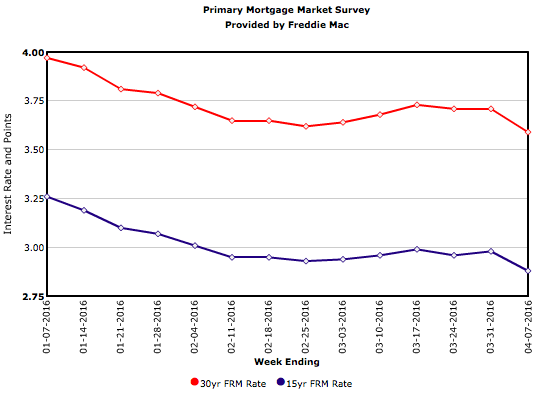

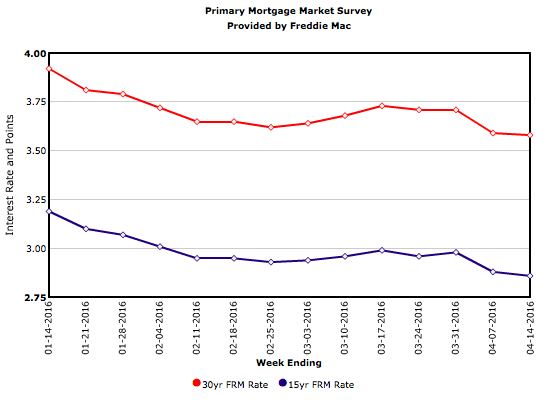

The April 14 release of results of Freddie Mac’s Primary Mortgage Market Survey® (PMMS®) shows mortgage rates again moving lower, in response to high demand for Treasuries. The 30-year mortgage rate fell 1 basis point to 3.58 percent. This rate represents yet another low for 2016 and the lowest mark since May 2013.