Where has the Twin Cities real estate market been and where is it heading? This monthly summary provides an overview of current trends and projections for future activity.

- « Previous Page

- 1

- …

- 226

- 227

- 228

- 229

- 230

- …

- 234

- Next Page »

Conventional is King Again as Government and Investors Exit

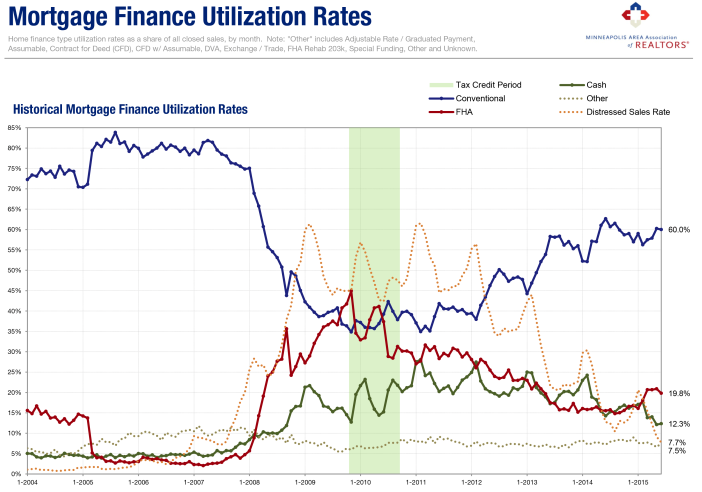

The changing popularity of various home financing tools tells a unique story and shows how the government and private sector mortgage market shares have evolved through the housing crisis and subsequent recovery.

The changing popularity of various home financing tools tells a unique story and shows how the government and private sector mortgage market shares have evolved through the housing crisis and subsequent recovery.

Following the ebbs and flows of the housing market itself, the mortgage finance marketplace has also transformed over the last decade. First, some scene setting. Each trendline above represents the percentage of closed sales in the Twin Cities 13-County MSA that utilized a particular form of mortgage financing, by month. No seasonal adjustments have been performed; the data is raw and comes directly from NorthstarMLS.

Between 2005 and mid-2007, conventional loans made up about 80.0 percent of all mortgages. With conventional mortgage liquidity—shall we say—plentiful, the government only represented about 5.0 percent of loans. As the economy and housing market began to unravel in 2007, the mortgage spigot was drying up. As such, the FHA started to take up that slack and became a dominant player in the mortgage marketplace. By the time of the first-time home buyer tax credit in late-2009, FHA loans comprised a whopping 45.0 percent of sales while conventional loans made up about 35.0 percent of sales. The remaining 20.0 percent include all-cash deals and other loan products.

Though its overall effectiveness remains somewhat debatable, that tax credit signaled a turning point—at least in the mortgage market. At that moment in late-2009, conventional loan market share began to recover and FHA market share started to shrink. Fast forward to present day and conventional loans now make up 60.0 percent of the market while FHA loans make up just 20.0 percent. Earlier in 2015, FHA loans made up about 15.0 percent of closed sales, which is consistent with 2004 levels. Most recognize this as a positive, as the private sector has once again assumed the majority of the risk associated with residential mortgage lending.

All-cash sales can also be illuminating, shining light in some of the more interesting nooks and crannies. Though not all cash sales reflect investor activity, it’s one of the better indications of investors in the market and can be used as a proxy.

Between 2004 and 2008, cash deals made up about 5.0 percent of all closed sales. By February 2011, about 28.0 percent of Twin Cities homes were purchased with cash—a record high. Note the dashed orange trendline. This was at the same time as distressed (foreclosure and short sale) market share was at its highest. Traditional sales volume had fallen dramatically and investors were picking up foreclosures for $0.30 – $0.70 cents on the dollar.

Of the consumers that could, even they were understandably nervous to make large purchases such as a home. Nowadays, about 12.0 percent of sales are done in cash, the lowest share in seven years, or since the middle of 2008. That reflects a mixture of fewer foreclosures and short sales, rising prices, a rising stock market attracting more capital and low inventory levels frustrating traditional buyers and investors alike.

The market numbers are well and good, but sometimes following the money can tell a unique story. The modes of financing behind the market can signal changes in investor behavior, consumer confidence, bank lending patterns and how those forces interplay with one another.

From The Skinny Blog.

Weekly Market Report

For Week Ending July 11, 2015

With the economy on the ups these days, the Federal Reserve Chair, Janet Yellen, is predicting a fine-tuning of monetary policy by the end of the year. In tandem with the improving economy, the unemployment rate dropped by 0.2 percent to 5.3 percent for June 2015. It is widely believed that interest rates will go up before the year is over, which is a pretty clear indicator that the housing market is thrumming along at a good clip.

In the Twin Cities region, for the week ending July 11:

- New Listings increased 2.7% to 2,143

- Pending Sales increased 7.5% to 1,310

- Inventory decreased 9.0% to 16,655

For the month of June:

- Median Sales Price increased 4.7% to $229,900

- Days on Market decreased 5.7% to 66

- Percent of Original List Price Received increased 0.5% to 97.7%

- Months Supply of Inventory decreased 15.9% to 3.7

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

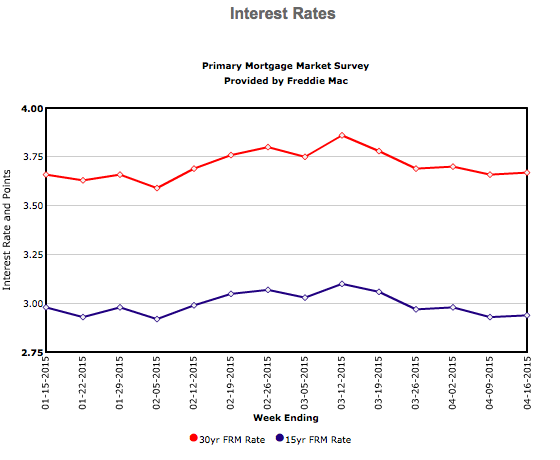

Mortgage Rates Change Little

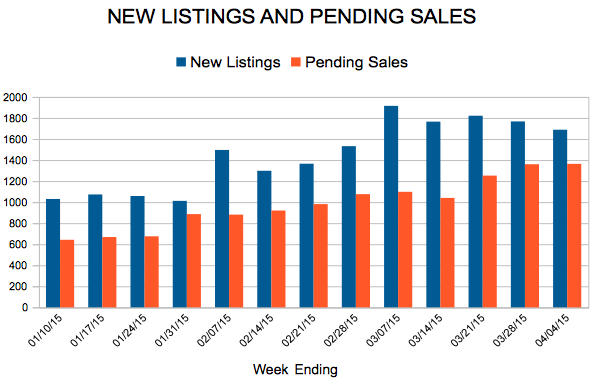

New Listings and Pending Sales

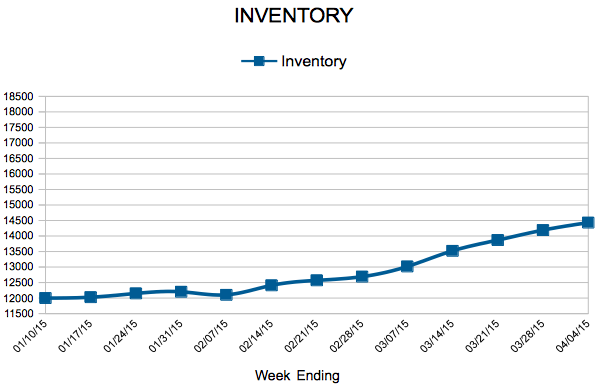

Inventory

Weekly Market Report

For Week Ending April 4, 2015

Rent or buy? It is the question on the minds of many as we cast full sail into the selling season. Whilst stories are written about which cities and neighborhoods are better to rent or buy in, we can hang in the peace of a fairly stable market where there are good options available for rent and sale. Spring is sprung, yet there is no raining on the hit parade of homeownership.

In the Twin Cities region, for the week ending April 4:

- New Listings decreased 8.4% to 1,688

- Pending Sales increased 32.8% to 1,364

- Inventory increased 2.8% to 14,431

For the month of March:

- Median Sales Price increased 10.5% to $210,000

- Days on Market increased 7.4% to 102

- Percent of Original List Price Received increased 0.8% to 95.9%

- Months Supply of Inventory remained flat at 3.3

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

March Pending Sales Soar by the Most Since 2011, Highest Since 2005

The number of signed purchase agreements in the 13-county Twin Cities region surged by 30.0 percent to 5,301 contracts. Sellers were also confident, as new listings increased 21.4 percent to 7,887 during the month. That is the largest increase in pending sales since August 2011 and the highest March count since 2005. New listings showed the second largest increase since July 2013 and the highest March count since 2010. Inventory levels rose 0.7 percent to 14,127 homes, the second increase this year.

The median sales price rallied 10.5 percent higher to $210,000, the strongest gain in over a year. The median home price has now seen over 36 months of year-over-year increases. Price per square foot—which adjusts for the square footage of homes selling—rose a more modest 4.5 percent to $121. Absorption rates remained flat at 3.3 months, and suggest an overall sellers’ market. Days on market rose 7.4 percent to 102 days.

The role of foreclosures and short sales continued to diminish on both the list and buy sides. Traditional new listings comprised 92.2 percent of all seller activity, the highest level since October 2006. Traditional sales made up 84.9 percent of all closed sales, which is on-par with late-2007 levels.

The finance environment remains favorable. Mortgage rates continue to hover near multi-year lows at around 3.7 percent, compared with a long-term average of about 7.0 percent.

Improvements in the economy and household finances could partly offset the impact of rising prices and interest rates. The Twin Cities housing affordability index of 198 has been fairly stable since the end of 2014.

A diverse and robust regional economy has served the Twin Cities housing market well throughout various cycles. According to the Bureau of Labor Statistics, the Twin Cities has one of the lowest unemployment rates of any major metropolitan area in the nation at 4.0 percent.

From The Skinny Blog.

New Listing

Photo Change

- « Previous Page

- 1

- …

- 226

- 227

- 228

- 229

- 230

- …

- 234

- Next Page »