- « Previous Page

- 1

- …

- 64

- 65

- 66

- 67

- 68

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending March 12, 2022

For Week Ending March 12, 2022

Following a brief decline recently, mortgage interest rates are on the rise again, as the average 30-year fixed-rate mortgage jumped to 4.27% for the week ending March 11, the highest level since May 2019, according to the Mortgage Bankers Association. Mortgage rates are now a full percentage point higher than this time last year and continue to impact mortgage demand, in particular refinance applications, which were down 49% compared to the same week one year ago.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 12:

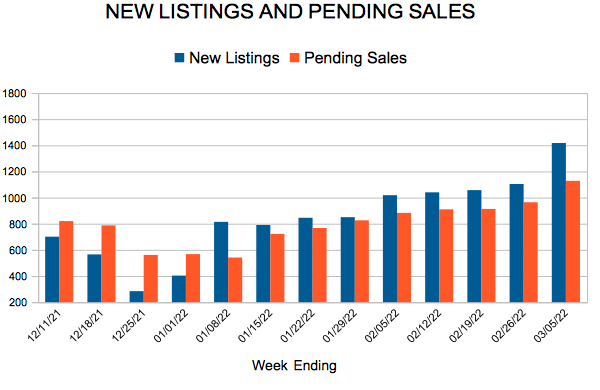

- New Listings decreased 10.1% to 1,313

- Pending Sales decreased 6.5% to 1,174

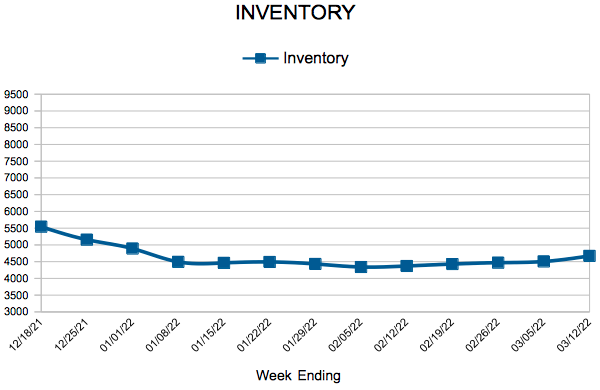

- Inventory decreased 14.0% to 4,671

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 8.3% to $340,000

- Days on Market decreased 8.7% to 42

- Percent of Original List Price Received increased 0.7% to 100.8%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Exceed Four Percent

March 17, 2022

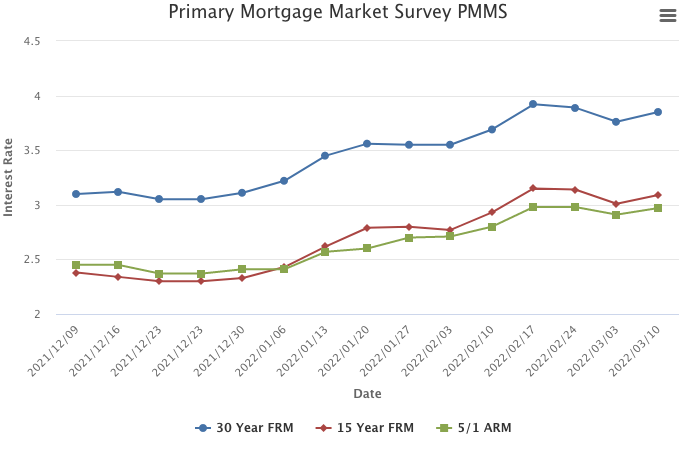

The 30-year fixed-rate mortgage exceeded four percent for the first time since May of 2019. The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year. While home purchase demand has moderated, it remains competitive due to low existing inventory, suggesting high house price pressures will continue during the spring homebuying season.

Information provided by Freddie Mac.

Mortgage Rates Exceed Four Percent

March 17, 2022

The 30-year fixed-rate mortgage exceeded four percent for the first time since May of 2019. The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year. While home purchase demand has moderated, it remains competitive due to low existing inventory, suggesting high house price pressures will continue during the spring homebuying season.

Information provided by Freddie Mac.

Sales begin seasonal upswing, but down from last two unusually strong Februarys

- Twin Cities saw 3,809 signed purchase agreements, down 10.5 percent from February 2021 but above 2019 levels

- The number of homes for sale at month-end fell 19.0 percent from last year

- Median Sales Price rose 8.3 percent to $340,000

(March 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, buyer activity in the Twin Cities metro showed its first month-over-month gain since August 2021. As the Covid reshuffle continues to temper, sales are down compared to February of 2020 and 2021, but up from 2019 levels.

LISTINGS & SALES

Buyers signed 10.5 percent fewer purchase agreements than last year and closed on 15.3 percent fewer homes. Since 2020, seller activity has remained especially sluggish—the 4,427 new listings are 18.2 percent fewer than February 2020. While the seasonal uptick toward spring market has begun, it may prove challenging to match activity levels from the prior two years, as the pandemic and the prospect of rising rates shifted activity up from 2022 and 2023 into 2020 and 2021 to accommodate working and learning from home.

“Homes sold more quickly last month than they did last February, and prices rose over 8.0 percent,” said Denise Mazone, President of Minneapolis Area REALTORS®. “While we may not reach the heights of 2020 and 2021, the market remains competitive, homes are still selling rapidly often with multiple bids, and buyers and sellers need to be prepared to move quickly.” Market times have been falling for years, but today’s listings spend even less time on the market. Two years ago, half of the listings went under contract in under 40 days, but last month, half of the listings spent fewer than 19 days on the market. That’s more than a 52.0 percent drop.

HOME PRICES & INVENTORY

The median sales price in the Twin Cities rose 8.3 percent from last February to $340,000. That’s exactly half the 16.6 percent year-over-year rate of price growth seen in May 2021. Rising prices are expected to continue in a persistently undersupplied market with historically strong demand. The Twin Cities presently has about three week’s supply of inventory (0.8 months), where a balanced market would supply four to six months’ worth of homes given recent demand.

Inventory levels dipped 19.0 percent from this time last year. Compounded with a 38.2 percent fall from 2020 to 2021, the metro is facing an inventory shortage that should keep prices strong, market times fast, multiple offers fairly commonplace and some sellers getting above asking price. “Homeowners have gained significant equity, particularly over the last few years,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “Having a knowledgeable advisor to navigate a fast and complex process can help buyers be more competitive and successful.”

LOCATION & PROPERTY TYPE

Market activity varies by area, price point and property type. New construction sales fell 15.5 percent compared to only a 12.2 percent dip in sales of previously owned homes. Single family sales tumbled 9.8 percent while condo sales were down an even 10.0 percent. Between Minneapolis and St. Paul, the latter took the harder hit in sales losses. Saint Paul’s sales were 24.8 percent down compared to Minneapolis’ loss of 15.1 percent. Hastings, Delano and Rush City all had more than double the sales from last year while Hugo, Little Canada and East Bloomington weren’t far behind. Sales fell by around 50.0 percent in Prior Lake, New Hope, Big Lake and Golden Valley.

February 2022 by the numbers compared to a year ago

- Sellers listed 4,427 properties on the market, a 7.3 percent decrease from last February

- Buyers signed 3,809 purchase agreements, down 10.5 percent (2,769 closed sales, down 15.3 percent)

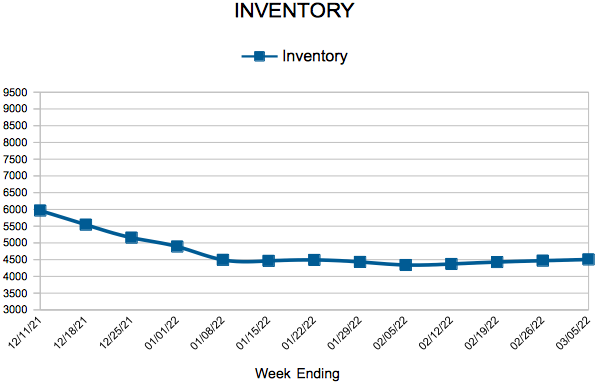

- Inventory levels fell 19.0 percent to 4,361 units

- Month’s Supply of Inventory was down 20.0 percent to 0.8 months (4-6 months is balanced)

- The Median Sales Price rose 8.3 percent to $340,000

- Days on Market fell 8.7 percent to 42 days, on average (median of 19 days, down 5.0 percent from February 2021)

- Changes in Sales activity varied by market segment

- Condo sales fell 16.0 percent, single family sales fell 14.8 percent & townhouse sales fell 4.6 percent

- Traditional sales were down 12.6 percent; foreclosure sales were down 44.4 percent; short sales fell 100.0 percent

- Previously owned sales dropped 12.6 percent; new construction sales decreased by 15.9 percent

February 2022 housing charts

From The Skinny Blog.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 5, 2022

For Week Ending March 5, 2022

The U.S. median listing price rose 12.9% year-over-year to a new high of $392,000 in February, exceeding the previous peak set in July 2021, according to Realtor.com’s Monthly Housing Trends Report. Despite rising sales prices, homes are disappearing in record time, with the typical U.S. home selling more than two weeks faster last month compared to the same period last year, and more than a month faster compared to February 2017 – 2019.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 5:

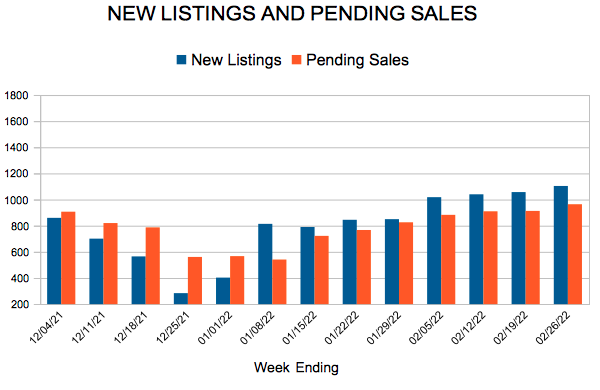

- New Listings decreased 5.8% to 1,417

- Pending Sales decreased 3.8% to 1,128

- Inventory decreased 16.3% to 4,505

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 10.6% to $333,000

- Days on Market decreased 2.4% to 41

- Percent of Original List Price Received increased 0.1% to 99.6%

- Months Supply of Homes For Sale decreased 20.0% to 0.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Rise

March 10, 2022

Following two weeks of declines, mortgage rates rose this week as U.S. Treasury yields increased. Over the long-term, we expect rates to continue to rise as inflation broadens and shortages increasingly impact many segments of the economy. However, uncertainty about the war in Ukraine is driving rate volatility that likely will continue in the short-term.

Information provided by Freddie Mac.

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 64

- 65

- 66

- 67

- 68

- …

- 234

- Next Page »