- « Previous Page

- 1

- …

- 71

- 72

- 73

- 74

- 75

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending November 27, 2021

For Week Ending November 27, 2021

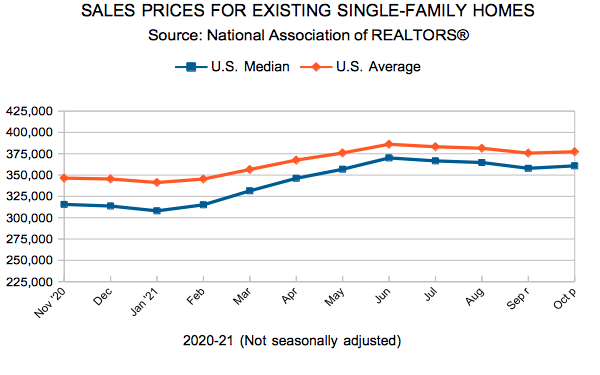

With showings, contract signings, and closed sales remaining strong throughout fall, experts are expecting an especially busy housing market this winter, as buyers rush to beat rising rental prices and anticipated increases in mortgage rates. Total existing home sales will top 6 million in 2021, the highest level in 15 years, according to the National Association of REALTORS®, who predicts home prices will continue to increase in 2022, albeit at a gentler rate compared to the recordsetting pace of this year.

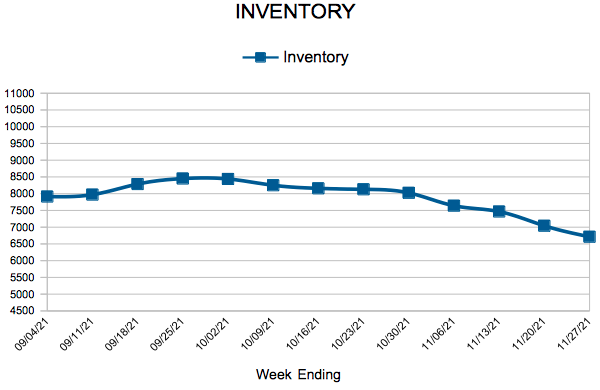

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 27:

- New Listings decreased 15.8% to 496

- Pending Sales decreased 0.8% to 843

- Inventory decreased 15.7% to 6,714

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 20, 2021

For Week Ending November 20, 2021

Consumer credit scores have risen since the beginning of the pandemic, according to FICO CEO William Lansing in a recent interview with MarketWatch. The average score across all segments rose eight points to 716, while consumers with scores below 600 saw a larger average increase, rising from 581 in April 2020 to 601 today. Pandemic-related relief programs and a decrease in consumer spending early in the pandemic are likely contributors to the improvement in scores. Higher credit scores can offer home buyers more loan options as well as lower interest rates, which can increase affordability and purchasing power.

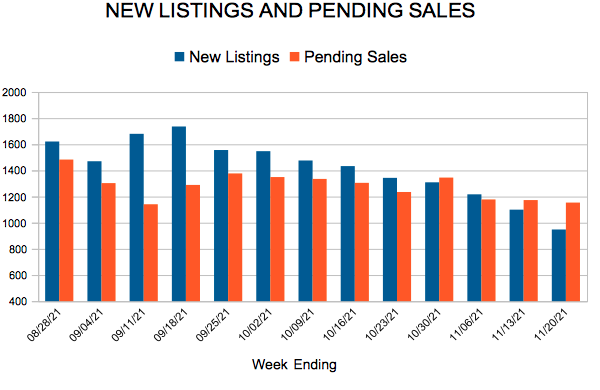

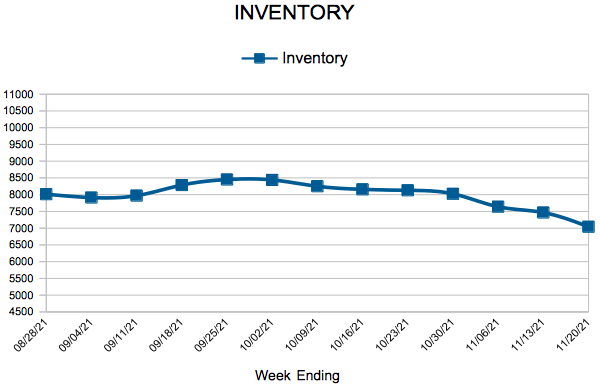

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 20:

- New Listings decreased 7.9% to 948

- Pending Sales increased 1.2% to 1,154

- Inventory decreased 15.5% to 7,042

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Existing Home Sales

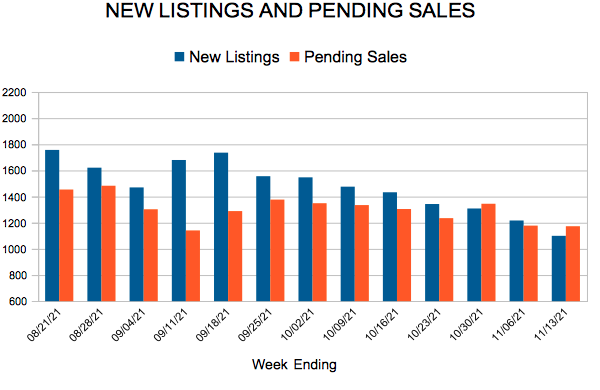

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 13, 2021

For Week Ending November 13, 2021

The Federal Housing Finance Agency may soon increase conforming loan limits, according to the Wall Street Journal, with Fannie Mae and Freddie Mac expected to back mortgage loans close to $1 million dollars in high-cost markets, and loans up to $650K in other markets, beginning in 2022. The final loan limits are expected to be announced November 30th. The projected increases are meant to keep pace with the historic rise of sales prices in the last year. Conforming loans often offer lower interest rates and smaller down payments, making it more affordable and easier for some borrowers to purchase a home.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 13:

- New Listings increased 9.3% to 1,100

- Pending Sales increased 2.5% to 1,173

- Inventory decreased 14.3% to 7,466

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 7.9% to $340,000

- Days on Market decreased 22.9% to 27

- Percent of Original List Price Received decreased 0.2% to 100.3%

- Months Supply of Homes For Sale decreased 17.6% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

October Monthly Skinny Video

Months’ supply of inventory was down 23.5 percent to 1.3 months. A balanced market is about 5-6 months of supply. 1.3 months of supply indicates a pretty extreme sellers’ market.

- « Previous Page

- 1

- …

- 71

- 72

- 73

- 74

- 75

- …

- 234

- Next Page »