- « Previous Page

- 1

- …

- 84

- 85

- 86

- 87

- 88

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending April 3, 2021

For Week Ending April 3, 2021

The University of Michigan’s latest Consumer Sentiment Index came in at 84.9 points, up from 76.8 in February and the highest level since last March’s 89.1 reading. The index is an economic indicator of the overall health of the economy as determined by consumer opinion. Increasing values point to increasing consumer confidence in their own financial health and the health of the overall economy.

In the Twin Cities region, for the week ending April 3:

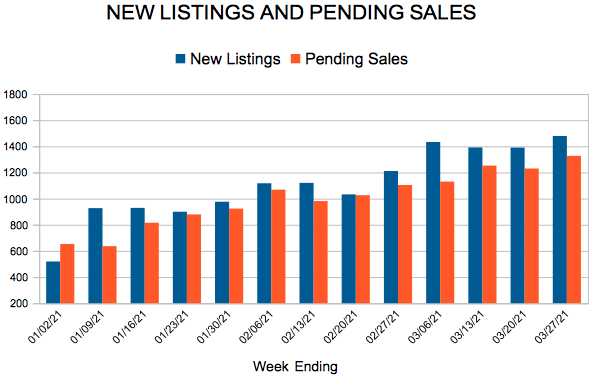

- New Listings decreased 7.6% to 1,406

- Pending Sales increased 21.8% to 1,358

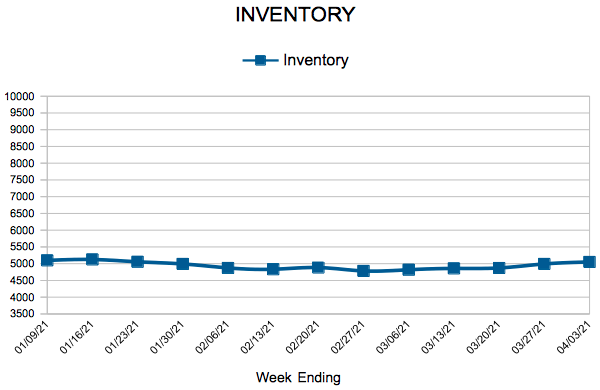

- Inventory decreased 49.4% to 5,051

For the month of February:

- Median Sales Price increased 11.5% to $314,000

- Days on Market decreased 31.3% to 46

- Percent of Original List Price Received increased 2.1% to 100.1%

- Months Supply of Homes For Sale decreased 47.1% to 0.9

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

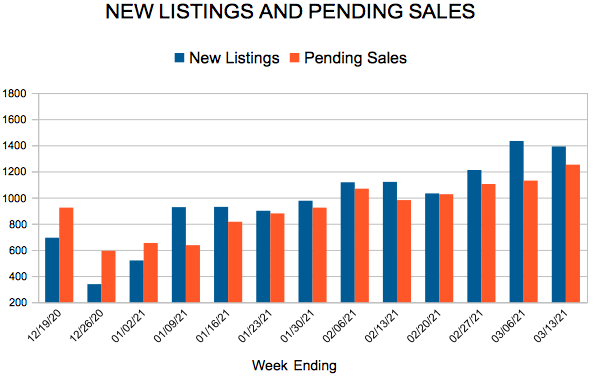

New Listings and Pending Sales

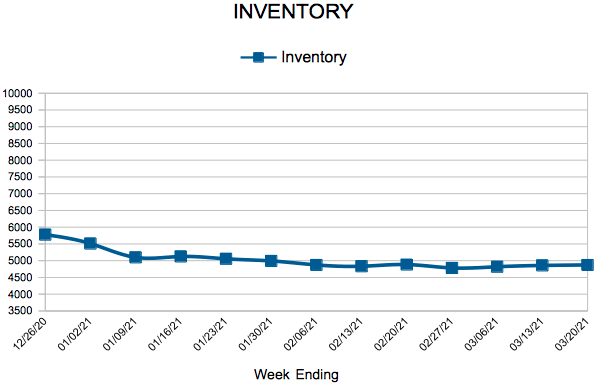

Inventory

Weekly Market Report

For Week Ending March 27, 2021

For Week Ending March 27, 2021

As the spring market is in full swing and home prices are ticking up, mortgage rates have moved higher in recent weeks as well. Freddie Mac reports that the national average rate for a 30-year fixed-rate mortgage rose to 3.17% with an average of .6 points. While rates are still below the average of 3.5% for the same week last year, the year over year comparison has been tightening in recent weeks.

In the Twin Cities region, for the week ending March 27:

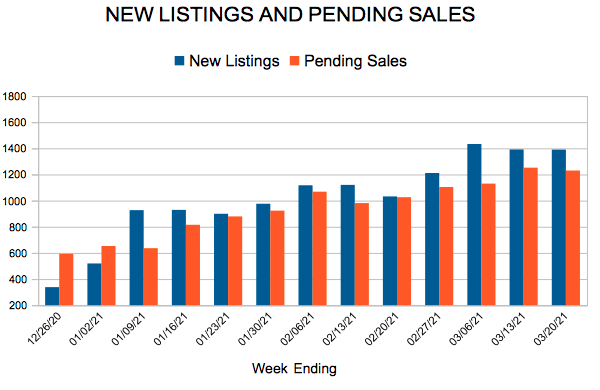

- New Listings decreased 3.8% to 1,479

- Pending Sales increased 15.5% to 1,327

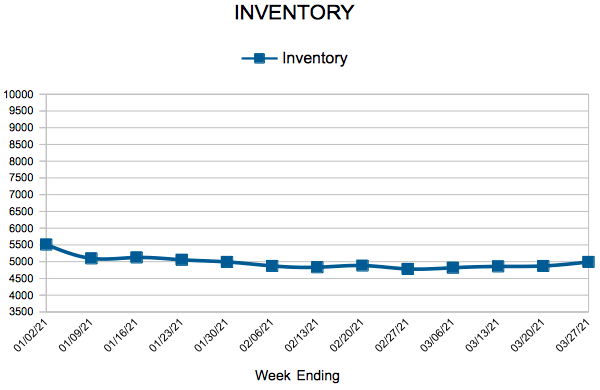

- Inventory decreased 49.0% to 4,992

For the month of February:

- Median Sales Price increased 11.5% to $314,000

- Days on Market decreased 31.3% to 46

- Percent of Original List Price Received increased 2.1% to 100.1%

- Months Supply of Homes For Sale decreased 47.1% to 0.9

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending March 20, 2021

For Week Ending March 20, 2021

Real estate data firm ATTOM Data Solutions reported that the number of homes flipped by investors decreased in 2020 for the first time since 2014. For this study, ATTOM defined a home flip as a condo or single-family home that sold twice within 12 months. Flips of single-family homes and condos fell 13.1% in 2020 compared to 2019, falling to its lowest point since 2016. ATTOM estimated that 5.9% of all homes sold in 2020 were flips.

In the Twin Cities region, for the week ending March 20:

- New Listings decreased 21.4% to 1,390

- Pending Sales increased 4.9% to 1,230

- Inventory decreased 48.6% to 4,872

For the month of February:

- Median Sales Price increased 11.5% to $314,000

- Days on Market decreased 31.3% to 46

- Percent of Original List Price Received increased 2.1% to 100.1%

- Months Supply of Homes For Sale decreased 47.1% to 0.9

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 84

- 85

- 86

- 87

- 88

- …

- 234

- Next Page »