- « Previous Page

- 1

- …

- 175

- 176

- 177

- 178

- 179

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending August 5, 2017

As we reach into August, we’ll begin to see the volume of activity wane in anticipation of the school year. Although not every buyer or seller has children, it’s no secret that homeownership is a popular housing option for those with kids. In bulk, this has historically been enough of a factor for turning down the summer’s market heat before lower temperatures take hold.

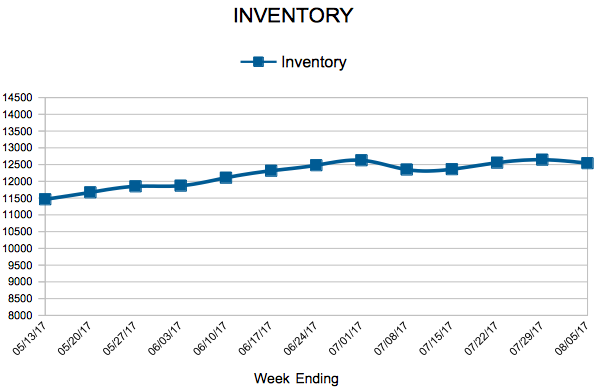

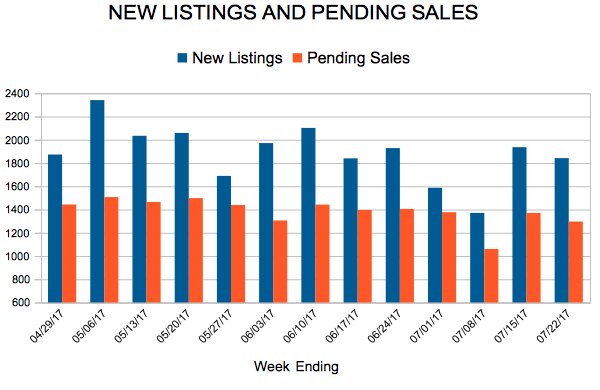

In the Twin Cities region, for the week ending August 5:

- New Listings decreased 0.5% to 1,787

- Pending Sales decreased 3.6% to 1,285

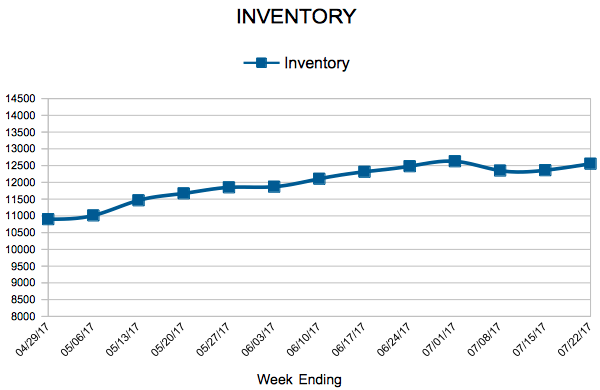

- Inventory decreased 16.9% to 12,541

For the month of June:

- Median Sales Price increased 7.0% to $259,000

- Days on Market decreased 16.1% to 47

- Percent of Original List Price Received increased 0.8% to 99.5%

- Months Supply of Inventory decreased 13.3% to 2.6

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

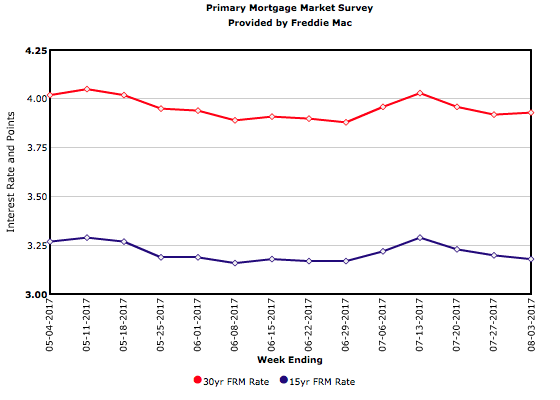

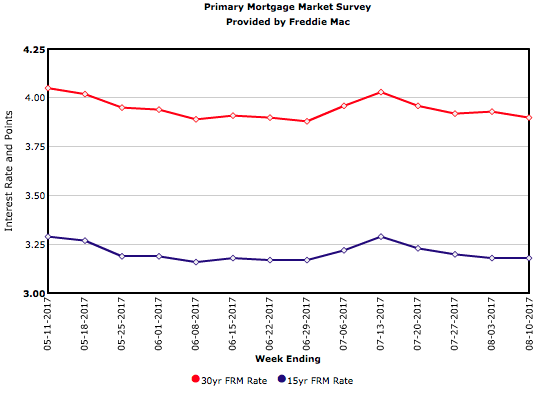

Mortgage Rates Inch Lower

After holding relatively flat last week, the 10-year Treasury yield fell 4 basis points this week. The 30-year mortgage rate moved in tandem with Treasury yields, dropping 3 basis points to 3.90 percent. Earlier this week, Federal Reserve officials highlighted the influence of continued weak inflation data on rates.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 29, 2017

A favorable economy has kept buyers active amidst a summer of stiff competition that has led prices upward and often over the asking price. The latest recorded national unemployment rate of 4.3 is historically low and has served as a general indicator of a strong economy. If wage growth shifts into overdrive from its current state of patient increases, we may see even higher prices or, conversely, more willingness by sellers to increase the inventory pool.

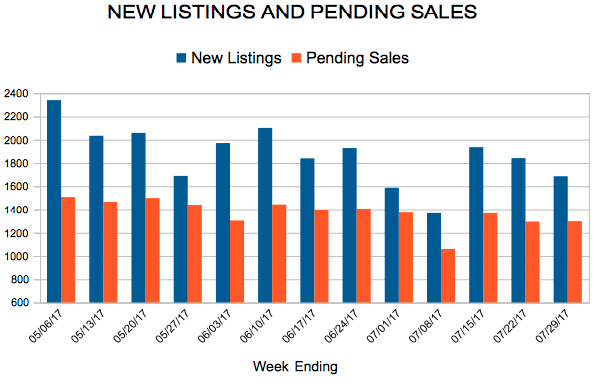

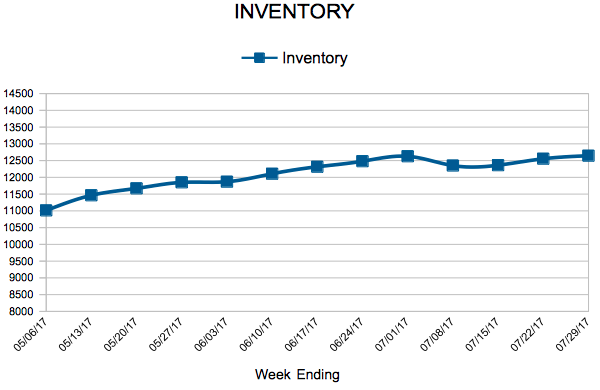

In the Twin Cities region, for the week ending July 29:

- New Listings decreased 2.3% to 1,686

- Pending Sales decreased 4.7% to 1,300

- Inventory decreased 16.9% to 12,645

For the month of June:

- Median Sales Price increased 7.0% to $259,000

- Days on Market decreased 16.1% to 47

- Percent of Original List Price Received increased 0.8% to 99.5%

- Months Supply of Inventory decreased 13.3% to 2.6

All comparisons are to 2016

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

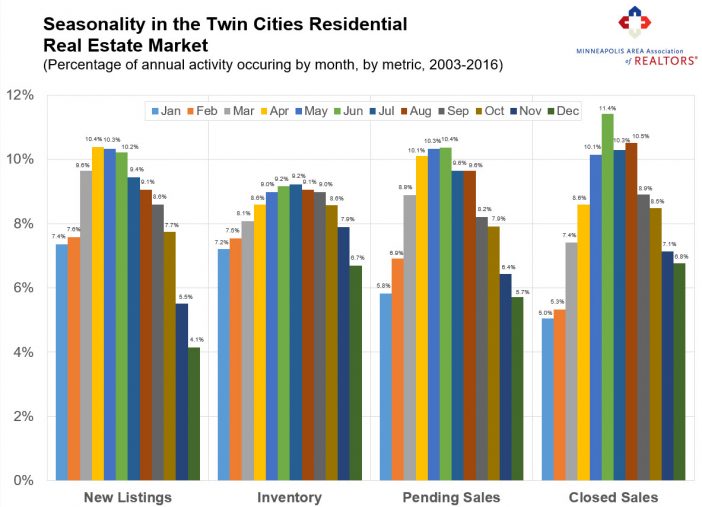

Seasonal Adjustments

Given the fact that the school year is about a month away (yikes) and we’ve already had our first preview of fall weather, it feels like a good time to talk about seasonality. First of all, whatever you do, don’t use the term “seasonably adjusted.” Second of all, don’t make matters worse by talking about the “seasonably adjusted medium sales price.” That’s not a thing.

All kidding aside, both agents and the public have a vested interested in knowing how and when listings, inventory levels, purchase agreements and closed sales ebb and flow throughout the year. Ever been asked the question or wondered “when do the most new listings come on the market?” Or “when do buyers write the most offers?” Or how about “what month tends to have the greatest number of homes for sale?”

These are legitimate and important questions that can inform a variety of market-related strategies. Technically, April sees the highest volume of new listings, but buyers have the greatest number of choices in July. Signed purchase agreements peak in June along with closed sales. The shape of the seasonal curves can also be revealing. Seller activity tends to ramp up quickly in March and April and then quiet down rapidly starting in October. New listings are front-loaded in the first half of the year. Buyer activity, particularly pending sales, tends to follow more of a “normal” or even distribution throughout the year.

From The Skinny Blog.

Mortgage Rates Hold Steady

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 175

- 176

- 177

- 178

- 179

- …

- 234

- Next Page »