New Listings and Pending Sales

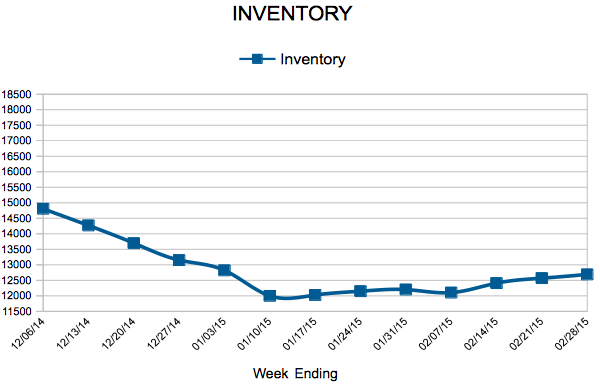

Inventory

Weekly Market Report

For Week Ending March 7, 2015

Many residential real estate markets across the country and locally are in a fairly stable state of balance, causing most stories about housing to be conservative in nature with not much change to report. As the weather continues to warm up across the country, more sales are expected.

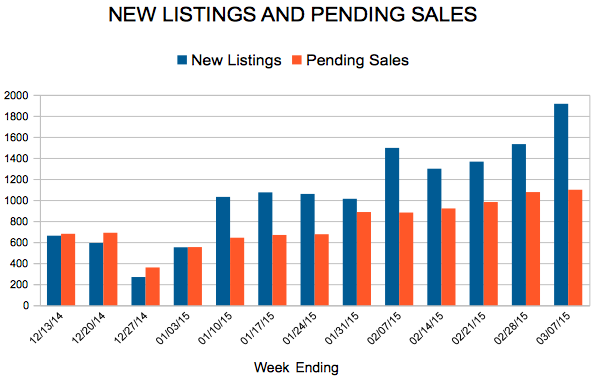

In the Twin Cities region, for the week ending March 7:

- New Listings increased 31.7% to 1,915

- Pending Sales increased 34.1% to 1,098

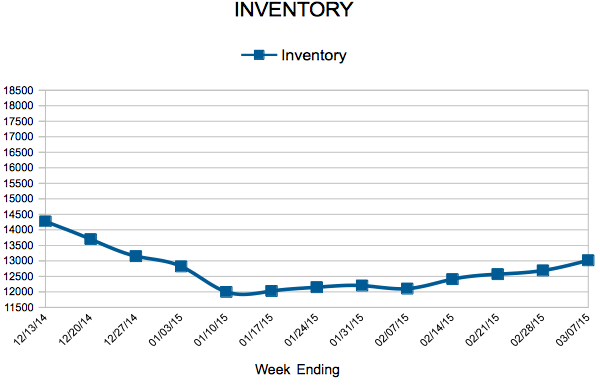

- Inventory increased 0.3% to 13,018

For the month of February:

- Median Sales Price increased 9.3% to $200,000

- Days on Market increased 7.1% to 106

- Percent of Original List Price Received increased 0.7% to 94.2%

- Months Supply of Inventory increased 3.3% to 3.1

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.

After three full years of price gains, recovery shows renewed vigor

The Twin Cities housing market showed refreshed signs of strength last month, partly in anticipation of what looks to be a promising spring market as well as favorable interest rates. Buyer and seller activity surged in February. New listings increased 23.2 percent to 5,690 during the month, the largest year-over-year increase since July 2013. Pending sales—or a count of the number of signed purchase agreements—increased 21.8 percent to 3,834, the largest year-over-year increase since October 2012. With only two months in the books, already buyers and sellers have shown more activity than they did for any one month of 2014. Inventory levels were still lower, down 2.0 percent to 12,700 homes, but that trend is unlikely to continue.

The median sales price rose 10.4 percent to $202,000, the strongest gain since last February. This increase officially marks 36 consecutive months or three full years of year-over-year median price gains. Price per square foot—which adjusts for the square footage of homes selling—rose 6.6 percent to $120. Absorption rates remained flat at 3.0 months, and still technically favor sellers. That said, today’s market environment is slightly less competitive than in 2013. Days on market rose 7.1 percent to 106 days.

The market share of foreclosures and short sales continued to shrink on both the supply and demand side. Traditional new listings rose a substantial 33.8 percent, while foreclosure and short sale new listings each fell between 25 and 30 percent. Traditional pending sales rose a massive 41.5 percent, while foreclosure and short sale pendings each fell between 32 and 36 percent. This dynamic has partly enabled three consecutive years of rising prices.

“If February is any indication, this spring is shaping up to be everything that spring markets should be,” said Mike Hoffman, President of the Minneapolis Area Association of REALTORS® (MAAR). “The fact that we’re seeing large gains in buyer and seller activity mostly driven by traditional properties bodes quite well for consumer confidence at a critical time.”

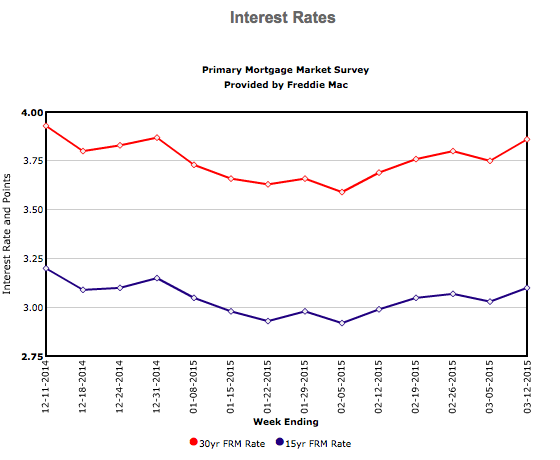

The finance environment remains enormously attractive. Mortgage rates continue to hover between 3.5 and 4.0 percent. The long-term average is roughly 7.0 percent. This appealing affordability picture can potentially offset recent home price increases and also encourages renters to consider homeownership. The Twin Cities housing affordability index of 210 has actually increased 2.4 percent from last February.

A highly diverse and robust economy has served the Twin Cities housing market well throughout various cycles. According to the Bureau of Labor Statistics, the Twin Cities has the lowest unemployment rate of any major metro in the nation at 3.3 percent. Recently, national private job creation has accelerated toward 300,000 jobs per month.

“Even though every area and market segment is unique, what we’re seeing in the numbers is definitely reflected out in the community,” said Judy Shields, MAAR President-Elect. “After being cooped up all winter, people are eager to get out there and find their dream home.”

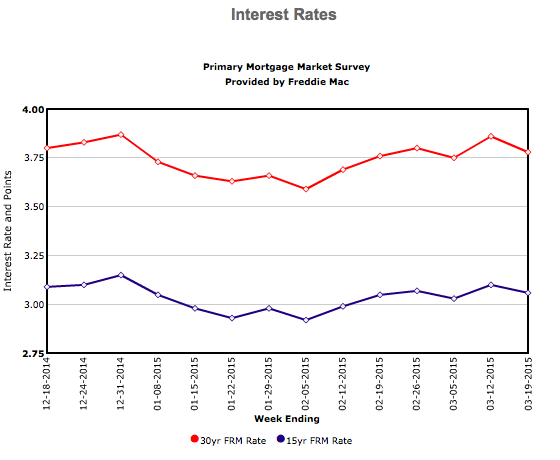

Mortgage Rates Head Higher

Freddie Mac’s March 12 release of the results of its Primary Mortgage Market Survey® (PMMS®) shows average fixed mortgage rates moving higher amid a strong jobs report and bringing mortgage rates back to where they were at the start of 2015. The 30-year fixed-rate mortgage has averaged below 4 percent since the week ending November 13, 2014.

16167 Crosby Cove Minnetonka MN 55391

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending February 28, 2015

Across the country, some Fortune 500 companies have been raising their

minimum wage. How does this correlate to the housing industry? Mo’ money =

mo’ house-buying powerz. Coupled with the dismantled idea that aging

millennials want to remain at home forever (because, come on, really?), the

housing market is making inroads into two factors that have plagued the buyer

market in recent years. Warmer weather sure can’t hurt either.

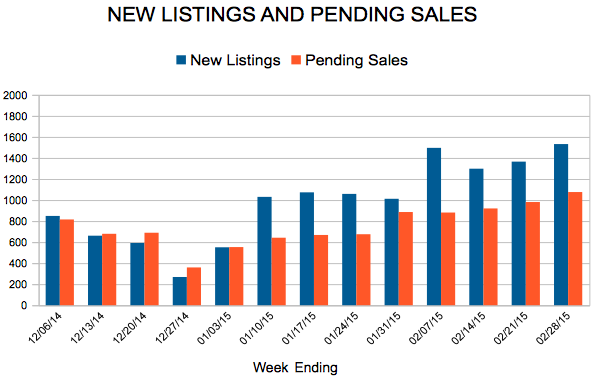

In the Twin Cities region, for the week ending February 28:

- New Listings increased 23.0% to 1,532

- Pending Sales increased 21.0% to 1,076

- Inventory decreased 2.2% to 12,690

For the month of February:

- Median Sales Price increased 10.4% to $202,000

- Days on Market increased 7.1% to 106

- Percent of Original List Price Received increased 0.6% to 94.1%

- Months Supply of Inventory remained flat at 3.0

All comparisons are to 2014

Click here for the full Weekly Market Activity Report. From The Skinny Blog.