- « Previous Page

- 1

- …

- 97

- 98

- 99

- 100

- 101

- …

- 234

- Next Page »

Weekly Market Report

For Week Ending September 12, 2020

The Mortgage Bankers Association (MBA) Mortgage Credit Availability Index (MCAI) in August fell by 4.7 percent to 120.9. A decline in the MCAI indicates that lending standards are tightening, and this latest drop finds the index at its lowest point since March 2014. Tightening lending standards often includes a reduction in loan programs with low credit scores, high loan-to-value ratios, and reduced borrower documentation requirements. So while mortgage rates continue to remain near all-time lows, qualifying for a mortgage is becoming a little more difficult for some borrowers.

In the Twin Cities region, for the week ending September 12:

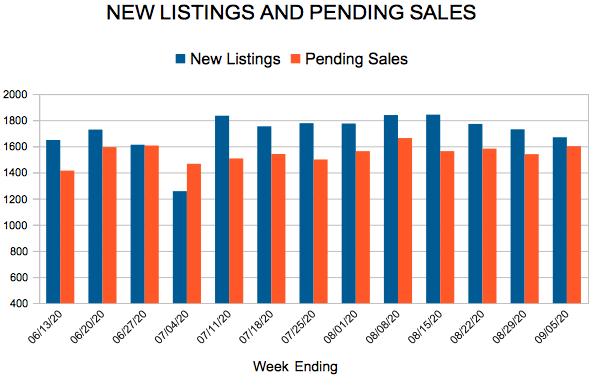

- New Listings decreased 3.8% to 1,783

- Pending Sales increased 13.5% to 1,384

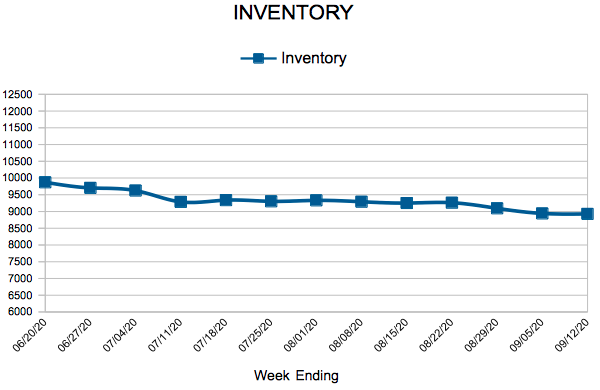

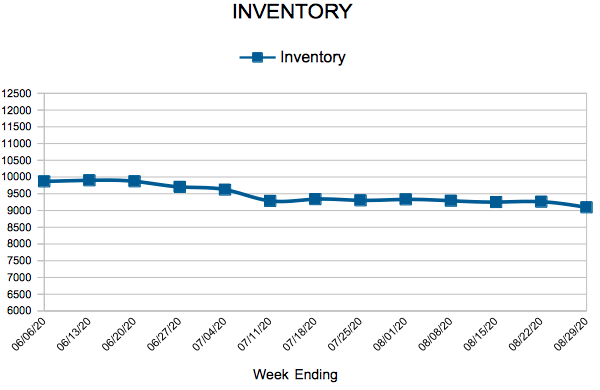

- Inventory decreased 31.5% to 8,928

For the month of August:

- Median Sales Price increased 9.8% to $315,000

- Days on Market decreased 4.9% to 39

- Percent of Original List Price Received increased 1.3% to 100.3%

- Months Supply of Homes For Sale decreased 30.8% to 1.8

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

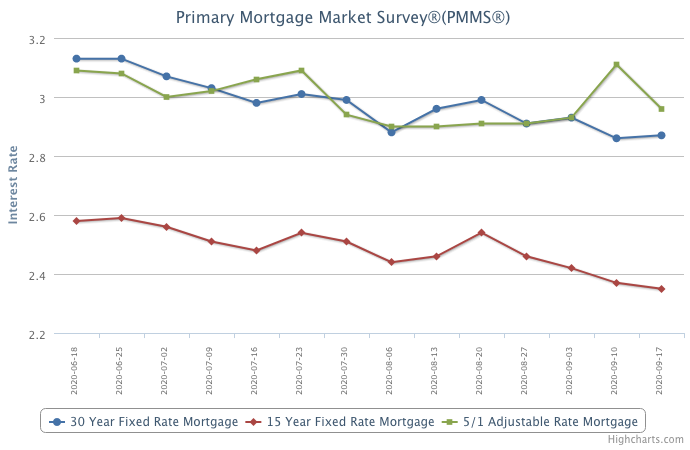

Mortgage Rates Generally Hold Steady

September 17, 2020

Despite the recession, the very low mortgage environment has spurred many first-time homebuyers to jump into the real estate market. In August, first-time homebuyer activity rose 19 percent from July to the highest monthly level ever for Freddie Mac. The first-time homebuyer driven rebound in the housing market has come at a critical time for the economy.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 5, 2020

Strong buyer activity continues into the back-to-school season that normally signals the seasonal slowing of the housing market. With more buyers in the market and the continued constrained supply of homes for sale, speedy sales and multiple offers are likely to remain a common occurrence and will keep agents and prospective homebuyers and sellers quite busy this fall.

In the Twin Cities region, for the week ending September 5:

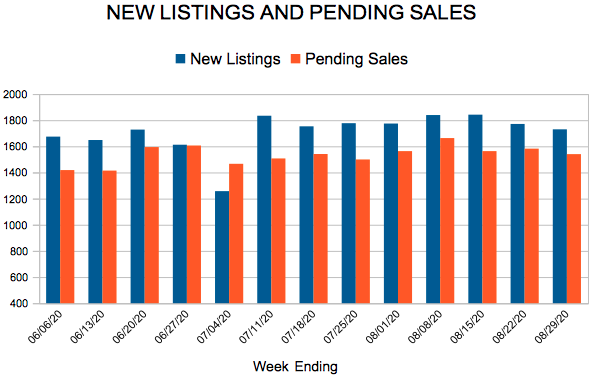

- New Listings decreased 3.4% to 1,669

- Pending Sales increased 40.3% to 1,601

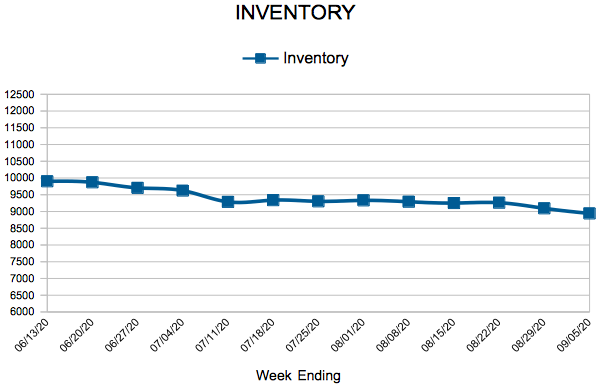

- Inventory decreased 30.2% to 8,942

For the month of July:

- Median Sales Price increased 10.6% to $313,000

- Days on Market increased 7.9% to 41

- Percent of Original List Price Received increased 0.5% to 100.1%

- Months Supply of Homes For Sale decreased 23.1% to 2.0

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

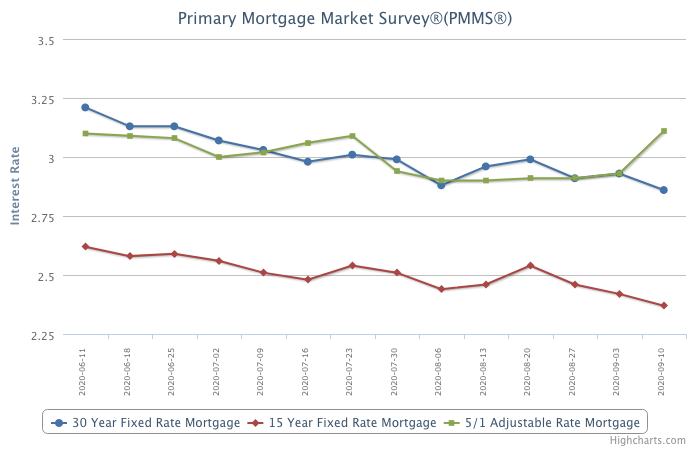

Mortgage Rates Hit Another All-Time Low

September 10, 2020

Mortgage rates have hit another record low due to a late summer slowdown in the economic recovery. These low rates have ignited robust purchase demand activity, which is up twenty-five percent from a year ago and has been growing at double digit rates for four consecutive months. However, heading into the fall it will be difficult to sustain the growth momentum in purchases because the lack of supply is already exhibiting a constraint on sales activity.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending August 29, 2020

Mortgage rates continue to remain near all-time lows. This week, mortgage giant Freddie Mac reported that average rates on a 30-year fixed-rate mortgage were 2.91% with an average of .8 points, just slightly above the record-low rate of 2.88% recorded earlier in the month. The Federal Reserve has announced that they will be adopting a more flexible monetary policy in an effort to achieve inflation that averages 2% over time, which is likely to keep mortgage rates low and provide further support to economic activity for an extended period of time.

In the Twin Cities region, for the week ending August 29:

- New Listings increased 24.2% to 1,730

- Pending Sales increased 18.0% to 1,540

- Inventory decreased 30.7% to 9,094

For the month of July:

- Median Sales Price increased 10.6% to $313,000

- Days on Market increased 7.9% to 41

- Percent of Original List Price Received increased 0.5% to 100.1%

- Months Supply of Homes For Sale decreased 29.6% to 1.9

All comparisons are to 2019

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 97

- 98

- 99

- 100

- 101

- …

- 234

- Next Page »