- « Previous Page

- 1

- …

- 40

- 41

- 42

- 43

- 44

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending March 4, 2023

For Week Ending March 4, 2023

According to recent data from Black Knight, more than 40% of US mortgages originated in 2020 – 2021, with almost 25% of all current home loans originating in 2021, when the pandemic helped mortgage rates tumble to historic lows. What’s more, nearly 65% of mortgages are at rates of 4% or below, offering little incentive for many current homeowners to sell their homes now that borrowing costs are significantly higher.

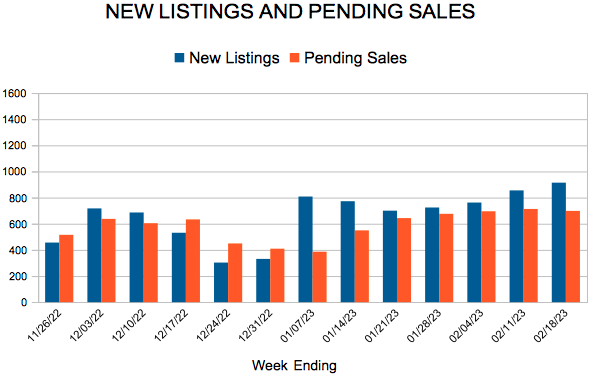

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 4:

- New Listings decreased 23.2% to 1,126

- Pending Sales decreased 36.1% to 751

- Inventory increased 11.3% to 5,539

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 2.7% to $342,000

- Days on Market increased 46.3% to 60

- Percent of Original List Price Received decreased 3.6% to 96.0%

- Months Supply of Homes For Sale increased 55.6% to 1.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

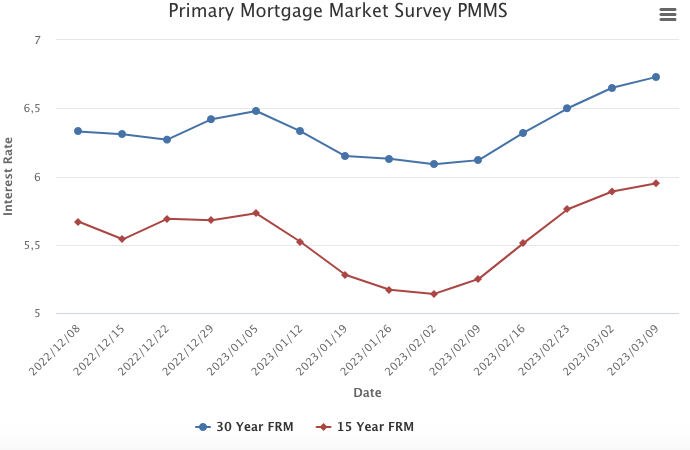

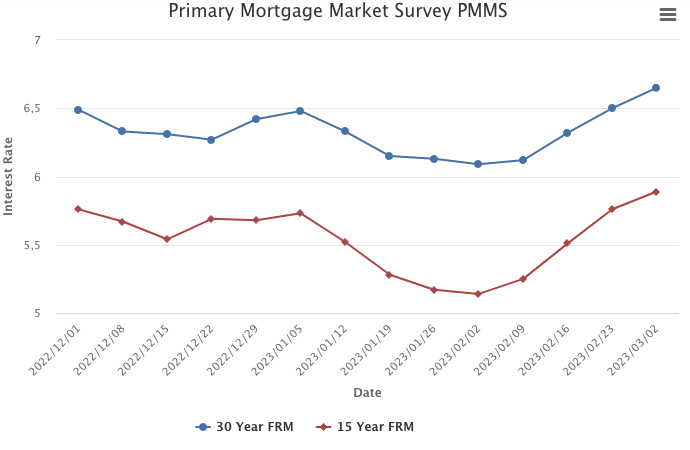

Mortgage Rates Continue Their Upward Trajectory

March 9, 2023

Mortgage rates continue their upward trajectory as the Federal Reserve signals a more aggressive stance on monetary policy. Overall, consumers are spending in sectors that are not interest rate sensitive, such as travel and dining out. However, rate-sensitive sectors, such as housing, continue to be adversely affected. As a result, would-be homebuyers continue to face the compounding challenges of affordability and low inventory.

Information provided by Freddie Mac.

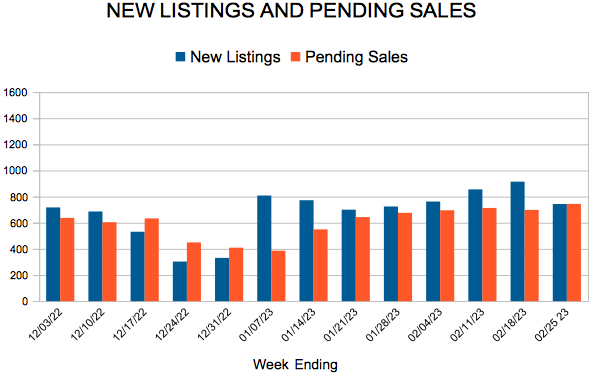

New Listings and Pending Sales

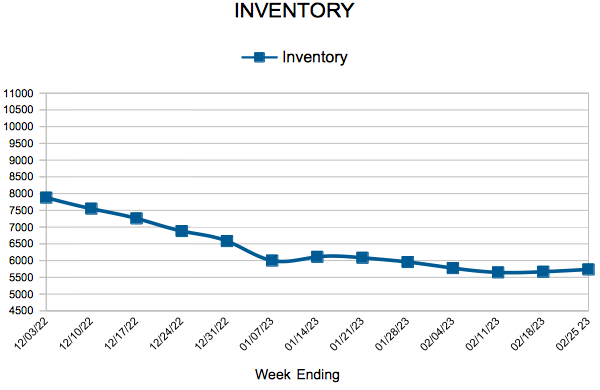

Inventory

Weekly Market Report

For Week Ending February 25, 2023

For Week Ending February 25, 2023

According to a recent National Association of Home Builders/Wells Fargo Housing Market Index (HMI) survey, building material prices were the most significant issue for US homebuilders last year, with 96% of builders reporting that building material prices were a problem. Availability of building materials and cost and availability of labor also ranked among the largest problems builders faced in 2022, along with rising inflation and higher interest rates, both of which remain top concerns this year for the majority of builders surveyed.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 25:

- New Listings decreased 35.3% to 743

- Pending Sales decreased 23.5% to 744

- Inventory increased 15.1% to 5,735

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 2.7% to $342,000

- Days on Market increased 46.3% to 60

- Percent of Original List Price Received decreased 3.6% to 96.0%

- Months Supply of Homes For Sale increased 55.6% to 1.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Climb Up

March 2, 2023

As we started the year, the 30-year fixed-rate mortgage decreased with expectations of lower economic growth, inflation and a loosening of monetary policy. However, given sustained economic growth and continued inflation, mortgage rates boomeranged and are inching up toward seven percent. Lower mortgage rates back in January brought buyers back into the market. Now that rates are moving up, affordability is hindered and making it difficult for potential buyers to act, particularly for repeat buyers with existing mortgages at less than half of current rates.

Information provided by Freddie Mac.

January Monthly Skinny Video

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 40

- 41

- 42

- 43

- 44

- …

- 234

- Next Page »