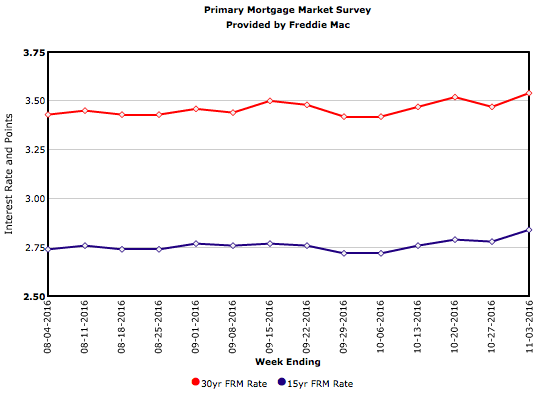

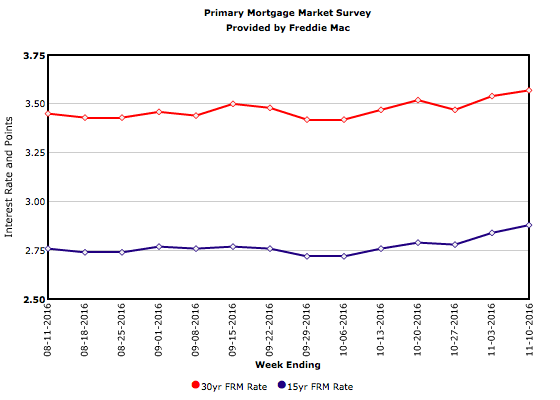

This week’s survey reflects pre-election market conditions. As a result, the 30-year mortgage rate increased to 3.57 percent, only 3 basis points higher than last week’s level. On Wednesday, the 10-year Treasury yield closed above 2 percent, about 25 basis points higher than its pre-election value and its highest yield since January. At this point, it is too soon to tell whether Treasuries will hold this new level or if the mortgage rate will increase as much over the coming week.