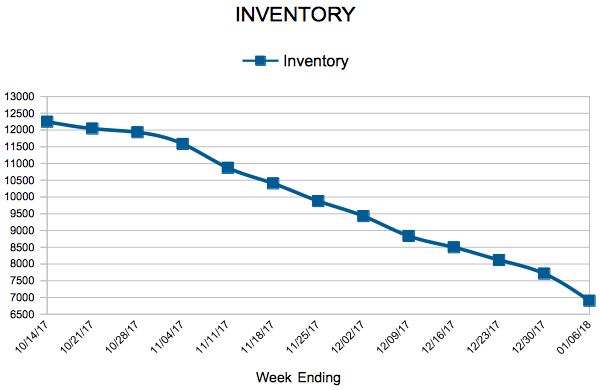

As we embark upon the 2018 campaign, watch for upward movement in some of the same areas for wanted improvements in 2017. The number of homes available for sale continues to be a key factor in the dynamics of residential real estate. Simply put, it would be good to have more inventory available for purchase. Buying a home is a viable and exciting option for many consumers, and having more homes to choose from is one way to assure that the dream of homeownership is an affordable achievement.

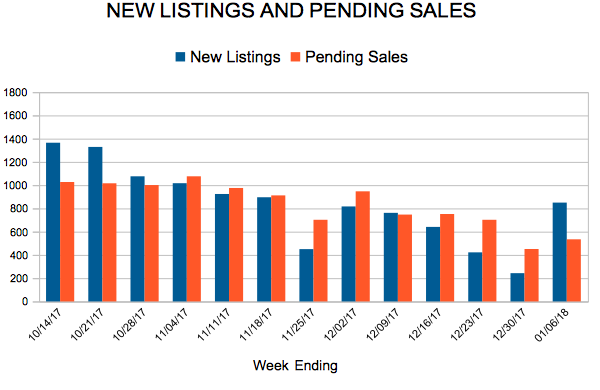

In the Twin Cities region, for the week ending January 6:

- New Listings decreased 13.4% to 850

- Pending Sales decreased 10.7% to 534

- Inventory decreased 26.7% to 6,904

For the month of December:

- Median Sales Price increased 9.8% to $248,200

- Days on Market decreased 15.3% to 61

- Percent of Original List Price Received increased 1.3% to 97.1%

- Months Supply of Inventory decreased 26.3% to 1.4

All comparisons are to 2017

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

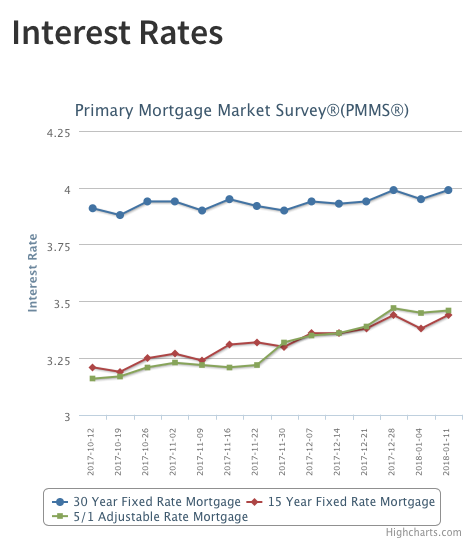

Mortgage Rates Bounce Back Up

After dipping slightly last week, Treasury yields surged this week amidst sell-offs in the bond market. The 10-year Treasury yield, for instance, reached its highest point since March of last year. Mortgage rates followed Treasury yields and ticked up modestly across the board. The 30-year fixed-rate mortgage averaged 3.99 percent, up 4 basis points from a week ago.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 164

- 165

- 166

- 167

- 168

- …

- 234

- Next Page »