- « Previous Page

- 1

- …

- 213

- 214

- 215

- 216

- 217

- …

- 234

- Next Page »

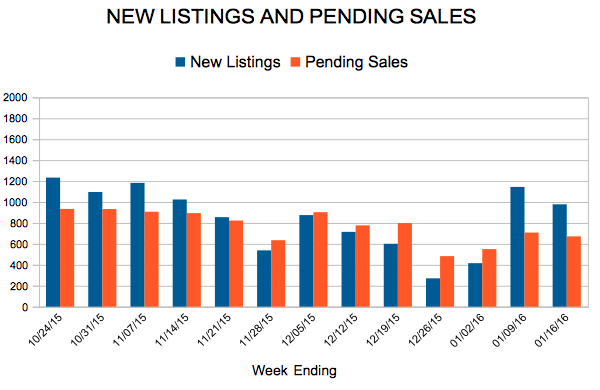

New Listings and Pending Sales

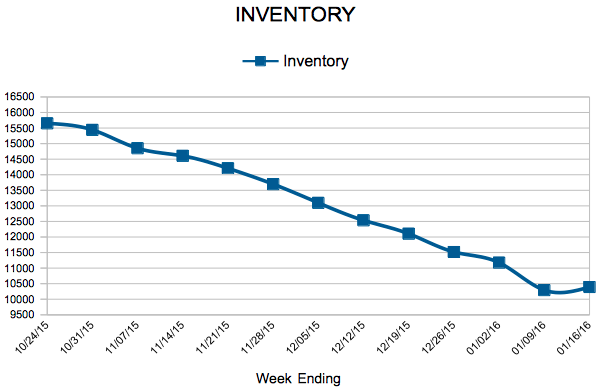

Inventory

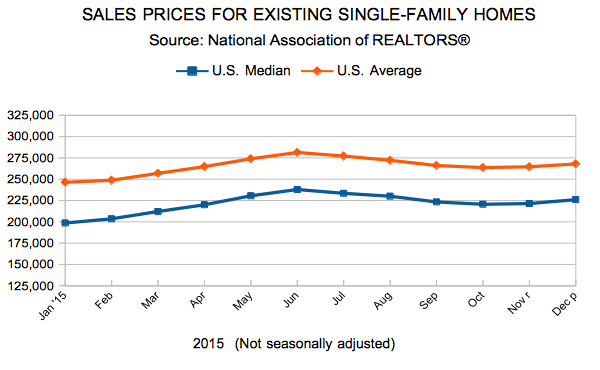

Existing Home Sales

Weekly Market Report

For Week Ending January 16, 2016

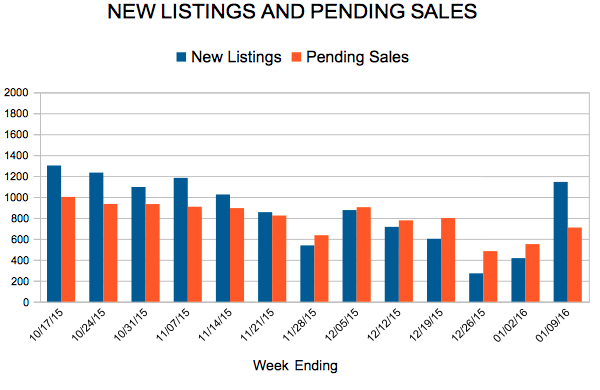

A pattern is emerging that shows a fresh willingness by sellers to put homes on the market and buyers to enter the market. New listings are on the rise, if not in year- over-year comparison, then certainly in week-over-week views, as we bounce well past the new year. Inventory is seemingly unfazed by the new 2016 calendar on the wall, as the trend line has remained roughly the same for the first weeks in January as the last weeks in December. If sales activity builds on what’s happening now and reaches a slow boil, it would be surprising if more inventory mix wasn’t added to the water soon.

In the Twin Cities region, for the week ending January 16:

- New Listings decreased 8.8% to 978

- Pending Sales increased 3.5% to 672

- Inventory decreased 20.3% to 10,392

For the month of December:

- Median Sales Price increased 9.9% to $219,900

- Days on Market decreased 11.2% to 79

- Percent of Original List Price Received increased 1.3% to 95.4%

- Months Supply of Inventory decreased 31.3% to 2.2

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

January Monthly Skinny Video

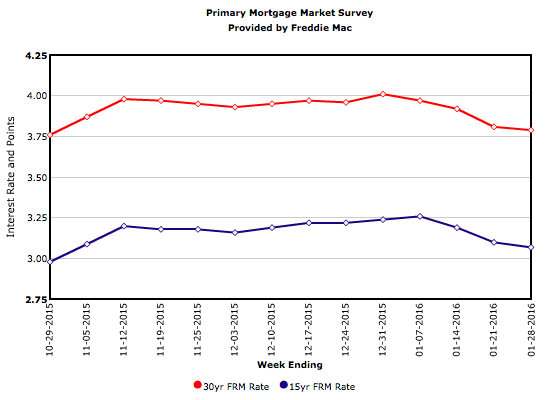

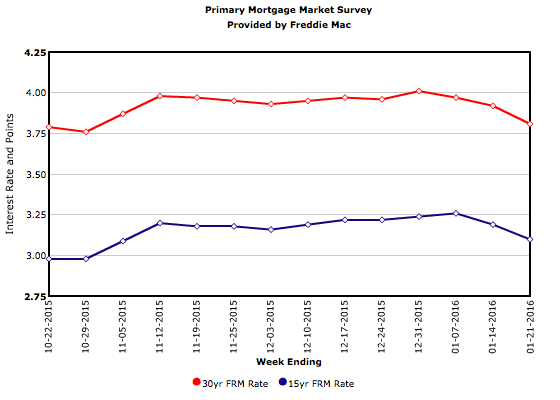

Mortgage Rates Fall for Third Straight Week

Twin Cities Housing Market Has Most Closed Sales Since 2005

At a press conference today, REALTOR® associations reported that the Twin Cities Metropolitan Area had the best year in terms of the number of closed sales since 2005. Closed sales finished 2015 13.7% better than 2014, boasting 56,390 compared to 49,604 in 2014.

The median sales price in 2015 was $220,000, a 7.0% increase from $205,600 in 2014. This is on top of gains in recent years of +14.4% in 2013 and 11.9% in 2012. The median sales price of single family homes was up 5.6% and townhouse-condos were up 3.8% over the prior year, continuing multi-year positive trends. Distressed sales were a mere 10.6% of all closed sales in 2015. This represents a one-year change in sales of foreclosures and short sales of -26.7%.

“Last year (2015) really showcased the durability of our economic and housing recovery, despite a few obstacles. As sales hit a 10-year high, the Twin Citizens are just as committed to homeownership as ever. Attractive rates, rising rents, job growth, wage increases and the lowest unemployment rate of any major metro area will continue to be positive factors for real estate,” said Judy Shields, President of the Minneapolis Area Association of REALTORS®

Months’ supply of inventory ended the year at an unprecedented low of 2.1 months. This metric indicates how long it would take to sell-off all existing inventory if no new inventory was added and is generally considered balanced, favoring neither buyer nor seller, at 5.0 months. While this metric indicates a sellers’ market that may leave some buyers with fewer options, it also has some market watchers asking themselves whether we’ve seen the supply bottom. While inventory is certainly a metric to watch it’s probably best measured and compared throughout the selling season and not at year end.

“Since inventory conditions vary across the metro and market conditions change quickly, would-be sellers are encouraged to contact their REALTORS® for an updated market analysis. Your home might be worth more than you think,” said Bob Clark, President of the Saint Paul Area Association of REALTORS®.

Days on market continued to shrink, ending 2015 at just 76 days on the market – a 10-year record low.

Percent of original list price, a metric that demonstrates a relationship of the original list price compared to the final sales price remains strong at 96.6% overall and across market segments. For example, this means if a home was originally listed at $100,000 its final sales price was $96,600.

Single family homes and townhouse-condo segments were at 96.6% of original list. Previously owned was at 96.4%. New construction topped out a 99.6% of original list. This indicates sellers have regained their pricing power and are accepting near-full price offers on their listings.

“We know that well maintained, appropriately priced homes with amenities are selling fairly quickly but moreover the data shows that as well,” said Clark.

From The Skinny Blog.

Weekly Market Report

For Week Ending January 9, 2016

We are just getting started into 2016 residential real estate market activity, but early indicators are pointing to a positive start. Home sales are expected to have a healthy amount of growth in 2016, but along with the rise in sales, modest increases in home prices are also expected. Low mortgage rates are an unexpected ray of sunshine this week, amidst typical winter doldrums.

In the Twin Cities region, for the week ending January 9:

- New Listings increased 11.3% to 1,144

- Pending Sales increased 15.3% to 708

- Inventory decreased 20.8% to 10,293

For the month of December:

- Median Sales Price increased 9.9% to $219,900

- Days on Market decreased 12.4% to 78

- Percent of Original List Price Received increased 1.3% to 95.4%

- Months Supply of Inventory decreased 31.3% to 2.2

All comparisons are to 2015

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 213

- 214

- 215

- 216

- 217

- …

- 234

- Next Page »