- « Previous Page

- 1

- …

- 220

- 221

- 222

- 223

- 224

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending October 10, 2015

Supply and demand drive housing prices, and this basic economic tenet has been in the spotlight recently, as inventory remains low across the country while prices continue to edge up in many locales. Cash investment has gobbled up supply in some regions, while a lack of new construction has hit the supply side in others. The truth remains that there is still healthy demand in most corners. Every market and situation is unique, so let’s track the listings and sales for the week in your area.

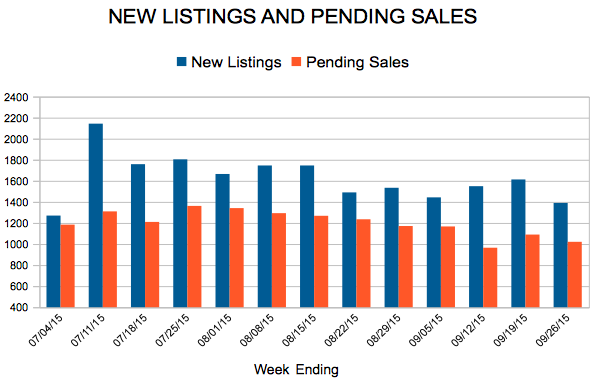

In the Twin Cities region, for the week ending October 10:

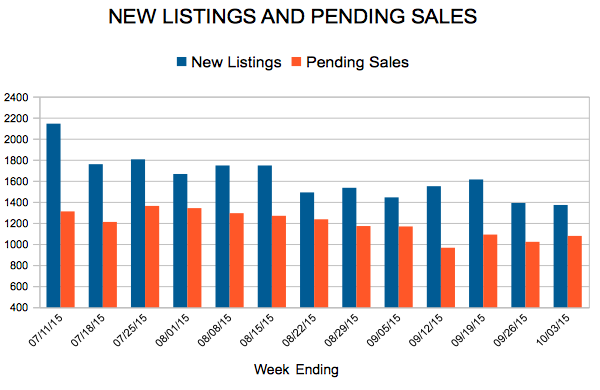

- New Listings increased 2.5% to 1,453

- Pending Sales increased 13.0% to 1,053

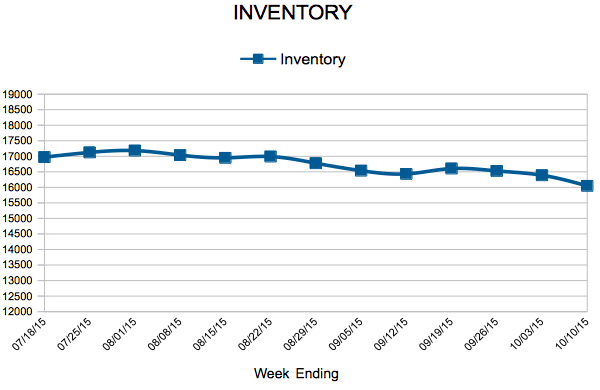

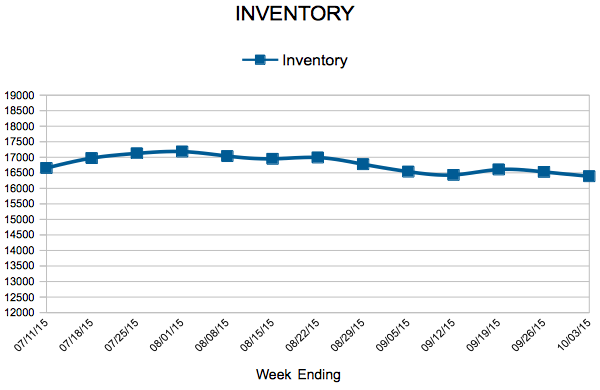

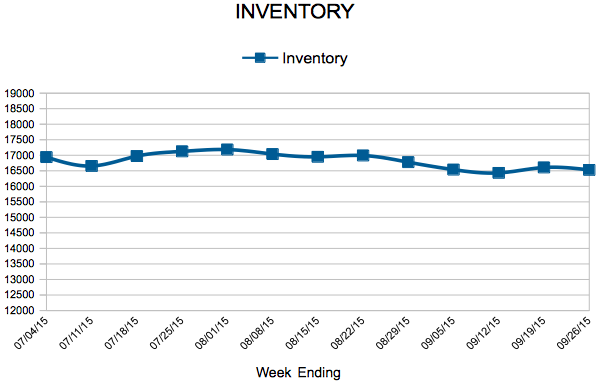

- Inventory decreased 14.7% to 16,048

For the month of September:

- Median Sales Price increased 8.3% to $222,000

- Days on Market decreased 8.5% to 65

- Percent of Original List Price Received increased 1.0% to 96.6%

- Months Supply of Inventory decreased 26.1% to 3.4

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

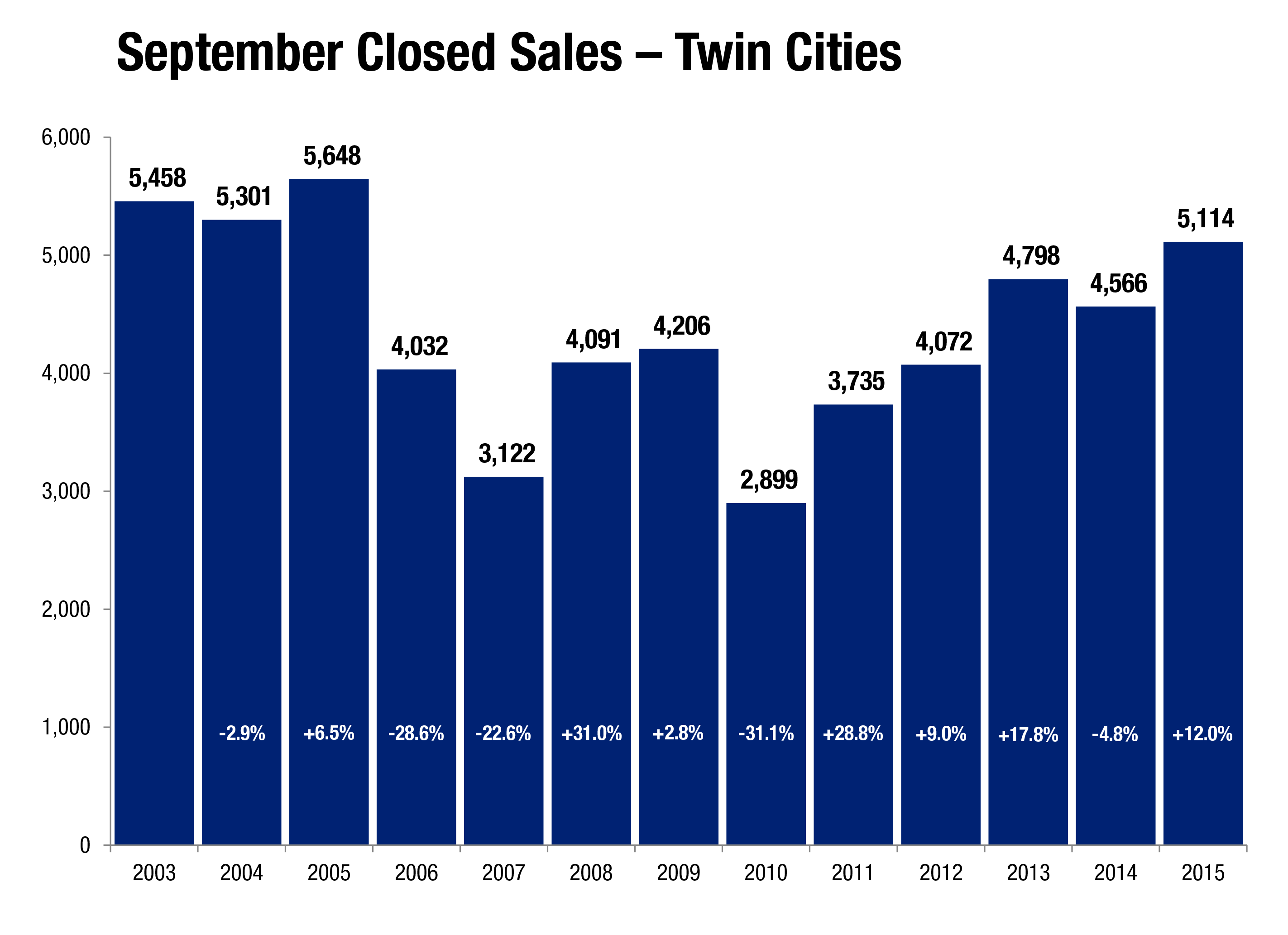

Twin Cities Housing Strong Heading into Fall

After an impressive summer, Twin Cities home sales continued at a 10-year record pace in September. Most indicators are beginning to show month-to-month moderation although year-over-year comparisons remain positive. The number of closed sales rose 12.0 percent to 5,114 homes. Fewer sellers listed their properties than last September, as new listings decreased 6.9 percent to 6,355. Inventory levels fell 16.0 percent to 15,928 active units. Prices continued to rise with the median sales price up 8.3 percent over last year.

Other price measures also continued to perform well. The median list price rose 2.1 percent to $245,000; while the average price per square foot rose 6.3 percent to $129. Sellers enjoyed their position of strength in the marketplace as the percent of original list price received at sale rose 1.0 percent to 96.6 percent. At 4,635 contracts signed, pending purchase activity also remains strong—12.3 percent above last September’s levels. On average, homes sold in less time. Days on market declined 8.5 percent to 65 days. This is consistent with a market leaning slightly towards sellers. Months supply of inventory fell a significant 26.1 percent to 3.4 months of supply. Generally, five to six months of supply is considered balanced. While the metro as a whole is favoring sellers, not all areas, segments and price points reflect that.

“September was another strong month for buyer activity,” said Mike Hoffman, Minneapolis Area Association of REALTORS® (MAAR) President. “Seller activity, however, remains restrained, meaning those who do choose to sell are getting top dollar in near-record time. The demand for homes is still exceeding the supply.”

Strong demand and low supply levels have created an environment where competitively-priced homes sell quickly and sometimes with multiple offers. This supply-demand imbalance, along with the “product mix shift” back to traditional sales, also means prices have risen for 43 consecutive months. The September 2015 median sales price rose 8.3 percent to $222,000 compared to a year-to-date increase of 6.8 percent to $220,000. Sellers are accepting offers at a median of 99.2 percent of their final list price.

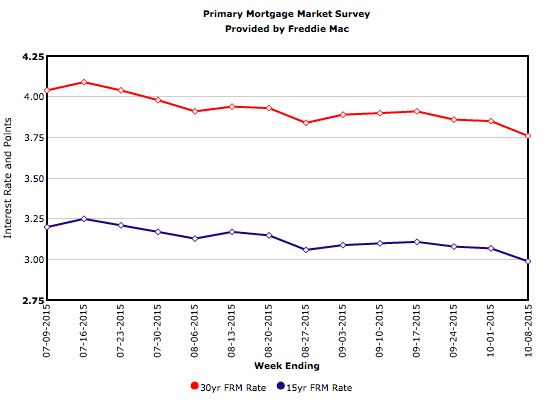

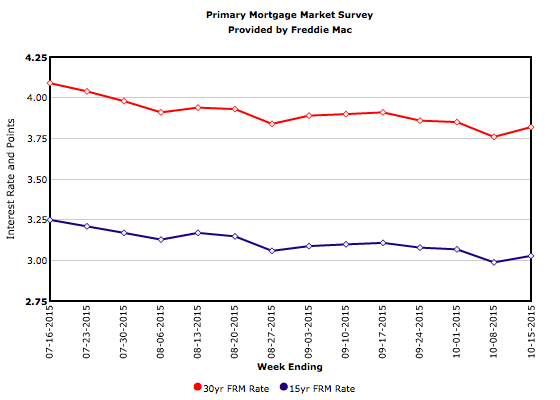

Since housing doesn’t occur in a vacuum, it depends on other economic forces like a recovering labor market, job growth, favorable interest rates and confident consumers. Those factors have helped support our recovering housing market. We’re in the midst of the longest stretch of private job growth on record, unemployment has been cut in half from its peak and consumer confidence is rising. The latest Bureau of Labor Statistics figures show the Minneapolis-St. Paul-Bloomington metropolitan area had the second lowest unemployment rate of any major metro at 3.3 percent compared to 5.1 percent nationally. Mortgage rates are around 4.0 percent, compared to a long-term average of over 7.0 percent. The Federal Reserve is committed to lifting their key Federal Funds rate, a major factor affecting mortgage rates.

“We expect interest rates to stay below their long-term average for years to come,” said Judy Shields, MAAR President-Elect. “The trick will be sustaining price gains that motivate enough sellers to list their properties without pricing out today’s buyers—particularly first timers.”

From The Skinny Blog.

Mortgage Rates Below Four Percent For Twelve Straight Weeks

Freddie Mac’s October 15 release of the results of its Primary Mortgage Market Survey® (PMMS®) shows average fixed mortgage rates nudging higher throughout the beginning of the week. However, Fed comments suggesting it may not raise short-term interest rates yesterday, coupled with weaker than expected consumer demand, pushed Treasury yields lower suggesting interest rates may remain lower than reported a while longer.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 3, 2015

Recovery has been on fleek now for a while. On what? Okay, let’s use a more recognizable term, like on point. But we should all get used to the lingo of the new wave of buyers if we want to continue to set record-breaking bragging rights. With the summer now well behind us, the week-over-week market trends will begin to wane. Hopefully, the fleek remains in year-over-year comparisons and all will be well through the end of the year.

In the Twin Cities region, for the week ending October 3:

- New Listings decreased 7.2% to 1,371

- Pending Sales increased 1.7% to 1,077

- Inventory decreased 15.1% to 16,390

For the month of September:

- Median Sales Price increased 8.3% to $222,000

- Days on Market decreased 8.5% to 65

- Percent of Original List Price Received increased 1.0% to 96.6%

- Months Supply of Inventory decreased 26.1% to 3.4

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

Mortgage Rates Dip

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 220

- 221

- 222

- 223

- 224

- …

- 234

- Next Page »