- « Previous Page

- 1

- …

- 202

- 203

- 204

- 205

- 206

- …

- 234

- Next Page »

Weekly Market Report

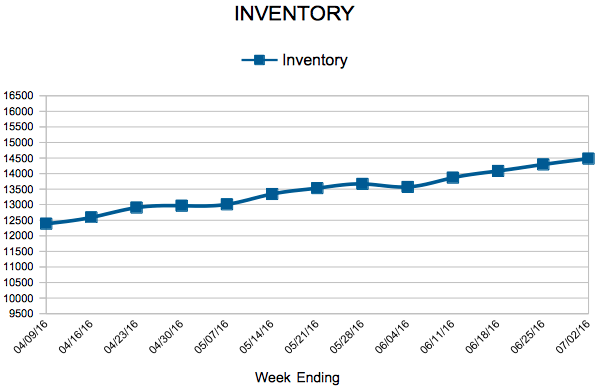

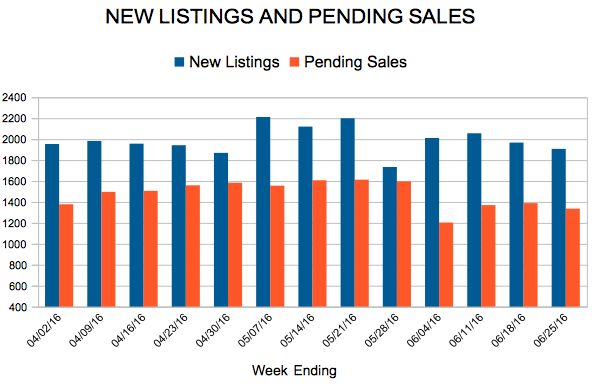

For Week Ending July 2, 2016

The United Kingdom vote for exit from the European Union (Brexit) has likely already had at least one short-term effect on the U.S. housing market. The decision to not raise interest rates until later this year was likely made because of Brexit, so unrest in financial markets can be watched further with hopes of stabilization. Long-term effects may include more or less foreign investment in U.S. residential real estate, but wholesale price declines are not expected any time soon.

In the Twin Cities region, for the week ending July 2:

- New Listings increased 24.2% to 1,589

- Pending Sales increased 12.9% to 1,351

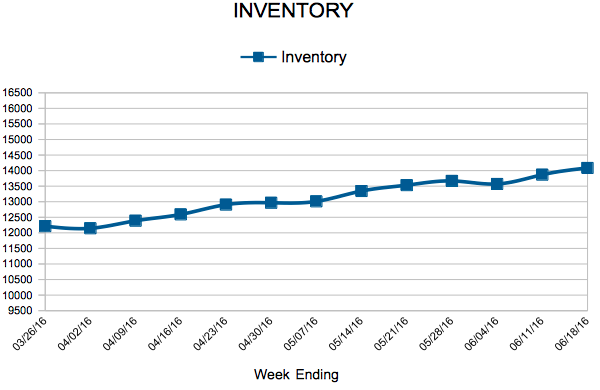

- Inventory decreased 17.7% to 14,480

For the month of June:

- Median Sales Price increased 5.3% to $242,000

- Days on Market decreased 16.7% to 55

- Percent of Original List Price Received increased 1.0% to 98.7%

- Months Supply of Inventory decreased 23.7% to 2.9

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

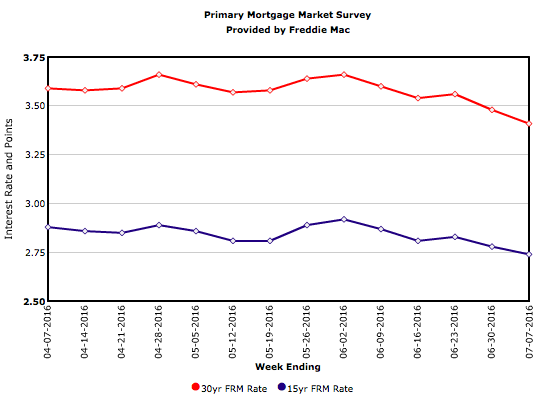

Mortgage Rates Approaching All-Time Record Lows

Continuing fallout from the Brexit vote drove Treasury yields lower again this week. The 30-year fixed-rate mortgage followed Treasury yields, falling 7 basis points to 3.41 percent in this week’s survey. Mortgage rates have now dropped 15 basis points over the past two weeks, leaving them only 10 basis points above the all-time low.

New Listings and Pending Sales

Inventory

Weekly Market Report

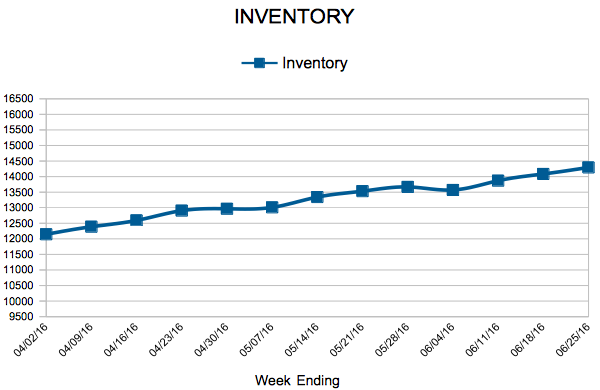

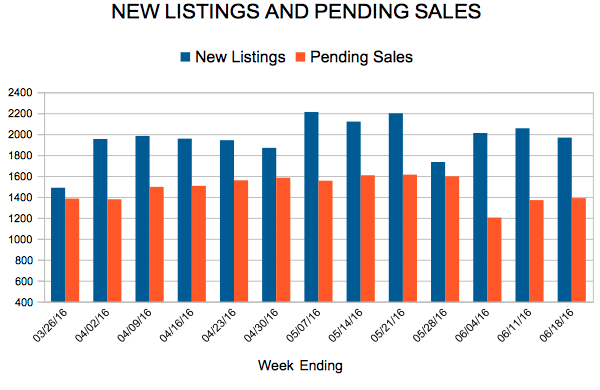

For Week Ending June 25, 2016

As we know, declining inventory has been the central focus of real estate news throughout the first half of the year. The lack of options of homes for sale seems to be keeping many from selling and instead, staying and renovating. This, in turn, leads to a lack of starter homes for first-time buyers. Sales are still climbing ever upward, and low mortgage rates continue to aid affordability.

In the Twin Cities region, for the week ending June 25:

- New Listings increased 2.2% to 1,907

- Pending Sales decreased 6.0% to 1,336

- Inventory decreased 19.0% to 14,294

For the month of May:

- Median Sales Price increased 5.8% to $236,900

- Days on Market decreased 21.1% to 60

- Percent of Original List Price Received increased 1.1% to 98.6%

- Months Supply of Inventory decreased 26.3% to 2.8

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

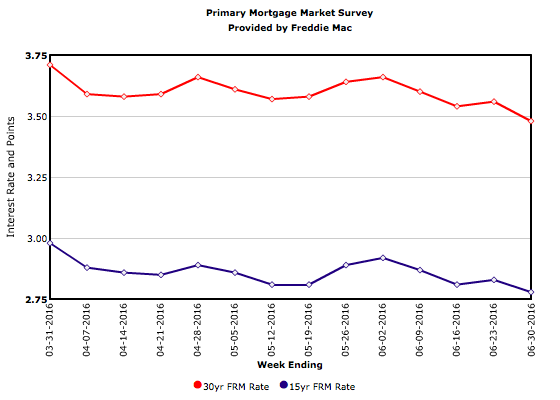

Mortgage Rates Touch New 2016 Lows

In the wake of the Brexit vote, the yield on the 10-year U.S. Treasury bond plummeted 24 basis points. The 30-year mortgage rate declined 8 basis points to 3.48 percent. This week’s survey rate is the lowest since May 2013 and only 17 basis points above the all-time low recorded in November 2012. This extremely low mortgage rate should support solid home sales and refinancing volume this summer.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 18, 2016

Like summer temperatures, home prices continue to inch up in most housing categories and geographic submarkets. Meanwhile, hopeful buyers are wishing for more options to fulfill the perfect fit. As we reach deeper into summer, dips in home sales are not unexpected. Even while people search for homes in which to move or start a family, summer is also about family time in other ways.

In the Twin Cities region, for the week ending June 18:

- New Listings decreased 4.2% to 1,967

- Pending Sales increased 1.9% to 1,389

- Inventory decreased 19.0% to 14,085

For the month of May:

- Median Sales Price increased 5.8% to $236,900

- Days on Market decreased 21.1% to 60

- Percent of Original List Price Received increased 1.1% to 98.6%

- Months Supply of Inventory decreased 26.3% to 2.8

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

- « Previous Page

- 1

- …

- 202

- 203

- 204

- 205

- 206

- …

- 234

- Next Page »