- « Previous Page

- 1

- …

- 38

- 39

- 40

- 41

- 42

- …

- 234

- Next Page »

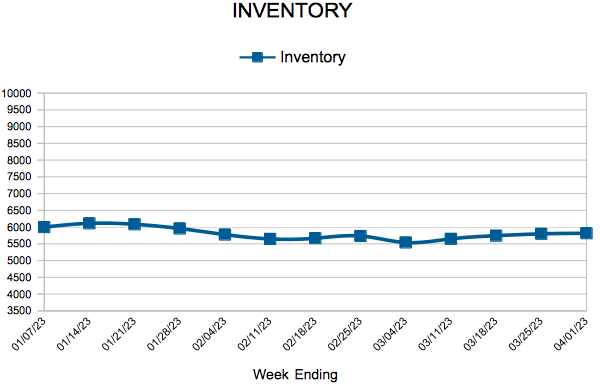

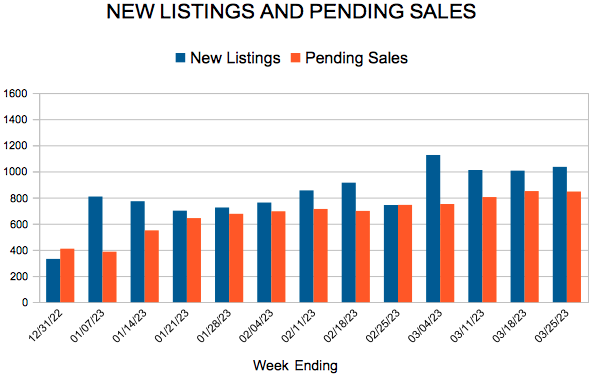

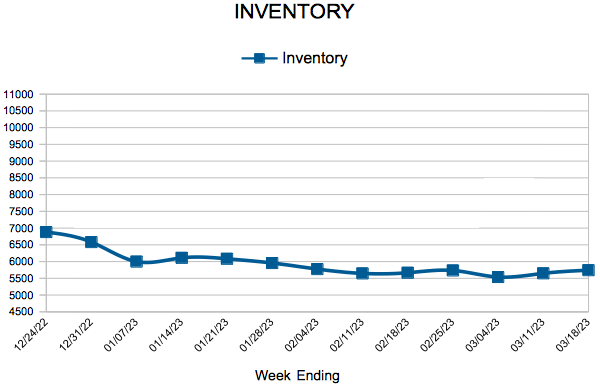

Inventory

Weekly Market Report

For Week Ending April 1, 2023

For Week Ending April 1, 2023

The annual rate of US rent growth has continued to slow annually, with single-family rents increasing 5.7% as of last measure, the lowest level since spring 2021, according to Corelogic’s most recent Single-Family Rent Index (SFRI). This marks the 9th consecutive month rent growth has slowed, with Orlando, FL, Charlotte, NC, and New York having the highest annual single-family rent price increases, while Phoenix posted the lowest annual rent price gain for the period.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING APRIL 1:

- New Listings decreased 30.4% to 1,081

- Pending Sales decreased 24.4% to 942

- Inventory increased 6.4% to 5,815

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.6% to $342,000

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

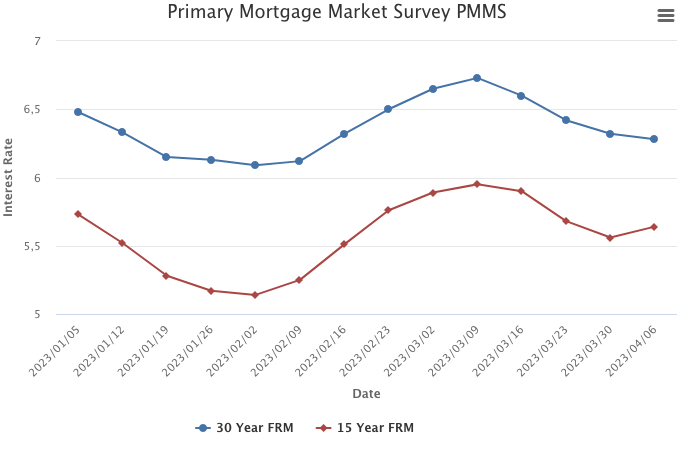

Mortgage Rates Trending Lower

April 6, 2023

Mortgage rates continue to trend down entering the traditional spring homebuying season. Unfortunately, those in the market to buy are facing a number of challenges, not the least of which is the low inventory of homes for sale, especially for aspiring first-time homebuyers.

Information provided by Freddie Mac.

New Listings and Pending Sales

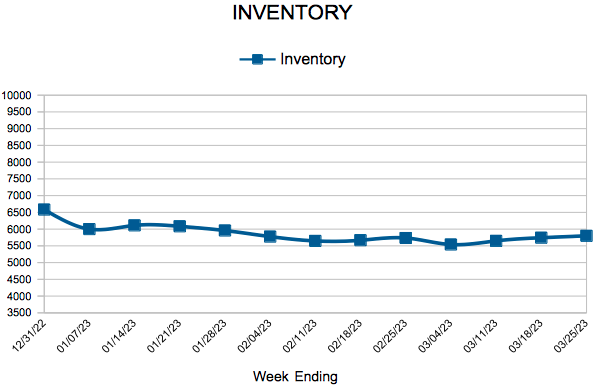

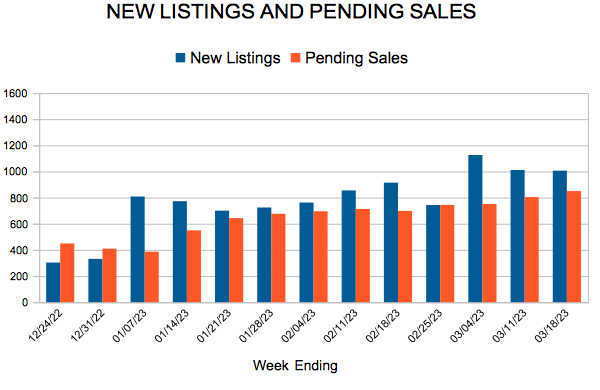

Inventory

Weekly Market Report

For Week Ending March 25, 2023

For Week Ending March 25, 2023

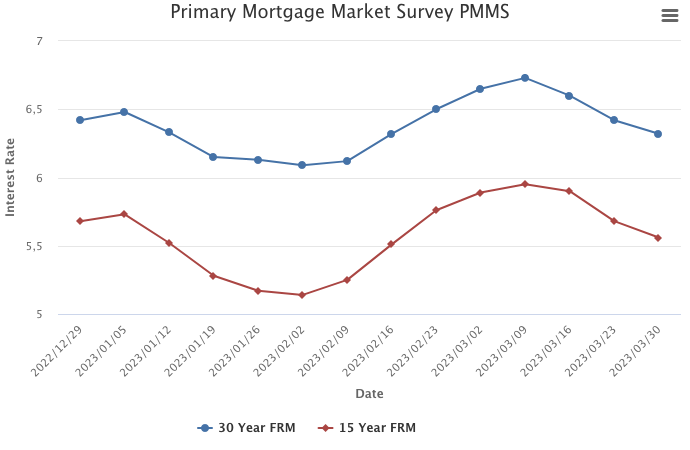

Mortgage interest rates declined for the third week in a row, with the 30-year fixed rate mortgage averaging 6.32% the week ending 3/30/23, the lowest level since mid-February, according to Freddie Mac. The drop in rates has led to an increase in mortgage demand, with mortgage applications to purchase a home rising 2% from the previous week, marking the fourth consecutive week home purchase applications increased, according to the Mortgage Bankers Association.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 25:

- New Listings decreased 28.1% to 1,035

- Pending Sales decreased 28.4% to 846

- Inventory increased 9.2% to 5,799

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.6% to $342,000

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Decrease for the Third Consecutive Week

March 30, 2023

Economic uncertainty continues to bring mortgage rates down. Over the last several weeks, declining rates have brought borrowers back to the market but, as the spring homebuying season gets underway, low inventory remains a key challenge for prospective buyers.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 38

- 39

- 40

- 41

- 42

- …

- 234

- Next Page »